- United States

- /

- Life Sciences

- /

- NasdaqGS:BRKR

US Growth Stocks With High Insider Ownership In October 2024

Reviewed by Simply Wall St

As the U.S. stock market continues its rally, with major indices like the S&P 500 and Dow Jones Industrial Average reaching record highs, investors are closely watching for key economic data and earnings reports that could influence future movements. In this buoyant environment, growth stocks with high insider ownership can be particularly appealing as they often signal confidence from those closest to the company's operations and potential.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.2% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 41.3% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

Let's explore several standout options from the results in the screener.

Bruker (NasdaqGS:BRKR)

Simply Wall St Growth Rating: ★★★★★☆

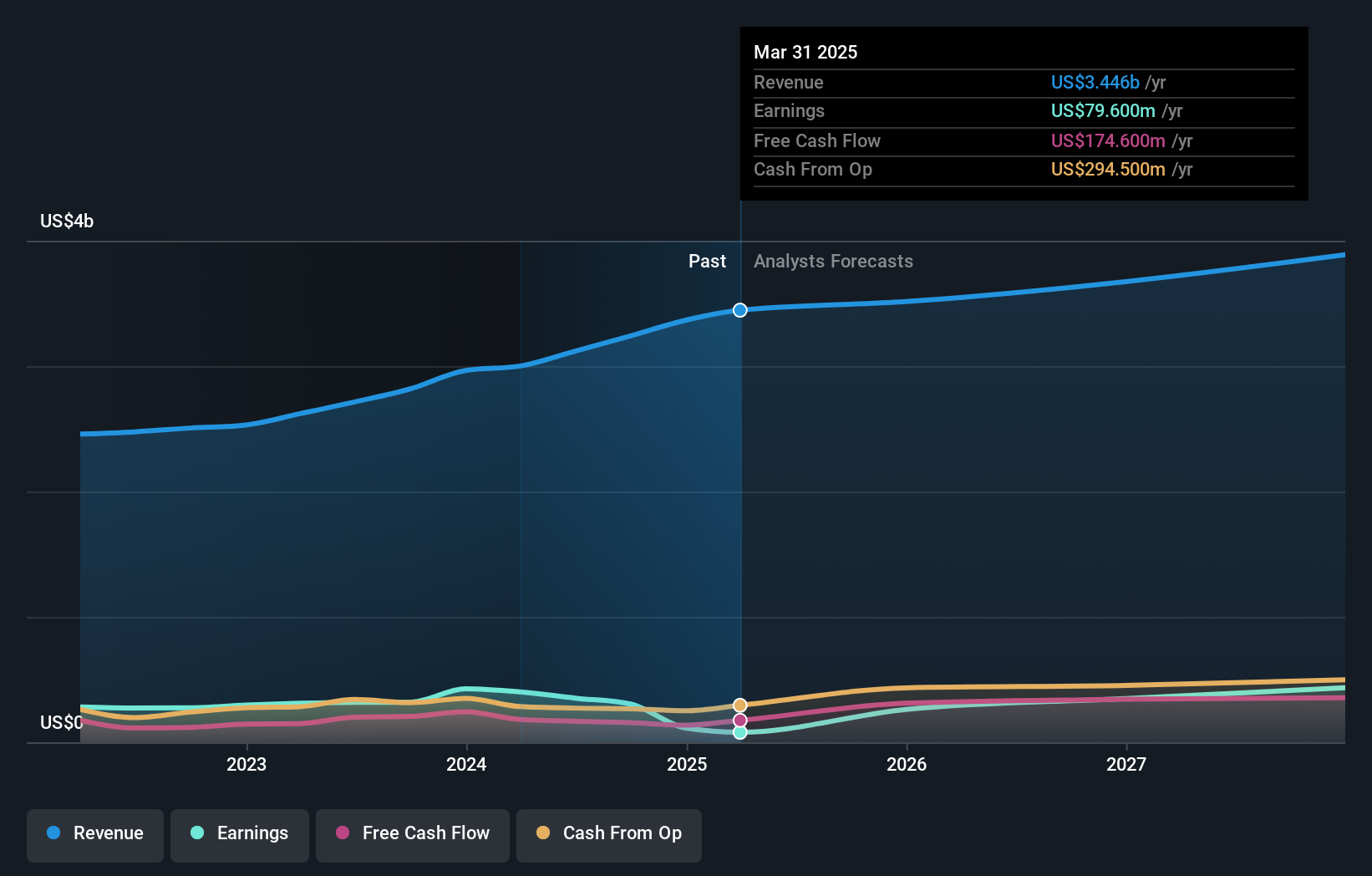

Overview: Bruker Corporation, along with its subsidiaries, operates in the development, manufacturing, and distribution of scientific instruments and analytical and diagnostic solutions globally, with a market cap of approximately $9.98 billion.

