- United States

- /

- Chemicals

- /

- NYSE:HUN

Insider Action On Undervalued Small Caps Across Regions In December 2025

Reviewed by Simply Wall St

In December 2025, the U.S. stock market is experiencing a mixed landscape, with the Dow Jones Industrial Average reaching new highs before retreating, while tech-heavy indices like the Nasdaq and S&P 500 face pressures due to AI bubble concerns. Amid these fluctuations, small-cap stocks in the United States present intriguing opportunities for investors seeking value in a volatile environment. Identifying potential growth within this segment requires careful consideration of economic indicators and market sentiment that influence small-cap performance.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Blue Bird | 12.5x | 1.1x | 46.66% | ★★★★★★ |

| Shore Bancshares | 11.0x | 2.9x | 37.79% | ★★★★★☆ |

| Wolverine World Wide | 17.0x | 0.8x | 37.77% | ★★★★★☆ |

| First United | 10.6x | 3.1x | 41.96% | ★★★★★☆ |

| Peoples Bancorp | 10.9x | 2.0x | 42.30% | ★★★★★☆ |

| Merchants Bancorp | 8.3x | 2.8x | 47.07% | ★★★★★☆ |

| Innovative Industrial Properties | 13.2x | 5.8x | 46.82% | ★★★★★☆ |

| S&T Bancorp | 12.1x | 4.1x | 33.70% | ★★★☆☆☆ |

| Farmland Partners | 6.6x | 8.1x | -94.61% | ★★★☆☆☆ |

| Vestis | NA | 0.4x | -18.93% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

SNDL (SNDL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: SNDL operates in the liquor and cannabis retail sectors, with additional involvement in cannabis operations, and has a market cap of approximately CA$1.15 billion.

Operations: The company generates revenue primarily from liquor retail and cannabis retail, with additional income from cannabis operations. The gross profit margin has shown an upward trend, reaching 27.13% by mid-2025. Operating expenses are significant, with general and administrative costs being a major component.

PE: -8.5x

SNDL, a smaller company in the U.S., recently announced a share repurchase program to buy back up to 24.5 million shares for CAD 100 million by November 2026, highlighting insider confidence. Despite reporting CAD 244.22 million in Q3 sales with reduced net losses compared to last year, SNDL remains unprofitable and relies on external borrowing for funding. The recent auditor change could affect investor sentiment, but ongoing buybacks might signal management's commitment to enhancing shareholder value amidst volatility.

- Dive into the specifics of SNDL here with our thorough valuation report.

Examine SNDL's past performance report to understand how it has performed in the past.

Huntsman (HUN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Huntsman is a global manufacturer and marketer of differentiated chemicals with operations in polyurethanes, advanced materials, and performance products, boasting a market capitalization of approximately $4.5 billion.

Operations: The company's revenue is primarily driven by its Polyurethanes segment, followed by Advanced Materials and Performance Products. Over recent periods, the gross profit margin has shown a declining trend, reaching 13.41% in the latest quarter. Operating expenses have consistently included significant allocations to General & Administrative and R&D expenses.

