- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

Vertex Pharmaceuticals And 2 Other Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has experienced an 11% increase over the past year with earnings projected to grow by 15% annually. In this environment, identifying stocks that may be trading below their estimated value can provide investors with potential opportunities for growth and stability.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| StoneCo (STNE) | $15.17 | $29.44 | 48.5% |

| Roku (ROKU) | $89.825 | $174.03 | 48.4% |

| Rapid7 (RPD) | $22.80 | $44.10 | 48.3% |

| MP Materials (MP) | $48.52 | $96.59 | 49.8% |

| Insteel Industries (IIIN) | $39.44 | $77.32 | 49% |

| Excelerate Energy (EE) | $26.68 | $51.75 | 48.4% |

| Definitive Healthcare (DH) | $4.02 | $7.82 | 48.6% |

| Carter Bankshares (CARE) | $18.35 | $35.50 | 48.3% |

| Atlantic Union Bankshares (AUB) | $33.33 | $65.45 | 49.1% |

| Acadia Realty Trust (AKR) | $18.67 | $36.68 | 49.1% |

Here's a peek at a few of the choices from the screener.

Vertex Pharmaceuticals (VRTX)

Overview: Vertex Pharmaceuticals Incorporated is a biotechnology company focused on developing and commercializing therapies for cystic fibrosis, with a market cap of approximately $120.40 billion.

Operations: The company generates $11.10 billion in revenue from its pharmaceuticals segment, primarily through therapies for cystic fibrosis.

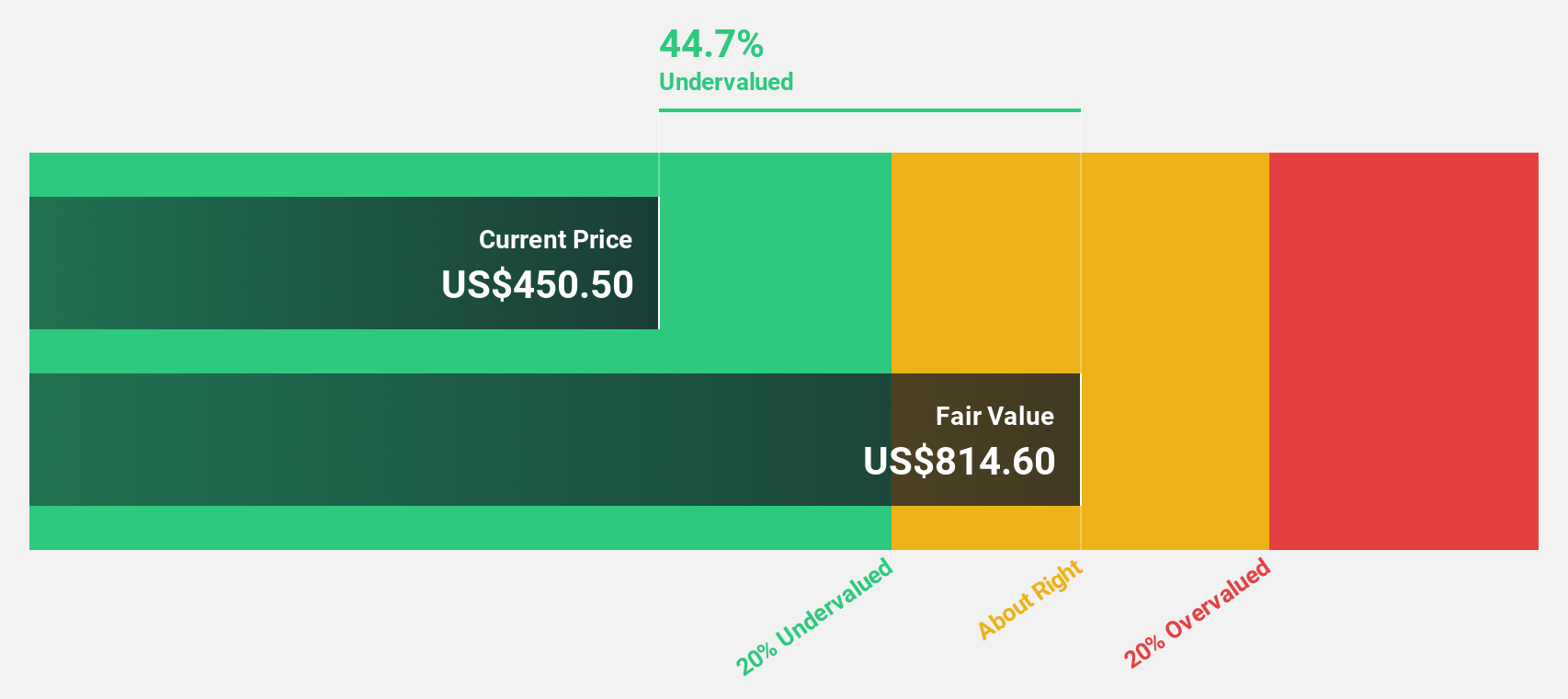

Estimated Discount To Fair Value: 44.9%

Vertex Pharmaceuticals, trading at US$472.35, is significantly undervalued with a fair value estimate of US$856.56. The company is expected to achieve profitability within three years and boasts revenue growth forecasts surpassing the broader US market. Recent strategic moves include a reimbursement agreement for its CF medicine in England and positive data from trials for sickle cell disease treatments, enhancing its future cash flow potential despite recent index exclusion events.

- The growth report we've compiled suggests that Vertex Pharmaceuticals' future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Vertex Pharmaceuticals' balance sheet health report.

Flutter Entertainment (FLUT)

Overview: Flutter Entertainment plc is a sports betting and gaming company with operations in the United States, the United Kingdom, Ireland, Australia, Italy, and internationally; it has a market cap of approximately $51.09 billion.

Operations: The company generates revenue from various regions, with $6.05 billion from the United States and $3.62 billion from the United Kingdom and Ireland.

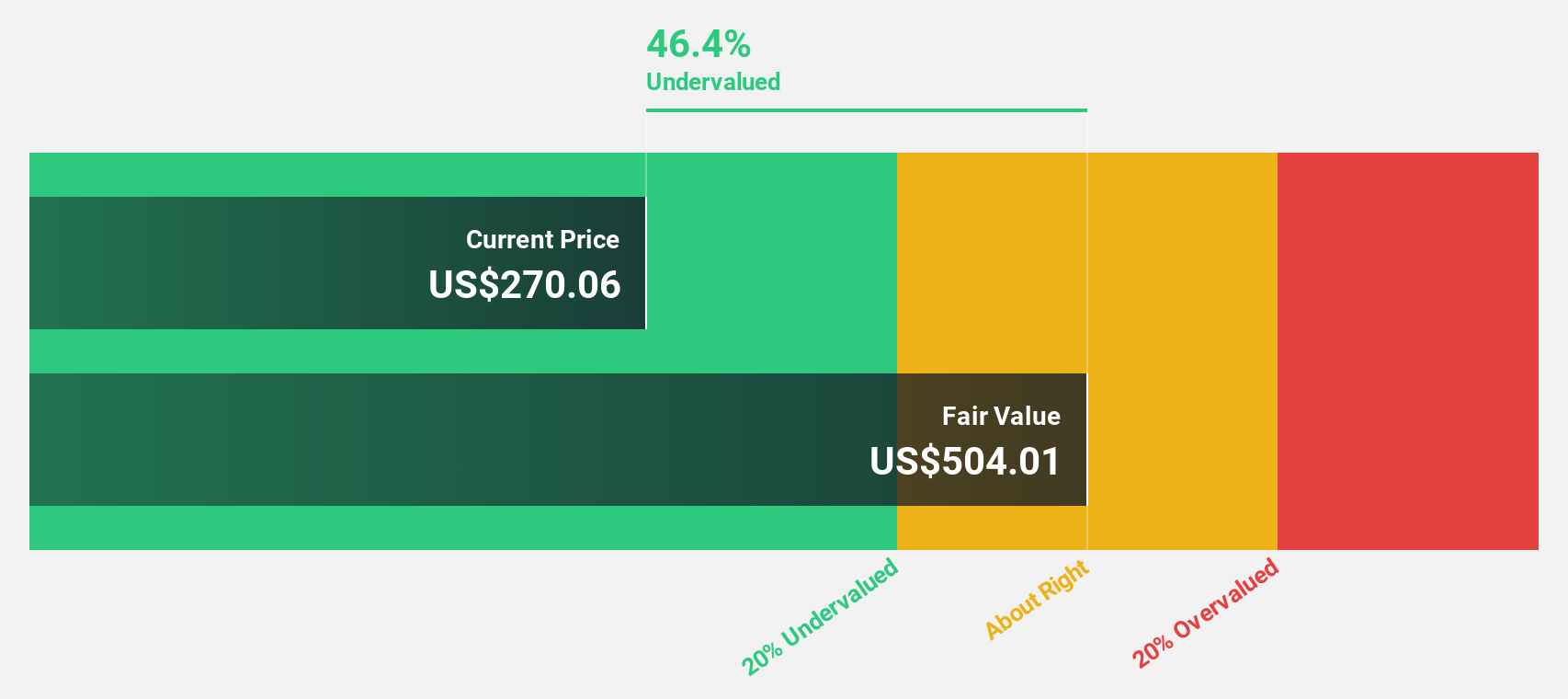

Estimated Discount To Fair Value: 43%

Flutter Entertainment, trading at US$295.12, is significantly undervalued with a fair value estimate of US$517.81. The company recently secured a US$1.75 billion credit facility to support corporate initiatives and working capital needs. Flutter's earnings are expected to grow 31% annually over the next three years, outpacing the broader US market growth rate, while its inclusion in multiple Russell indices highlights its expanding market presence and potential for enhanced cash flow generation.