Operations: The company's revenue segments include Bruker Nano with $1.00 billion, Bruker CALID at $990 million, Bruker Biospin generating $856.50 million, and Bruker Energy & Supercon Technologies (BEST) contributing $288 million.

Insider Ownership: 29.3%

Earnings Growth Forecast: 20.8% p.a.

Bruker demonstrates strong growth potential with a Price-To-Earnings ratio of 27.9x, below the Life Sciences industry average, and earnings forecasted to grow significantly at 20.8% annually. Despite recent shareholder dilution, its financial guidance for 2024 indicates revenue growth up to $3.44 billion from $2.96 billion in 2023. Recent innovations like the OptoVolt module enhance its research capabilities, while strategic alliances further bolster its position in drug discovery technologies and methods development.

- Dive into the specifics of Bruker here with our thorough growth forecast report.

- Our expertly prepared valuation report Bruker implies its share price may be lower than expected.

MP Materials (NYSE:MP)

Simply Wall St Growth Rating: ★★★★★☆

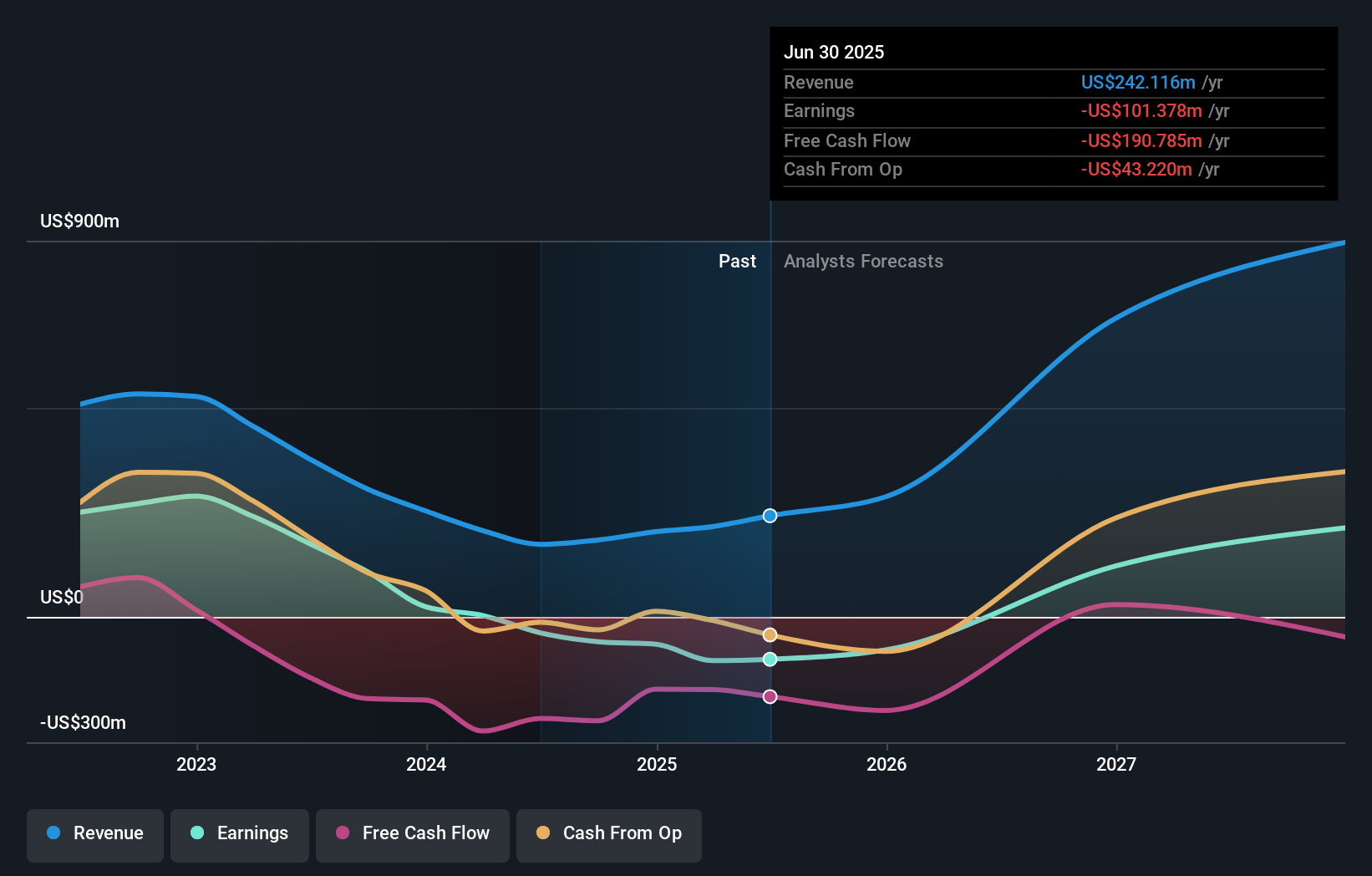

Overview: MP Materials Corp., with a market cap of $2.91 billion, produces rare earth materials through its subsidiaries.

Operations: The company's revenue is primarily derived from its Metals & Mining - Miscellaneous segment, amounting to $173.66 million.

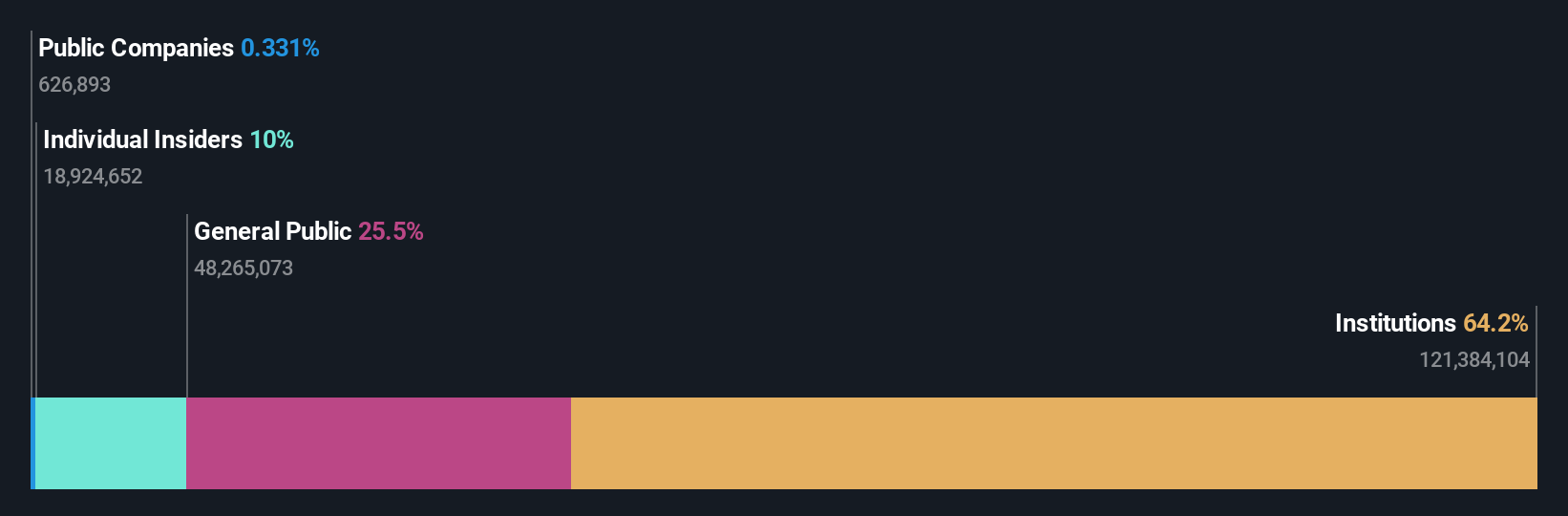

Insider Ownership: 12.5%

Earnings Growth Forecast: 76.7% p.a.

MP Materials showcases potential as a growth company with substantial insider ownership, evidenced by significant insider buying over the past three months. The company's revenue is projected to grow at 37.7% annually, outpacing the US market average. Despite recent financial challenges, including a net loss of US$34.06 million in Q2 2024 and decreased production volumes, MP's strategic initiatives like an expanded US$600 million buyback plan highlight its commitment to long-term shareholder value.

- Click to explore a detailed breakdown of our findings in MP Materials' earnings growth report.

- Upon reviewing our latest valuation report, MP Materials' share price might be too optimistic.

SmartRent (NYSE:SMRT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SmartRent, Inc. is an enterprise real estate technology company offering management software and applications to rental property stakeholders globally, with a market cap of approximately $333.95 million.

Operations: The company's revenue is primarily derived from its Electronic Security Devices segment, which generated $217.36 million.

Insider Ownership: 11.9%

Earnings Growth Forecast: 69.8% p.a.

SmartRent demonstrates growth potential with significant insider buying in the past three months, indicating confidence in its future. The company's revenue is forecast to grow at 12.6% annually, exceeding the US market average of 8.8%. Despite reporting a net loss reduction to US$4.61 million in Q2 2024, SmartRent's strategic initiatives include launching the Alloy Fusion hub and appointing Natalie Cariola as Chief Revenue Officer to enhance market share and customer relations.

- Unlock comprehensive insights into our analysis of SmartRent stock in this growth report.

- The valuation report we've compiled suggests that SmartRent's current price could be quite moderate.

Key Takeaways

- Embark on your investment journey to our 181 Fast Growing US Companies With High Insider Ownership selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bruker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BRKR

Bruker

Develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally.

Good value with moderate growth potential.