- United States

- /

- Personal Products

- /

- NasdaqGM:ODD

Top Growth Companies With High Insider Ownership On US Exchanges February 2025

Reviewed by Simply Wall St

As the U.S. stock market continues to hover near record highs, with major indexes posting weekly gains, investors are keenly observing growth companies that demonstrate resilience and potential in a fluctuating economic landscape. In this context, high insider ownership can be a promising indicator of confidence in a company's future performance, particularly when combined with robust growth prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 27.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Astera Labs (NasdaqGS:ALAB) | 15.7% | 61.3% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 103.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.3% | 33.8% |

| Capital Bancorp (NasdaqGS:CBNK) | 31% | 30.2% |

Here's a peek at a few of the choices from the screener.

Oddity Tech (NasdaqGM:ODD)

Simply Wall St Growth Rating: ★★★★☆☆

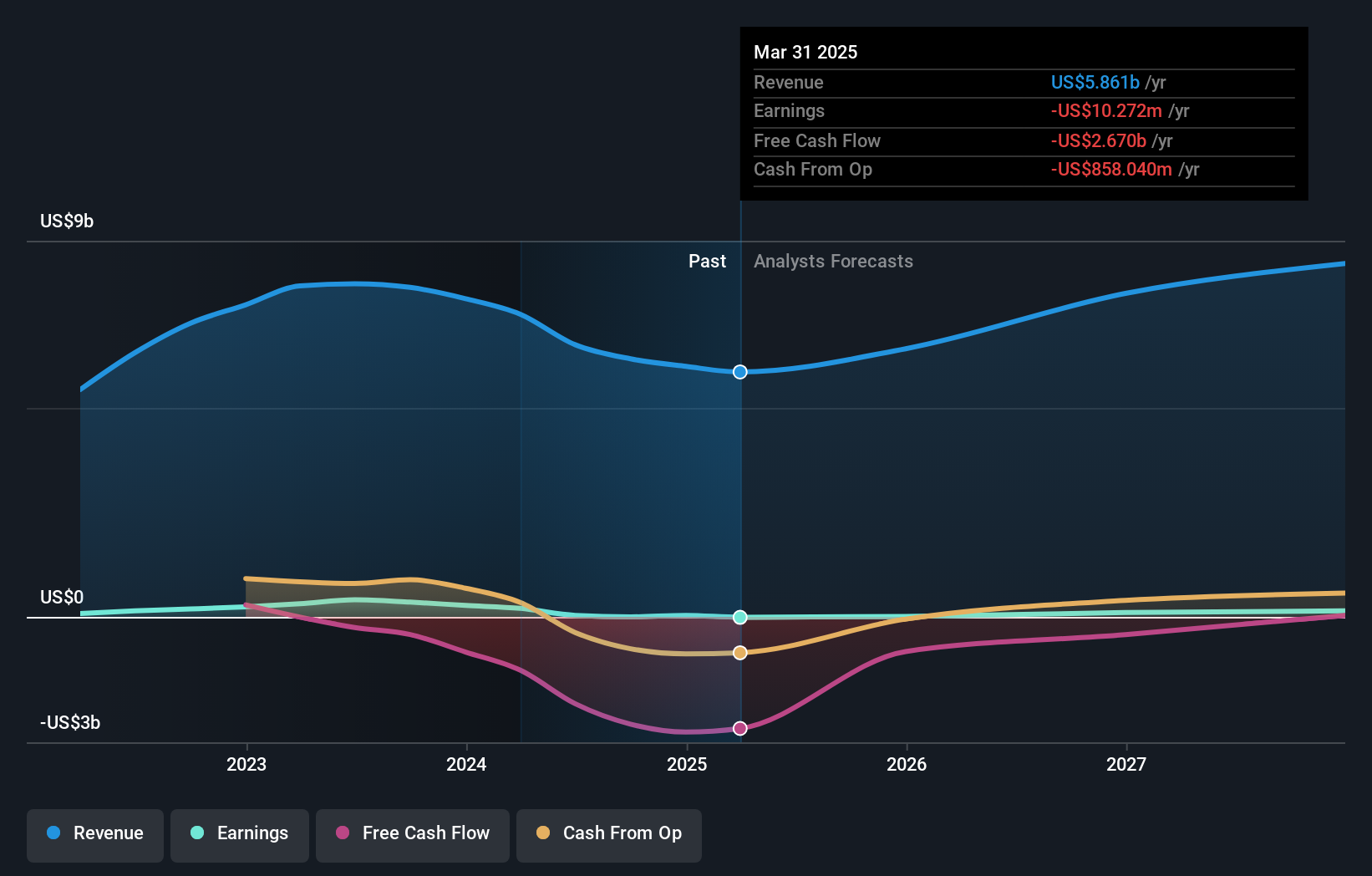

Overview: Oddity Tech Ltd. is a consumer tech company focused on developing digital-first brands in the beauty and wellness sectors globally, with a market cap of approximately $2.46 billion.

Operations: The company generates revenue from its Personal Products segment, which amounts to $620.65 million.