- Our earnings growth report unveils the potential for significant increases in Flutter Entertainment's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Flutter Entertainment.

MP Materials (MP)

Overview: MP Materials Corp. operates in the production of rare earth materials in the Western Hemisphere and has a market cap of approximately $7.37 billion.

Operations: The company's revenue is primarily derived from its Materials segment, which generated $210.79 million.

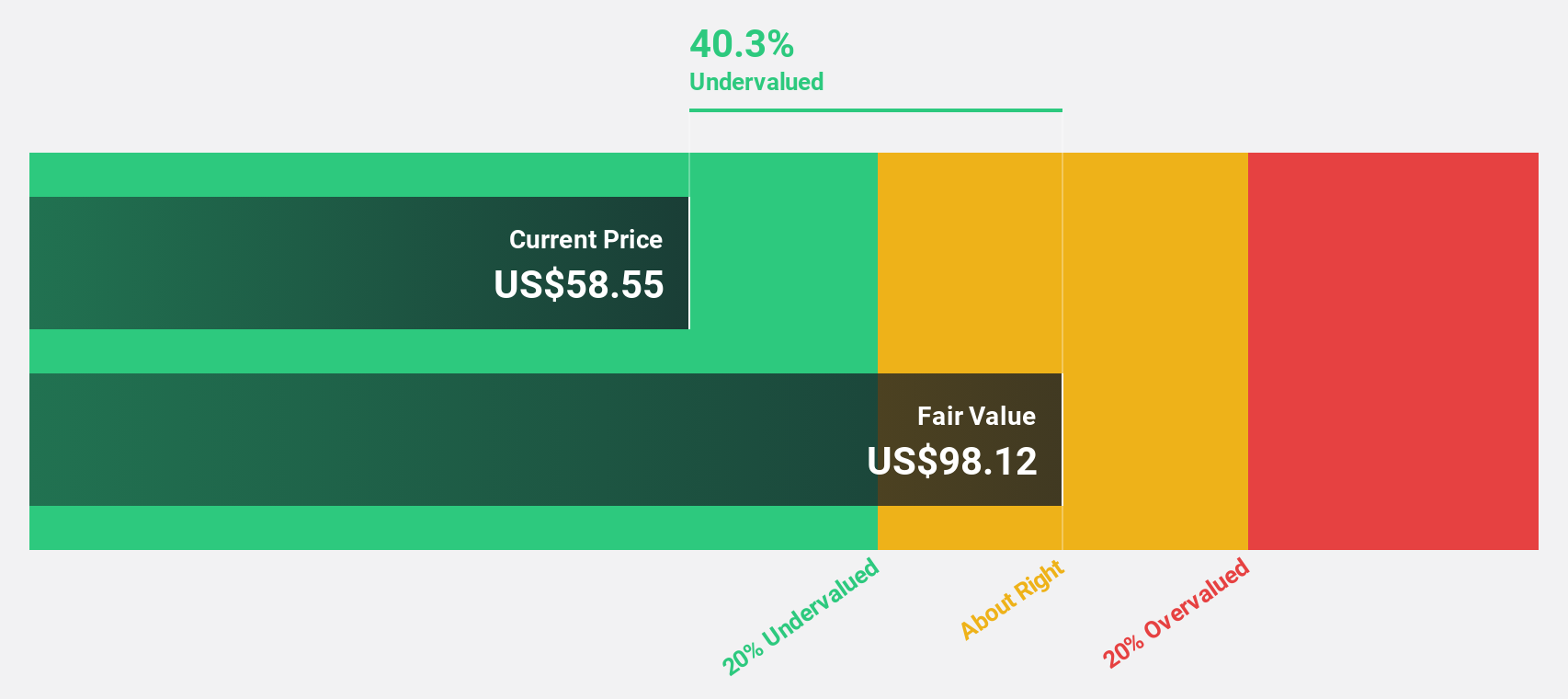

Estimated Discount To Fair Value: 49.8%

MP Materials, with a trading price of US$48.52, is significantly undervalued compared to its fair value estimate of US$96.59. The company has entered a transformative partnership with the U.S. Department of Defense to enhance domestic rare earth magnet production, ensuring stable cash flows through long-term commitments and price floor agreements. Despite recent volatility in share prices and current losses, MP's revenue growth is projected at 31.5% annually, surpassing market averages and supporting future profitability expectations within three years.

- Our comprehensive growth report raises the possibility that MP Materials is poised for substantial financial growth.

- Click here to discover the nuances of MP Materials with our detailed financial health report.

Taking Advantage

- Discover the full array of 175 Undervalued US Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives