- United States

- /

- Chemicals

- /

- NYSE:ICL

How Investors Are Reacting To ICL (ICL) Cutting EPS Amid Raised Sales Outlook and New Dividend

Reviewed by Simply Wall St

- On August 6, 2025, ICL Group announced updated full-year sales volume guidance of 4.3 to 4.5 million metric tons, declared a cash dividend of US$0.04260 per share (about US$55 million), and reported second quarter 2025 sales of US$1.83 billion with net income of US$93 million.

- Despite year-over-year sales growth, ICL Group’s second quarter net income and earnings per share declined compared to the prior period, signaling ongoing operational and margin pressures.

- We'll explore how ICL Group's revised sales volume outlook and dividend decision could influence the company’s longer-term investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

ICL Group Investment Narrative Recap

For shareholders, the ICL Group story is built around confidence in its specialty products, commitment to cash generation, and the ability to sustain dividend payouts, even when earnings fluctuate. The revised full-year sales guidance and new dividend declaration are straightforward signals, but these updates do not appear to fundamentally change the fact that margin pressures remain the company's most meaningful short-term risk, while stabilization in specialty market sales is still the key near-term catalyst for performance.

Among recent announcements, the downward revision of expected full-year sales volumes stands out, as it directly relates to both future revenue momentum and ICL’s ongoing operational challenges. With volumes now set between 4.3 and 4.5 million metric tons for 2025, lower than previously indicated, investors may watch for any further effects on profit margins and the company’s ability to support ongoing dividend payments.

However, it's important for investors to remember, if specialty market demand suddenly weakens, the consequences for ICL could be far more significant than...

Read the full narrative on ICL Group (it's free!)

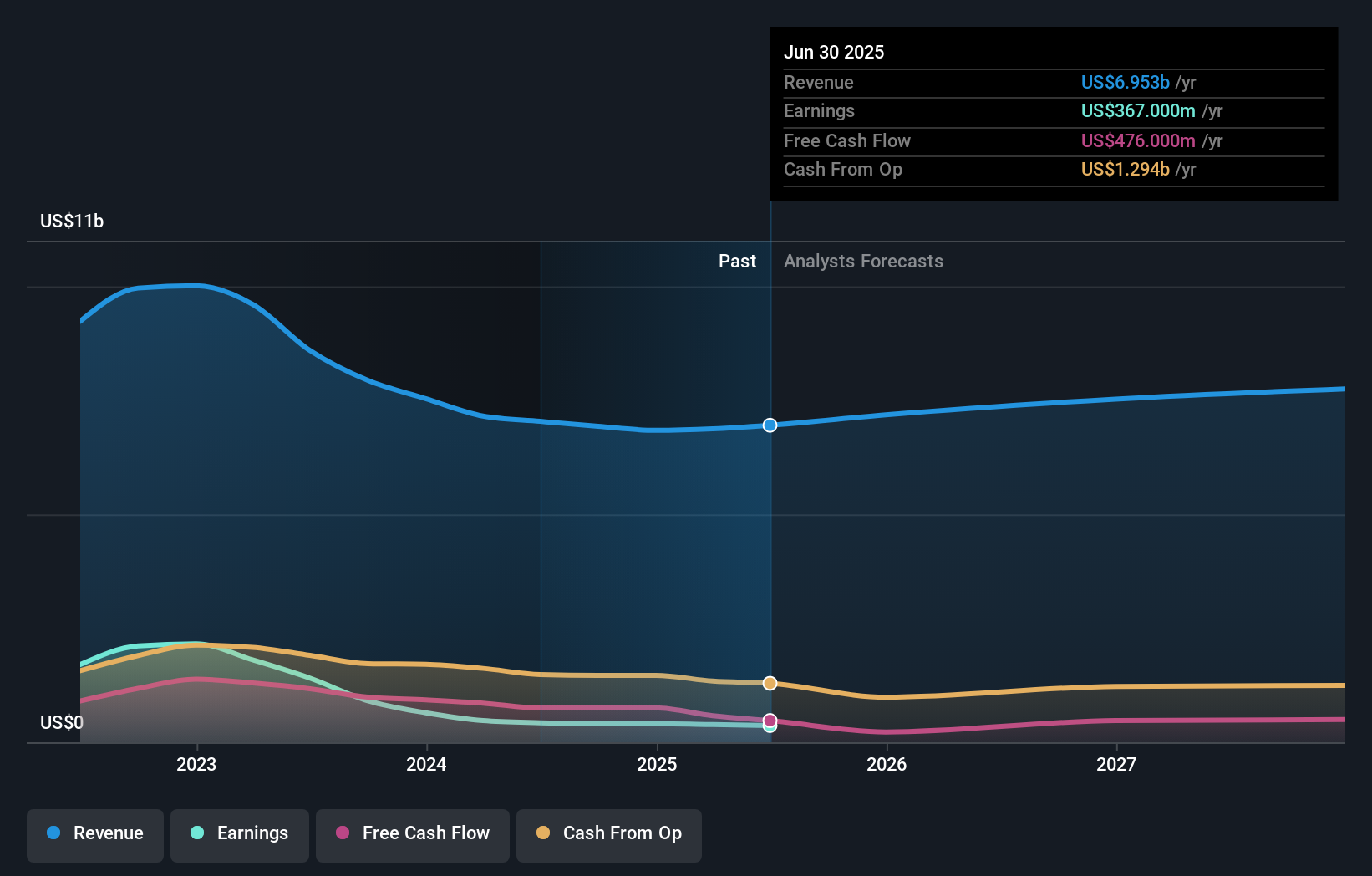

ICL Group's outlook anticipates $8.1 billion in revenue and $714.9 million in earnings by 2028. This scenario assumes a 5.2% annual revenue growth rate and a $310.9 million increase in earnings from the current $404.0 million.

Uncover how ICL Group's forecasts yield a $6.74 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Community fair value estimates for ICL Group range from US$6.31 to US$6.74 per share across three individual perspectives from the Simply Wall St Community. While specialty market sales remain a core catalyst, investors should keep in mind how sharply opinions can differ on ICL’s future outlook and explore a broad set of viewpoints before making decisions.

Explore 3 other fair value estimates on ICL Group - why the stock might be worth as much as 11% more than the current price!

Build Your Own ICL Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ICL Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free ICL Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ICL Group's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ICL

ICL Group

Operates as a specialty minerals and chemicals company worldwide.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives