- United States

- /

- Chemicals

- /

- NYSE:IPI

Intrepid Potash Second Quarter 2025 Earnings: EPS: US$0.25 (vs US$0.065 loss in 2Q 2024)

Intrepid Potash (NYSE:IPI) Second Quarter 2025 Results

Key Financial Results

- Revenue: US$57.3m (up 15% from 2Q 2024).

- Net income: US$3.26m (up from US$833.0k loss in 2Q 2024).

- Profit margin: 5.7% (up from net loss in 2Q 2024).

- EPS: US$0.25 (up from US$0.065 loss in 2Q 2024).

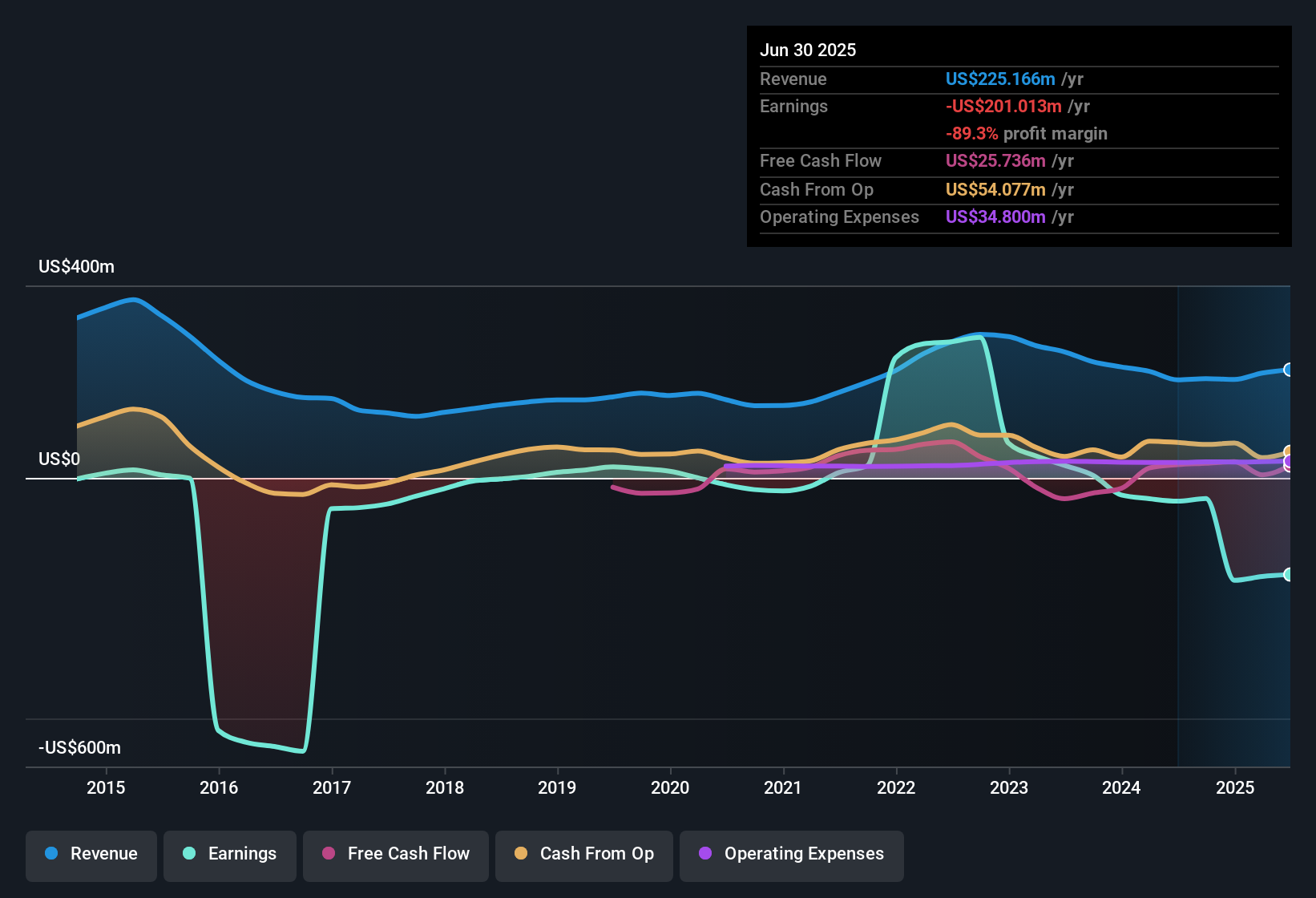

All figures shown in the chart above are for the trailing 12 month (TTM) period

Intrepid Potash Earnings Insights

Looking ahead, revenue is expected to decline by 2.4% p.a. on average during the next 3 years, while revenues in the Chemicals industry in the US are expected to grow by 4.5%.

Performance of the American Chemicals industry.

The company's shares are down 13% from a week ago.

Risk Analysis

Before you take the next step you should know about the 2 warning signs for Intrepid Potash (1 is significant!) that we have uncovered.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:IPI

Intrepid Potash

Intrepid Potash, Inc. delivers potassium, magnesium, sulfur, salt, and water products.

Flawless balance sheet with minimal risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)