- United States

- /

- Chemicals

- /

- NYSE:ICL

ICL Group (NYSE:ICL) Faces DOE Funding Cut—What It Means for the Stock’s Current Valuation

Reviewed by Kshitija Bhandaru

ICL Group (NYSE:ICL) is re-evaluating its lithium iron phosphate (LFP) cathode plant in St. Louis after the U.S. Department of Energy discontinued funding for the project. The department cited updated budget priorities and increased cost projections.

See our latest analysis for ICL Group.

While ICL's lithium project setback grabbed headlines, the company’s stock has actually shown upside momentum. Year to date, the share price has returned 30.7%, and over the last twelve months, total shareholder return stood at 63.7%, despite some recent volatility. Over the longer run, shareholders have enjoyed solid performance, with a 111% total return in five years, signalling robust long-term potential even as risks and strategy evolve.

If you're curious to discover what else is driving growth in the materials space, broaden your search and check out fast growing stocks with high insider ownership

Given the company’s resilience and recent outperformance, the key question now is whether ICL’s recent gains have left the stock undervalued or if the market has already priced in all of its future growth potential.

Most Popular Narrative: 3.8% Undervalued

ICL Group’s last close price of $6.48 sits just below the widely followed narrative fair value of $6.74. This creates high expectations for future earnings and margins.

Strong financial performance and diversification efforts, combined with innovation in new products, signal ICL's growth potential and financial stability, enhancing shareholder value.

Want to know the key factors driving this premium valuation? Insiders are projecting a mix of higher profit margins, bold earnings milestones, and an evolving revenue mix. Discover what surprising growth forecasts support this narrative and why the current price could be just the beginning.

Result: Fair Value of $6.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, factors such as ongoing geopolitical instability or weaker-than-expected returns from new innovations could challenge the bullish case for ICL’s growth narrative.

Find out about the key risks to this ICL Group narrative.

Another View: Discounted Cash Flow Model

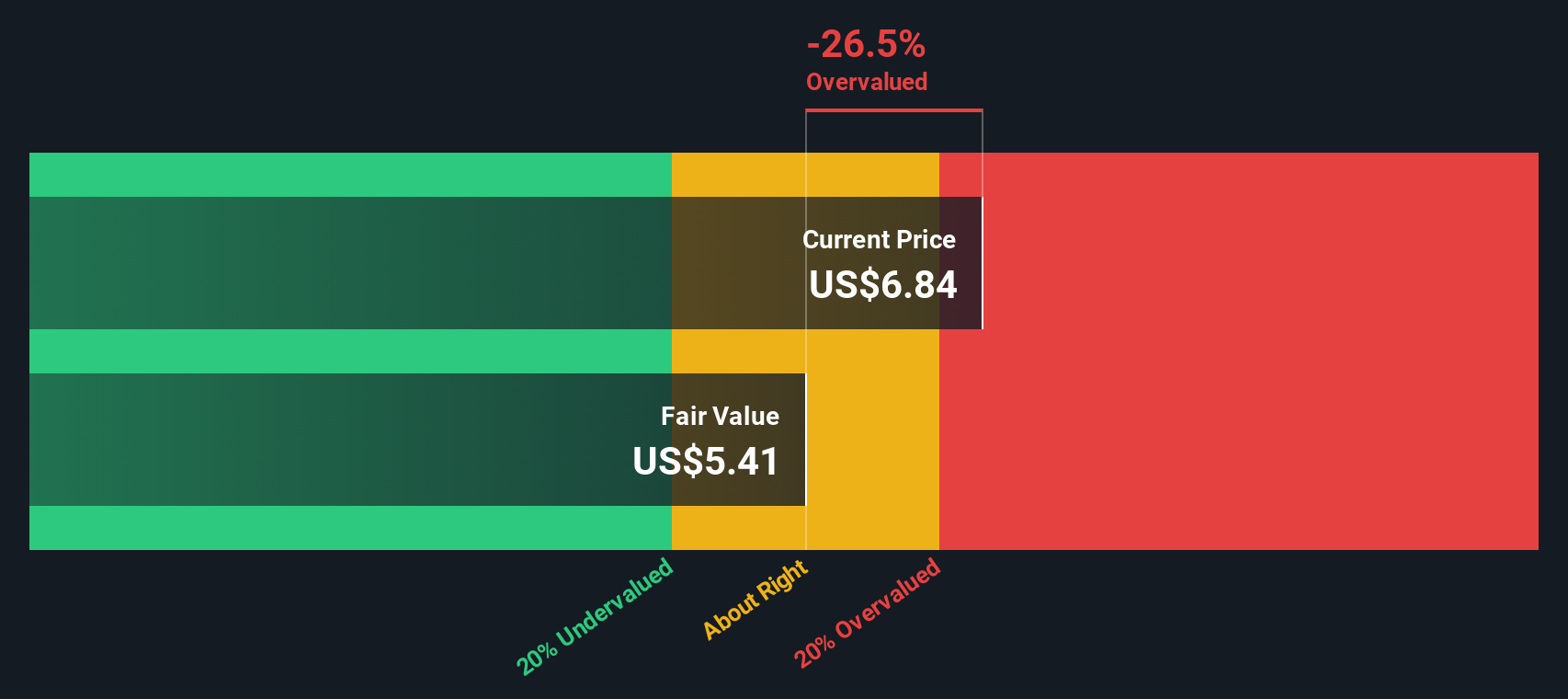

Taking a different approach, the Simply Wall St DCF model suggests ICL is trading above its estimated fair value of $5.43. This method, which projects future cash flows, implies ICL might actually be overvalued. This offers a check against the more optimistic multiples-based narratives. Which approach will prove more accurate as the story unfolds?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ICL Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ICL Group Narrative

If you have a different perspective or want to dig deeper, you can quickly run your own analysis and develop a narrative using just a few minutes. Do it your way

A great starting point for your ICL Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart moves start with the right tools. Don’t let opportunity pass you by. Check out these targeted lists to give your next investment an edge.

- Spot unique growth stories by targeting these 3581 penny stocks with strong financials that combine robust financials with breakthrough innovation before they become household names.

- Uncover future industry leaders with strong yields when you check out these 19 dividend stocks with yields > 3% boasting payout ratios above 3% for steady returns.

- Benefit from high-conviction trends and companies at the heart of transformation by tapping into these 24 AI penny stocks at the forefront of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ICL

ICL Group

Operates as a specialty minerals and chemicals company worldwide.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives