- United States

- /

- Metals and Mining

- /

- NYSEAM:CMCL

How Might CMCL’s Shifting Institutional Ownership Reflect Market Perceptions of Caledonia Mining’s Strategy?

Reviewed by Sasha Jovanovic

- Caledonia Mining Corporation Plc recently announced that Allan Gray Bermuda Limited’s clients’ aggregate shareholding fell below 3% of its total issued shares, now standing at 2.9303% as of 13 October 2025.

- This change in shareholding structure highlights shifts in institutional investor strategies and could influence the company’s market dynamics and investor relations.

- We’ll explore how this reduction in a key institutional shareholder’s stake may affect Caledonia Mining’s investment narrative and risk outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Caledonia Mining Investment Narrative Recap

To own shares in Caledonia Mining, an investor needs to be confident in sustained gold demand and the company’s ability to execute cost controls and growth at its Zimbabwe operations, while managing exposure to regulatory and operational risks. The recent reduction in Allan Gray Bermuda Limited’s client shareholding below 3% does not materially alter the main short-term catalyst, which remains the company’s operational performance at Blanket Mine, nor does it worsen the central risk of concentrated exposure to Zimbabwe’s economic and policy environment.

One recent announcement directly tied to shareholder interests is Caledonia’s latest quarterly dividend of US$0.14 per share, declared on August 11, 2025. This continued dividend underscores management’s commitment to returning value, but also highlights the pressure to maintain internal capital balances, especially as the company pursues growth projects and navigates industry-wide cost escalation.

Yet, investors should be mindful that despite steady dividends and earnings, the biggest risk remains concentrated exposure to Zimbabwe, where regulatory changes and currency volatility can quickly...

Read the full narrative on Caledonia Mining (it's free!)

Caledonia Mining's narrative projects $201.2 million revenue and $39.4 million earnings by 2028. This requires a 0.6% annual revenue decline and a $2.4 million earnings increase from current earnings of $37.0 million.

Uncover how Caledonia Mining's forecasts yield a $37.50 fair value, a 10% upside to its current price.

Exploring Other Perspectives

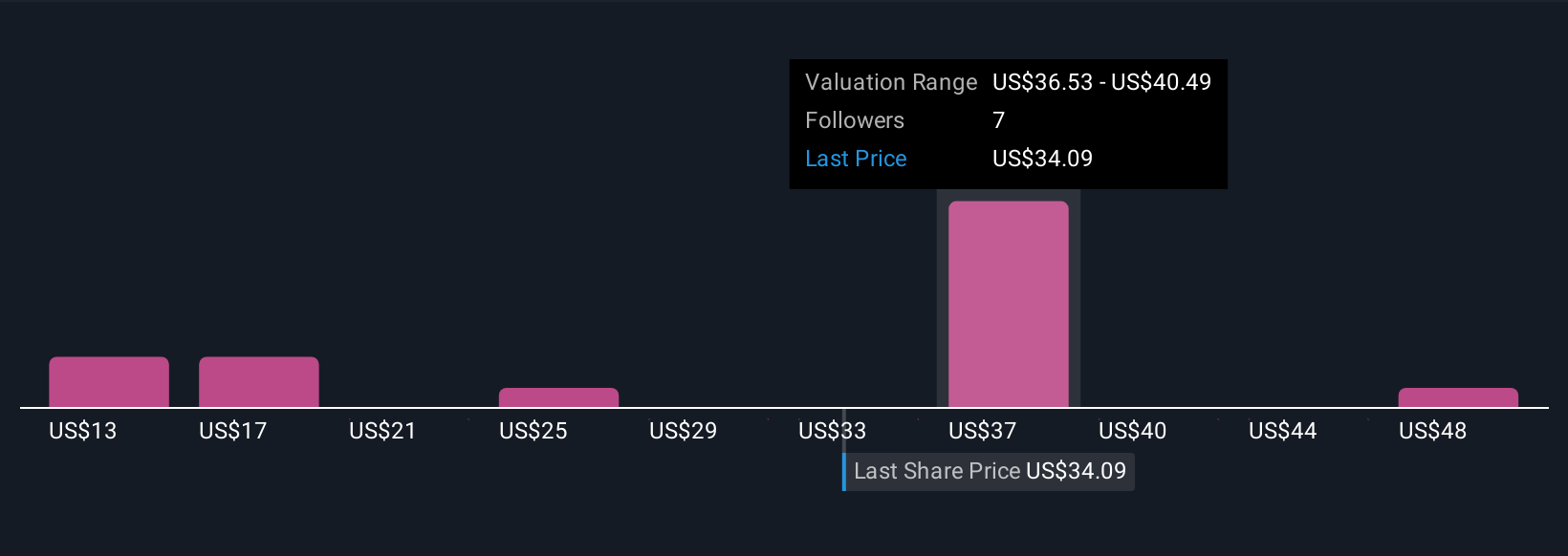

Simply Wall St Community members supplied 8 fair value estimates for Caledonia Mining, ranging from US$10.50 up to US$52.35. While opinions differ, remember both dividend sustainability and jurisdictional risk are central to future performance, so consider what matters most for your portfolio.

Explore 8 other fair value estimates on Caledonia Mining - why the stock might be worth less than half the current price!

Build Your Own Caledonia Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Caledonia Mining research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Caledonia Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Caledonia Mining's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:CMCL

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)