- United States

- /

- Metals and Mining

- /

- NYSE:FCX

Freeport-McMoRan (FCX) Margin Improvement Challenges Premium Valuation Narrative

Reviewed by Simply Wall St

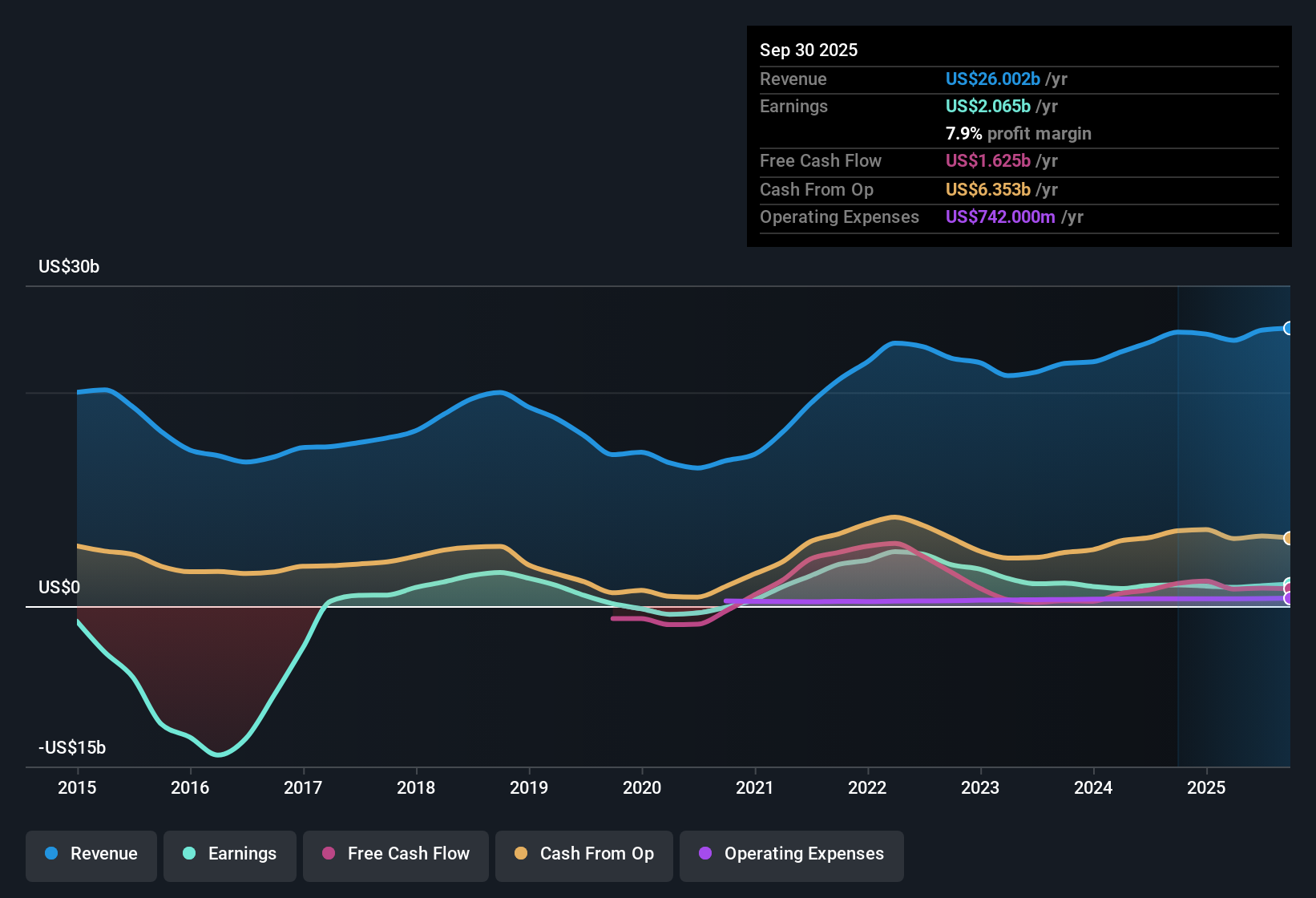

Freeport-McMoRan (FCX) reported earnings forecasted to grow at 22.24% per year, with revenue projected to increase annually at 6.6%, trailing the broader US market’s 10% growth rate. Net profit margins reached 7.9%, a slight improvement from last year’s 7.8%, and the company delivered a modest year-over-year earnings growth of 3.8%, outperforming its five-year average decline of -5.1% per year. These results, combined with a lack of identified risks and a perception of undervaluation based on discounted cash flow measures, set the stage for investor optimism even as the stock trades at a premium relative to industry peers.

See our full analysis for Freeport-McMoRan.The next step is to see how these headline numbers compare with the prevailing narratives investors follow most closely. Some expectations will hold up, while others may get a fresh perspective.

See what the community is saying about Freeport-McMoRan

Margin Expansion Outpaces Analyst Forecasts

- Net profit margins reached 7.9%, already exceeding the 7.4% level that analysts currently assume and showing momentum towards the 10.7% margin target over the next three years.

- Analysts' consensus view heavily supports the idea that new smelter operations in Indonesia and cost-saving US innovations will continue fueling margin gains.

- Full ramp-up is expected to reduce export duties and boost future cash flows.

- Infrastructure and electrification-driven copper demand is expected to keep momentum for higher margins globally.

- With margins improving before some catalysts have reached full impact, analysts see rising potential for outperformance if integration and innovation targets are met.

Consensus analysts believe further margin upside is possible as catalysts like the Indonesian smelter and US innovation scale up. The question remains whether this will be enough to keep Freeport’s earnings growth ahead of peers. 📊 Read the full Freeport-McMoRan Consensus Narrative.

Capital Discipline Drives Profitability Story

- Freeport-McMoRan’s annual earnings growth of 3.8% has reversed a challenging five-year trend of -5.1% per year, providing a stepping stone for the bullish narrative around disciplined capital management and project selection.

- Analysts' consensus view underscores how the company’s focus on disciplined capital allocation, returning 50% of excess cash via dividends and buybacks while keeping an investment-grade balance sheet, reinforces the durability of profits through volatile commodity cycles.

- Commitment to measured brownfield expansion is expected to boost volume by up to 2.5 billion pounds of new copper supply in tight markets.

- Minimized dilution projected by a planned 0.08% per year share count decline raises per-share value over time.

Valuation Premium vs. DCF Fair Value

- The current share price of $41.37 trades at a premium compared to industry peers and remains well below the DCF fair value estimate of $75.02, highlighting competing views on Freeport-McMoRan’s worth.

- Analysts' consensus narrative contends that despite a Price-to-Earnings ratio of 32.9x, which is higher than the US metals and mining average of 22.5x, investors may still see value if projected revenue and earnings growth targets are realized.

- The analyst price target stands at $47.17, about 14% above today’s price, but still far below the DCF-based estimate.

- Ongoing market and regulatory risks, especially those tied to Indonesia operations and potential shifts in copper demand, temper the case for a much higher valuation.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Freeport-McMoRan on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the numbers? Share your insights and build a narrative in just a few minutes: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Freeport-McMoRan.

See What Else Is Out There

Despite strong margin progress, Freeport-McMoRan’s premium valuation and dependence on catalysts raise concerns about consistent value compared to industry peers.

If you’re looking for companies where the price better matches earnings potential, filter your search using our these 870 undervalued stocks based on cash flows and uncover stocks offering greater upside for the risk taken.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCX

Freeport-McMoRan

Engages in the mining of mineral properties in North America, South America, and Indonesia.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)