- United States

- /

- Metals and Mining

- /

- NYSEAM:CMCL

Caledonia Mining (NYSEAM:CMCL): Assessing Valuation as Shareholder Structure Shifts with Institutional Stake Reduction

Reviewed by Kshitija Bhandaru

Caledonia Mining (NYSEAM:CMCL) disclosed that Allan Gray Bermuda Limited’s clients have reduced their aggregate holding below the 3% mark. This change subtly shifts the company’s shareholder landscape and stirs fresh questions about market positioning.

See our latest analysis for Caledonia Mining.

The reduced stake from a key institutional holder comes at a time when Caledonia Mining’s share price has been making remarkable moves. After some volatility, it sits at $34.09. The company’s share price return has soared over 250% year-to-date and an impressive 67.8% in the last 90 days, signaling robust momentum. The 1-year total shareholder return of 115.3% reflects significant gains for patient investors. Recent shifts in ownership may be adding fuel to market interest, with traders closely watching for signs of new trends or risks as the company’s growth narrative evolves.

If brisk momentum like this has you wondering where else value might be hiding in the market, now’s a good time to discover fast growing stocks with high insider ownership

With the stock’s rapid ascent and shifting ownership dynamics, the real question is whether Caledonia Mining represents undervalued potential or if the market has already priced in all the upside for future growth opportunities.

Most Popular Narrative: 9% Undervalued

With Caledonia Mining’s last close at $34.09 and the most popular narrative assigning a fair value of $37.50, analysts see room for the market to bridge this modest gap. The narrative draws on upwardly revised production forecasts and improving free cash flow as the main catalysts redefining short-term expectations for the stock.

Higher-than-expected gold production reported in Q2 from the primary Zimbabwean mine. Increased 2025 gold production guidance signaling improved operational outlook.

Want to know what’s powering this bullish target? The calculations reportedly rely on upgraded output guidance and anticipated margin expansion fueled by operational tweaks. The full narrative unpacks a new earnings trajectory. Find out what stands behind these bold projections.

Result: Fair Value of $37.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Caledonia’s reliance on Zimbabwe and a single mine means that regulatory changes or operational disruptions could quickly shift the outlook for investors.

Find out about the key risks to this Caledonia Mining narrative.

Another View: What Do Market Ratios Say?

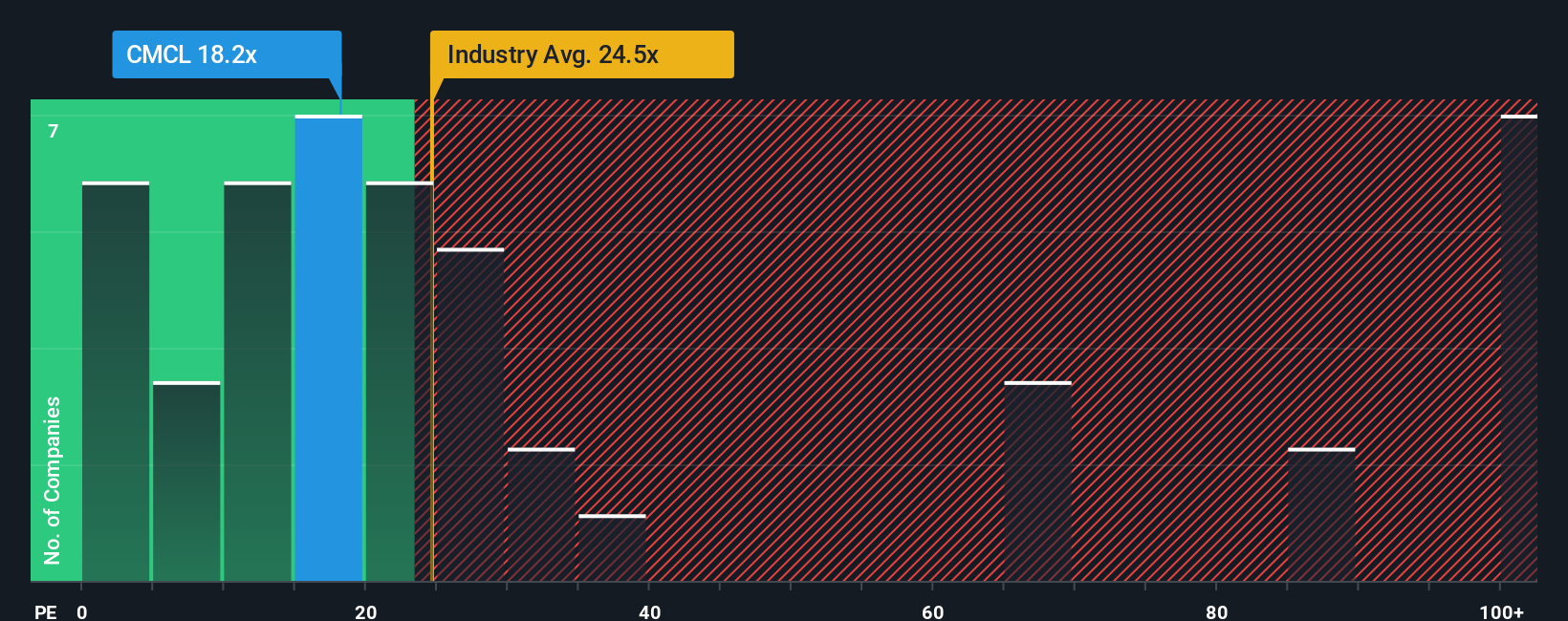

While many see potential upside, looking at Caledonia Mining’s price-to-earnings ratio brings a more cautious perspective. Trading at 17.8 times earnings, the shares are cheaper than peers and the industry average. However, the ratio is still higher than the calculated fair value of 14.8 times, which suggests some valuation risk remains. Could the market be a bit too optimistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Caledonia Mining Narrative

If you see things differently, or want to test your own thesis, you can quickly craft a custom narrative using our tools in just a few minutes, Do it your way

A great starting point for your Caledonia Mining research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the best opportunities pass you by. The market’s top performers aren’t always where you expect. Supercharge your strategy with these unique stock ideas today.

- Amplify your returns with reliable yields by tapping into these 18 dividend stocks with yields > 3%. This can help you pinpoint stocks offering attractive income potential.

- Ride the AI revolution by checking out these 24 AI penny stocks, where transformative innovations and powerful growth stories are waiting to be uncovered.

- Capitalize on scarce value by scouting these 871 undervalued stocks based on cash flows, giving you an edge in finding quality stocks trading at compelling prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:CMCL

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)