- United States

- /

- Packaging

- /

- NYSE:IP

Should Slowing Growth And Weaker Cash Returns Require Action From International Paper (IP) Investors?

Reviewed by Sasha Jovanovic

- In recent years, International Paper has reported annual sales growth of only 2.4%, while its free cash flow margin fell sharply and returns on capital weakened as competition and capital needs increased.

- This combination of sluggish top-line progress, lower cash generation, and diminishing capital efficiency has raised fresh questions about the effectiveness of past and current management initiatives.

- We’ll now examine how this slowdown in sales growth and profitability may alter International Paper’s investment narrative built around margin recovery.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

International Paper Investment Narrative Recap

To own International Paper, you need to believe its mill upgrades, cost cuts and portfolio tweaks can eventually restore margins and cash generation in a slow growth, capital intensive business. The latest data on weak sales growth, shrinking free cash flow margins and softer returns on capital directly pressure the margin recovery story and heighten the near term risk that heavy spending and competitive pricing could outweigh the benefits of ongoing efficiency programs.

Against that backdrop, recent quarterly results showing a year to date net loss of US$1,132 million on US$17,628 million of sales, and full year 2025 net sales guidance of US$24,000 million, look especially important. These figures sit at the center of the current catalyst debate, because they show how much profit compression and capital intensity the business must work through before any improvement in margins, returns on capital and free cash flow can support a more durable turnaround.

But while the long term plan is ambitious, investors should be aware that chronic mill reliability issues and ongoing underinvestment could still...

Read the full narrative on International Paper (it's free!)

International Paper's narrative projects $28.1 billion revenue and $2.0 billion earnings by 2028. This requires 8.6% yearly revenue growth and about a $2.0 billion increase in earnings from -$27.0 million today.

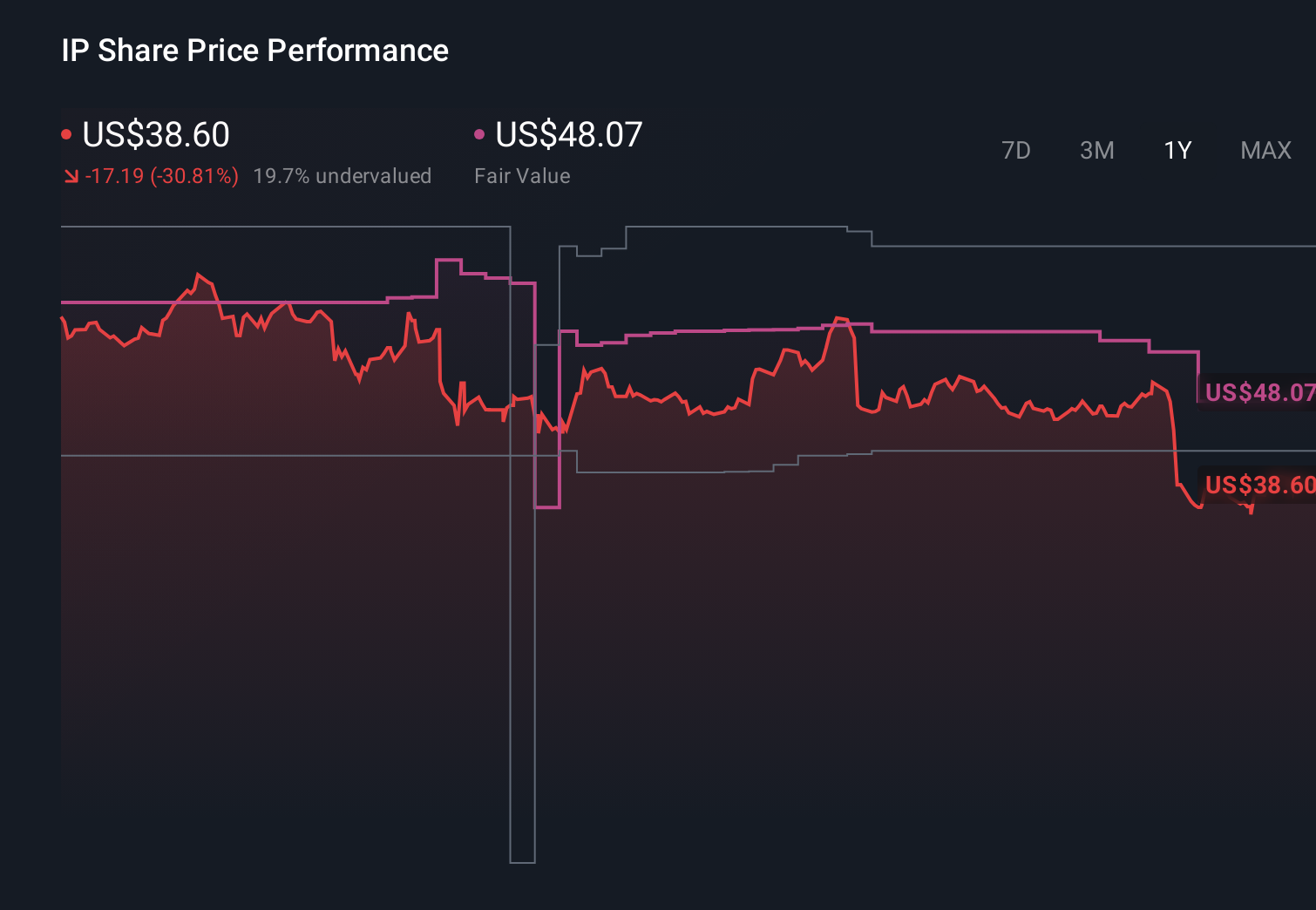

Uncover how International Paper's forecasts yield a $48.07 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community estimates put fair value for International Paper between US$48.07 and US$84.74 per share, underlining how far opinions can stretch. When you set those against concerns about mill reliability, underinvestment and already pressured cash flows, it becomes clear why you may want to review several viewpoints before deciding what the current price really implies for future performance.

Explore 3 other fair value estimates on International Paper - why the stock might be worth over 2x more than the current price!

Build Your Own International Paper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Paper research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free International Paper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Paper's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IP

International Paper

Produces and sells renewable fiber-based packaging and pulp products in North America, Latin America, Europe, and North Africa.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026