- United States

- /

- Chemicals

- /

- NYSE:LYB

How LyondellBasell's (LYB) Bio-Based Packaging Partnership With Shiseido May Shape Its Sustainability Narrative

Reviewed by Simply Wall St

- LyondellBasell announced a partnership with Futamura Chemical, Iwatani Corporation, and Shiseido to jointly develop a new bio-based film packaging solution using the CirculenRenew polymer for select Shiseido products.

- This collaboration highlights LyondellBasell's commitment to sustainability and signals a growing shift toward low-carbon packaging in the beauty sector.

- We'll explore how this focus on innovative bio-based materials could influence LyondellBasell's outlook and long-term sustainability positioning.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

LyondellBasell Industries Investment Narrative Recap

To be a LyondellBasell shareholder, you need to believe in the company’s ability to transform its portfolio toward circular and sustainable products while navigating cyclical pressure and persistent overcapacity in core markets. The recent partnership to develop a bio-based packaging film for Shiseido showcases LYB's direction on sustainability, but its impact on near-term earnings or margin volatility appears immaterial relative to broader industry risks and catalysts.

Among recent developments, LyondellBasell’s expanded propylene production investment at Channelview stands out, aligning with ongoing efforts to optimize its portfolio and reinforce core business strength. While these steps support resilience, they do not fully offset current headwinds in revenue and earnings, which remain pressured by market dynamics and ongoing transition costs.

However, investors should also be alert to the risk that, despite new sustainable initiatives, slow progress in moving away from fossil-derived feedstocks may leave LYB more exposed if...

Read the full narrative on LyondellBasell Industries (it's free!)

LyondellBasell Industries is projected to reach $29.2 billion in revenue and $2.2 billion in earnings by 2028. This outlook assumes an annual revenue decline of 8.9% and an increase in earnings of $2.05 billion from current earnings of $150 million.

Uncover how LyondellBasell Industries' forecasts yield a $61.83 fair value, a 10% upside to its current price.

Exploring Other Perspectives

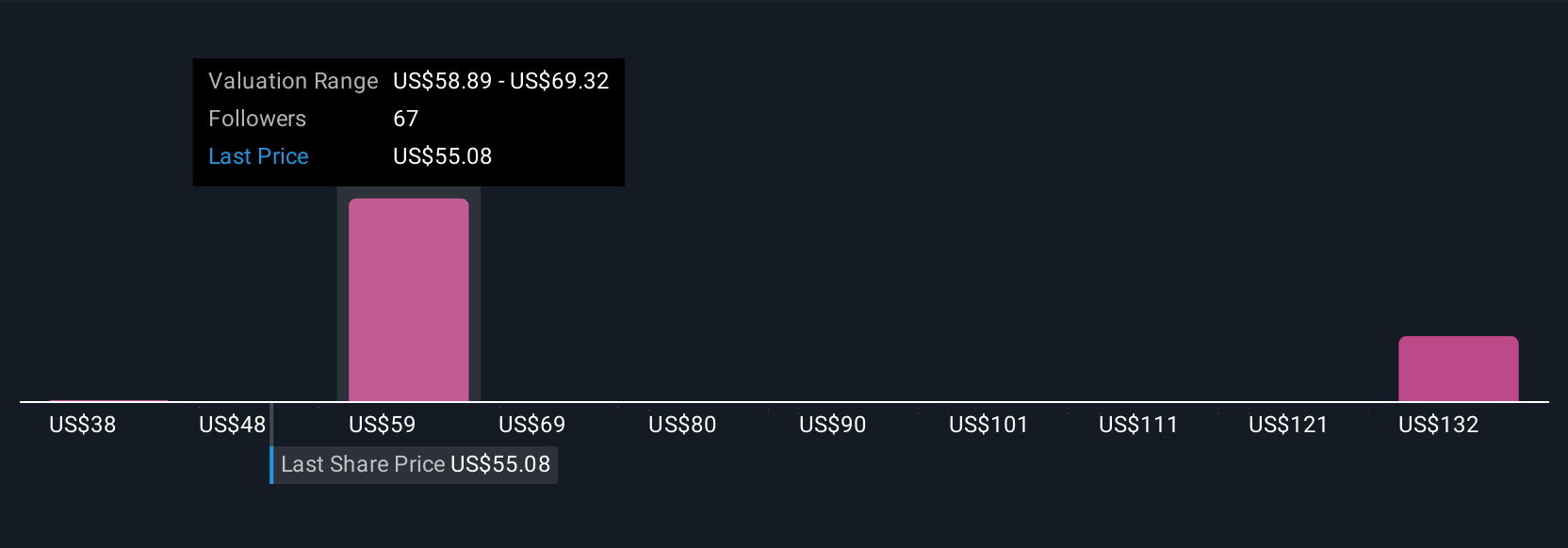

Simply Wall St Community members put fair values on LyondellBasell between US$38.02 and US$145.32, with 10 different perspectives included. While this highlights distinct confidence levels, current industry overcapacity and margin pressure continue to weigh on the company’s performance and expectations, make sure to consider a variety of viewpoints as you build your own outlook.

Explore 10 other fair value estimates on LyondellBasell Industries - why the stock might be worth 33% less than the current price!

Build Your Own LyondellBasell Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LyondellBasell Industries research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free LyondellBasell Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LyondellBasell Industries' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LYB

LyondellBasell Industries

Operates as a chemical company in the United States, Germany, Mexico, Italy, Poland, France, Japan, China, the Netherlands, and internationally.

Moderate risk average dividend payer.

Similar Companies

Market Insights

Community Narratives