PE: -5.9x

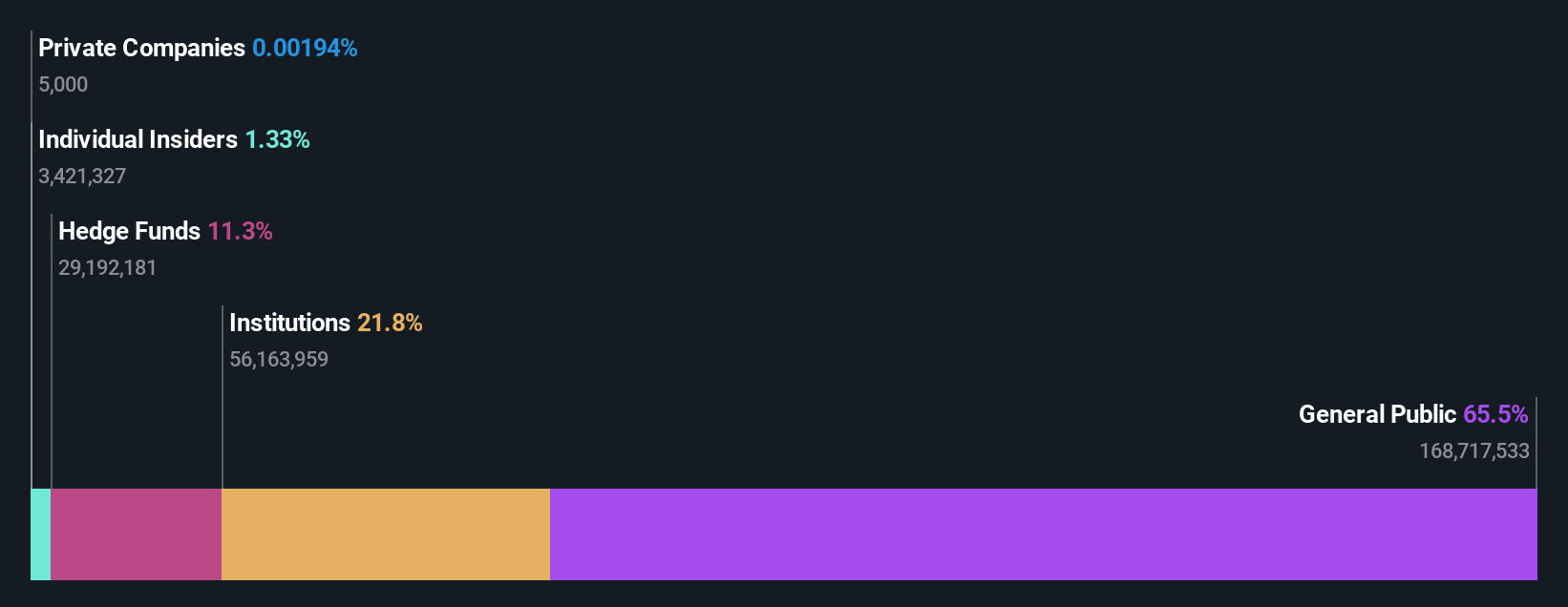

Huntsman, a smaller player in the chemical industry, has caught attention with insider confidence shown by Peter Huntsman purchasing 45,000 shares for US$503,405 in November 2025. Despite reporting a net loss of US$25 million for Q3 2025 and reduced sales compared to last year, their earnings are expected to grow significantly at over 110% annually. The company faces challenges with higher-risk funding due to reliance on external borrowing but remains active in industry conferences and maintains shareholder engagement through dividends.

- Click to explore a detailed breakdown of our findings in Huntsman's valuation report.

Explore historical data to track Huntsman's performance over time in our Past section.

Innovative Industrial Properties (IIPR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Innovative Industrial Properties focuses on acquiring, developing, and leasing real estate to tenants in the regulated cannabis industry, with a market cap of approximately $1.47 billion.

Operations: The primary revenue stream comes from acquiring, developing/redeveloping, and leasing real estate to tenants, generating $276.04 million. Over recent periods, the gross profit margin has shown a declining trend, reaching 89.20% in the latest quarter. Operating expenses are a significant cost component at $107.64 million, with general and administrative expenses contributing $33.87 million to this figure.

PE: 13.2x

Innovative Industrial Properties, a small company in the U.S., is navigating challenging times with declining earnings and revenue. In Q3 2025, they reported sales of US$64.29 million, down from US$76.05 million the previous year, while net income fell to US$29.31 million from US$40.22 million. Their funding relies entirely on external borrowing, highlighted by a new US$100 million credit facility secured in October 2025 at an interest rate of 6.1%. Despite these hurdles, insider confidence remains steady as evidenced by consistent dividend payments; they declared a third-quarter dividend of $1.90 per share and have completed a buyback tranche under their March plan for $20.1 million worth of shares repurchased earlier this year.

Summing It All Up

- Take a closer look at our Undervalued US Small Caps With Insider Buying list of 75 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Huntsman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUN

Huntsman

Manufactures and sells diversified organic chemical products worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)