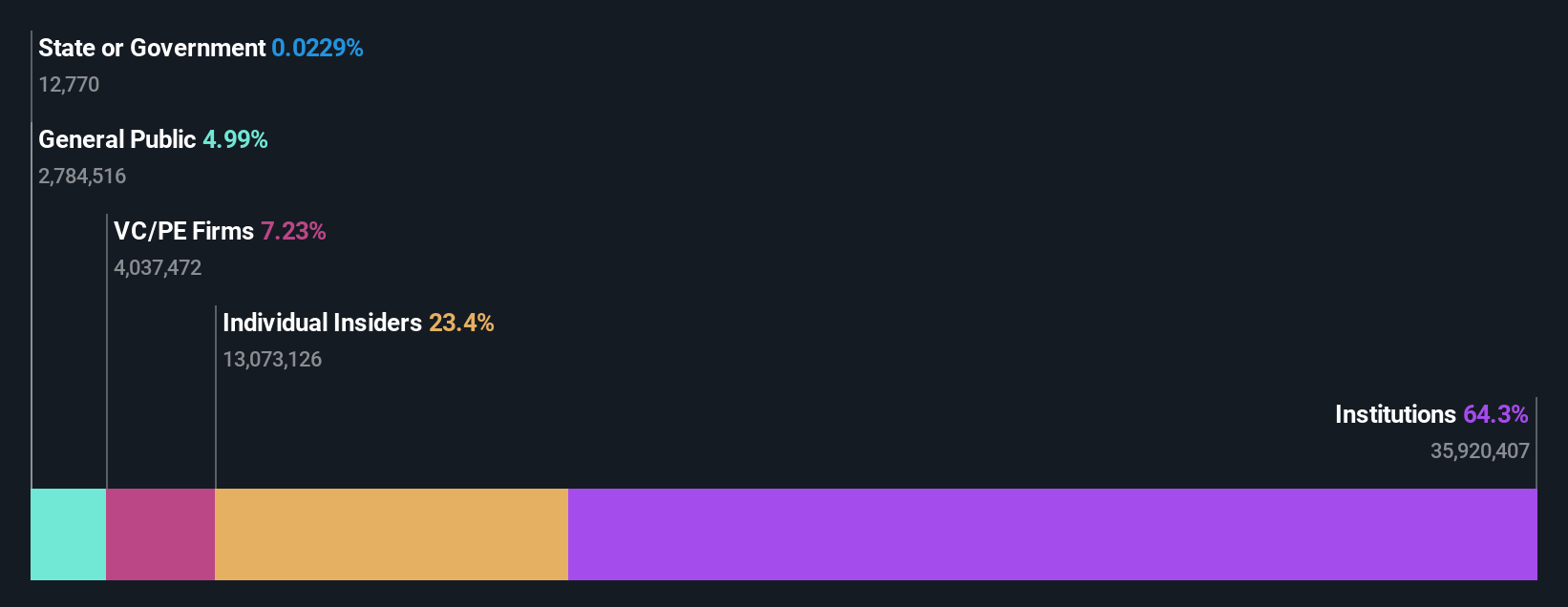

Insider Ownership: 32.5%

Earnings Growth Forecast: 19.6% p.a.

Oddity Tech exhibits strong growth potential, with forecasted revenue and earnings growth surpassing the US market averages. The company's recent $200 million credit facility enhances its financial flexibility for strategic initiatives. Despite trading at a significant discount to fair value, analyst consensus suggests a notable price increase. With robust earnings growth and high forecasted return on equity, Oddity remains financially solid with substantial cash reserves and no recent insider trading activity reported.

- Click to explore a detailed breakdown of our findings in Oddity Tech's earnings growth report.

- Our expertly prepared valuation report Oddity Tech implies its share price may be lower than expected.

Canadian Solar (NasdaqGS:CSIQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Canadian Solar Inc., with a market cap of approximately $703.32 million, offers solar energy and battery storage products and solutions across Asia, the Americas, Europe, and other international markets.

Operations: The company's revenue is primarily derived from its CSI Solar segment, which generated $6.49 billion, and its Recurrent Energy segment, which contributed $188.76 million.

Insider Ownership: 21.2%

Earnings Growth Forecast: 76.2% p.a.

Canadian Solar's growth trajectory is supported by its expansive project pipeline, including 26 GWp of solar and 66 GWh of battery energy storage capacity. Recent agreements with Sunraycer Renewables enhance its footprint in Texas. Despite a net loss in Q3 2024, revenue forecasts suggest recovery potential. The company faces legal challenges over patent infringement but remains a key player in renewable energy, trading at good value compared to peers despite low forecasted return on equity.

- Unlock comprehensive insights into our analysis of Canadian Solar stock in this growth report.

- The analysis detailed in our Canadian Solar valuation report hints at an deflated share price compared to its estimated value.

Magnera (NYSE:MAGN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Magnera Corporation manufactures and sells non-woven and related products globally, with a market cap of approximately $795.53 million.

Operations: The company's revenue segments include $1.57 billion from the Americas and $805 million from the Rest of World.

Insider Ownership: 27%

Earnings Growth Forecast: 106.4% p.a.

Magnera's insider ownership is underscored by substantial recent insider buying, indicating confidence despite a net loss of US$60 million in Q1 2025. The company's revenue grew to US$702 million from US$519 million year-over-year, outpacing the broader market growth forecast. Although trading at nearly 40% below estimated fair value and expected to become profitable within three years, interest payments are not well covered by earnings, posing financial challenges.

- Delve into the full analysis future growth report here for a deeper understanding of Magnera.

- Our valuation report here indicates Magnera may be undervalued.

Seize The Opportunity

- Access the full spectrum of 197 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ODD

Oddity Tech

Operates as a consumer tech company that builds digital-first brands for the beauty and wellness industries in the United States and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives