- United States

- /

- Metals and Mining

- /

- NYSEAM:CMCL

Spotlight On 3 Growth Stocks With Strong Insider Confidence

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 3.0% drop, yet it remains up by 4.6% over the past year with earnings forecasted to grow by 14% annually. In this environment, growth stocks with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the company’s operations and future potential.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.2% | 29.8% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37.2% |

| Hims & Hers Health (NYSE:HIMS) | 13.3% | 21.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.3% | 64.8% |

| Astera Labs (NasdaqGS:ALAB) | 15.8% | 61.4% |

| Red Cat Holdings (NasdaqCM:RCAT) | 19.4% | 122.6% |

| Niu Technologies (NasdaqGM:NIU) | 36.2% | 82.8% |

| Clene (NasdaqCM:CLNN) | 19.5% | 63.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.2% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.8% |

Let's dive into some prime choices out of the screener.

LendingTree (NasdaqGS:TREE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LendingTree, Inc. operates an online consumer platform in the United States with a market cap of approximately $604.72 million.

Operations: LendingTree's revenue is primarily derived from its Insurance segment at $548.70 million, followed by Consumer at $222.46 million, and Home at $128.85 million.

Insider Ownership: 18.8%

LendingTree has demonstrated significant insider buying recently, indicating confidence in its future prospects. The company reported a marked improvement in financial performance for 2024, with sales reaching US$900.22 million and a reduced net loss of US$41.7 million compared to the previous year. Despite volatile share prices, LendingTree is expected to achieve profitability within three years and forecasts double-digit revenue growth in key segments for 2025, though overall growth lags behind the broader market expectations.

- Delve into the full analysis future growth report here for a deeper understanding of LendingTree.

- In light of our recent valuation report, it seems possible that LendingTree is trading behind its estimated value.

Xometry (NasdaqGS:XMTR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xometry, Inc. operates an AI-powered online manufacturing marketplace serving both the United States and international markets with a market cap of approximately $1.08 billion.

Operations: Xometry generates revenue of $545.53 million from its Internet Software & Services segment.

Insider Ownership: 13.4%

Xometry, Inc. is positioned for growth with forecasted earnings expansion of 68.38% annually, despite revenue growth expectations of 14.5% per year being slower than some high-growth benchmarks. The company anticipates profitability within three years and trades at a significant discount to its estimated fair value. Recent changes include the appointment of Deloitte & Touche LLP as auditors and board member Deborah Bial's decision not to seek reelection, highlighting ongoing corporate adjustments amidst strategic growth initiatives.

- Click to explore a detailed breakdown of our findings in Xometry's earnings growth report.

- Upon reviewing our latest valuation report, Xometry's share price might be too optimistic.

Caledonia Mining (NYSEAM:CMCL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Caledonia Mining Corporation Plc primarily operates a gold mine in Jersey and has a market cap of approximately $260.36 million.

Operations: The company's revenue primarily stems from its operations at the Blanket gold mine, which generated $170.29 million, with additional contributions from South Africa at $19.30 million and the Bilboes Oxide Mine at $3.47 million.

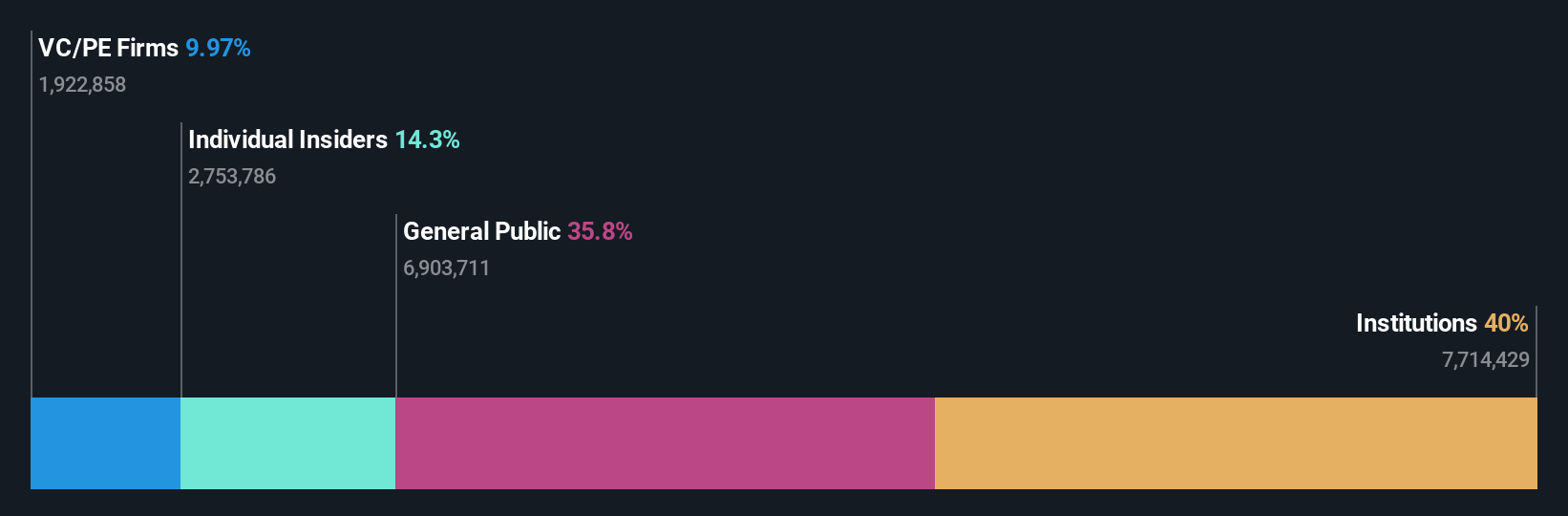

Insider Ownership: 14.2%

Caledonia Mining is poised for substantial growth, with earnings projected to increase by 33.1% annually, surpassing the US market average. The company trades significantly below its estimated fair value and has recently reported a profitable quarter with net income of US$5.87 million. Despite a sustainable dividend yield of 4.01%, it is not fully covered by free cash flows, indicating potential financial management challenges amidst ongoing feasibility studies to optimize project economics at Bilboes and Motapa projects.

- Dive into the specifics of Caledonia Mining here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Caledonia Mining is priced lower than what may be justified by its financials.

Key Takeaways

- Delve into our full catalog of 198 Fast Growing US Companies With High Insider Ownership here.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:CMCL

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives