- United States

- /

- Banks

- /

- NasdaqGM:QCRH

CPI Card Group And 2 Other Undervalued Small Caps With Insider Action In US

Reviewed by Simply Wall St

In the last week, the United States market has remained flat, yet it has experienced a notable 22% increase over the past year with earnings projected to grow by 15% annually. In this context, identifying stocks that are potentially undervalued and exhibit insider activity can be crucial for investors seeking opportunities in small-cap companies.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 11.6x | 3.0x | 48.21% | ★★★★★☆ |

| Array Technologies | NA | 1.1x | 49.80% | ★★★★★☆ |

| First United | 12.7x | 3.4x | 32.34% | ★★★★☆☆ |

| Eagle Financial Services | 7.4x | 1.6x | 36.19% | ★★★★☆☆ |

| S&T Bancorp | 11.7x | 4.0x | 37.79% | ★★★★☆☆ |

| German American Bancorp | 14.3x | 4.8x | 46.18% | ★★★☆☆☆ |

| Citizens & Northern | 12.8x | 3.1x | 39.08% | ★★★☆☆☆ |

| Arrow Financial | 15.2x | 3.4x | 38.25% | ★★★☆☆☆ |

| Guardian Pharmacy Services | NA | 1.1x | 33.01% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -80.59% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

CPI Card Group (NasdaqGM:PMTS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: CPI Card Group is a payment technology company specializing in the production and personalization of financial payment cards, with a market cap of approximately $0.44 billion.

Operations: The company generates revenue primarily from its Debit and Credit segment, contributing $365.45 million, and the Prepaid Debit segment with $94.14 million. The gross profit margin has shown variability, reaching 41.33% in mid-2021 before declining to 37.26% by the end of 2023. Operating expenses have been a significant cost factor, with General & Administrative expenses consistently forming a large portion of these costs over time.

PE: 21.0x

CPI Card Group, a small player in the card manufacturing industry, grapples with financial challenges like negative shareholder equity and low profit margins at 3.4%, down from 7.2% last year. Despite these hurdles, earnings are projected to grow by nearly 47% annually. Insider confidence is evident from recent share purchases over the past year, signaling potential optimism about future performance. The company recently updated its bylaws to align with Delaware law and modern practices, reflecting proactive governance adjustments as of December 2024.

- Dive into the specifics of CPI Card Group here with our thorough valuation report.

Explore historical data to track CPI Card Group's performance over time in our Past section.

QCR Holdings (NasdaqGM:QCRH)

Simply Wall St Value Rating: ★★★★★★

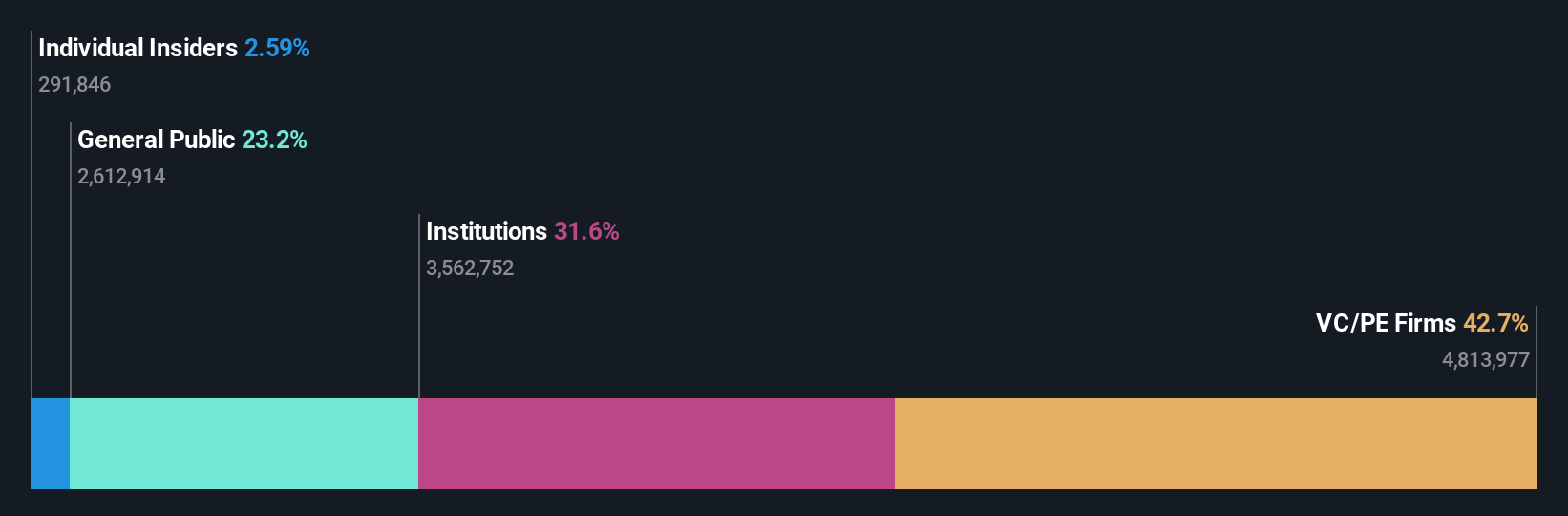

Overview: QCR Holdings is a financial services company that provides commercial and consumer banking, trust and asset management services primarily in the Midwest region of the United States, with a market capitalization of approximately $1.63 billion.

Operations: QCR Holdings generates revenue primarily through its operations, with a consistent gross profit margin of 100%. The company incurs significant operating expenses, largely driven by general and administrative costs, which reached $177.01 million in the most recent period. Notably, the net income margin has shown variability over time, reaching 34.48% in the latest quarter.

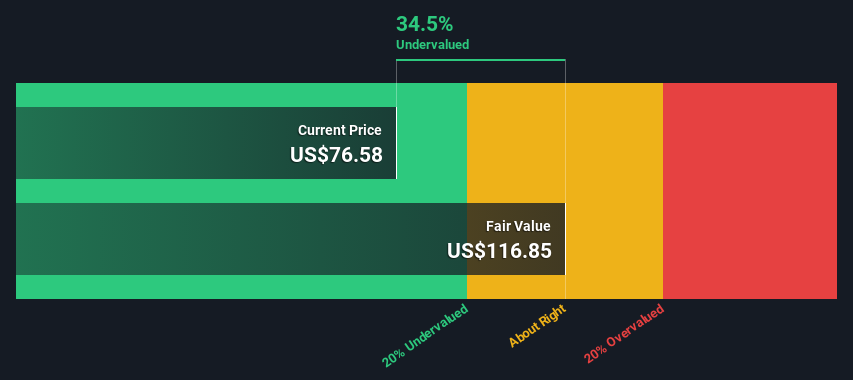

PE: 11.5x

QCR Holdings, a small company in the financial sector, has shown steady net interest income growth, reaching US$231.79 million for 2024. Despite a slight dip in quarterly net income to US$30.23 million from the previous year, insider confidence is evident with recent share purchases. The company's earnings per share remained stable over the year at US$6.71 diluted, suggesting resilience amidst market challenges. Looking ahead, earnings are forecasted to grow annually by 4.9%.

McEwen Mining (NYSE:MUX)

Simply Wall St Value Rating: ★★★★★☆

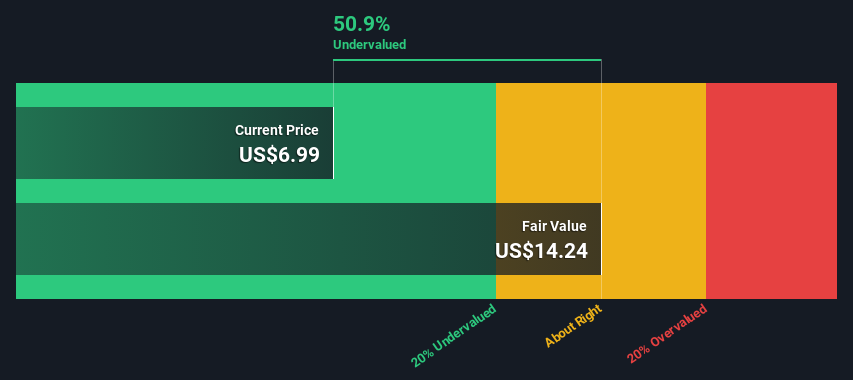

Overview: McEwen Mining is a diversified gold and silver producer with operations in Canada, Mexico, and the United States, and it has a market cap of approximately $0.8 billion.

Operations: The company generates its revenue primarily from operations in the USA, Canada, and Mexico. Over recent periods, it has experienced fluctuating gross profit margins, with a notable shift from negative to positive figures; for instance, reaching 33.18% by September 2024. Operating expenses are significant and include general and administrative costs alongside depreciation and amortization expenses.

PE: 3.8x

McEwen Mining, a smaller company in the mining industry, recently faced legal challenges from the Apitipi Anicinapek Nation over environmental and financial obligations related to the Black Fox Mine. Despite these issues, they have completed a US$95 million fixed-income offering with convertible notes due in 2030. The company is expanding its gold resources at Grey Fox, driven by exploration successes and favorable gold prices. However, earnings are projected to decline significantly over the next three years.

- Click here and access our complete valuation analysis report to understand the dynamics of McEwen Mining.

Understand McEwen Mining's track record by examining our Past report.

Where To Now?

- Gain an insight into the universe of 53 Undervalued US Small Caps With Insider Buying by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QCR Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:QCRH

QCR Holdings

A multi-bank holding company, provides commercial and consumer banking, and trust and asset management services.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives