- United States

- /

- Metals and Mining

- /

- NYSE:CLF

Cleveland-Cliffs (NYSE:CLF) Drops 8% Following US$447 Million Q4 Net Loss

Reviewed by Simply Wall St

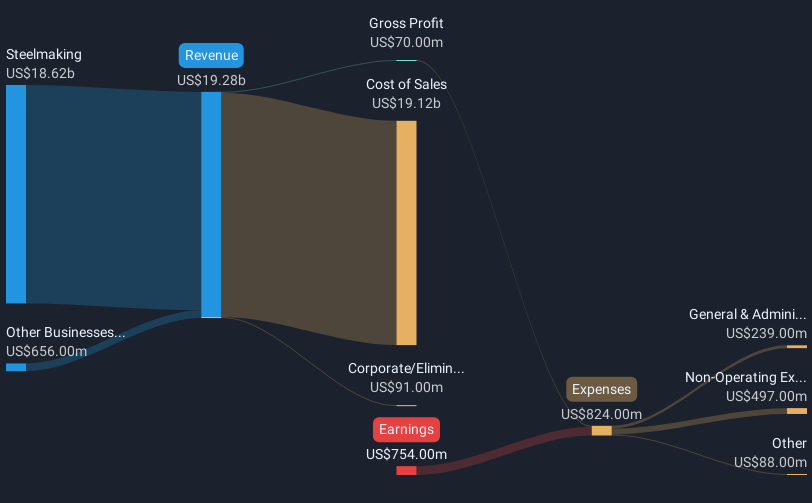

Cleveland-Cliffs (NYSE:CLF) experienced a 7.5% price decline over the last month, influenced by both internal and external factors. The company's recent earnings announcement reported a significant net loss of $447 million in Q4, a notable increase from the $155 million loss the previous year. This performance decline coincided with broader market fluctuations driven by trade tensions and mixed economic data, as highlighted by recent market volatility and tariff developments. Additionally, Cleveland-Cliffs issued $850 million in senior notes to manage its debt, reflecting strategic financial maneuvering amidst challenging economic conditions. Meanwhile, the company's share buyback program showed limited recent activity. While automaker stocks rallied due to potential tariff relief, broader market indexes like the Dow and S&P 500 oscillated amid economic uncertainties. The overall market dropped 3.1% last week, contributing to the company's share price trajectory against a backdrop of declining steel sales and profitability challenges.

Take a closer look at Cleveland-Cliffs's potential here.

Over the five-year span, Cleveland-Cliffs achieved a 99.62% total return including share price and dividends. This performance reflects various significant undertakings and market movements. In recent years, the company has been active with transactions like the issuance of $850 million in senior notes intended to manage debt, highlighting an effort to stabilize its financial framework. Simultaneously, earnings have been affected, with the latest announcement in February 2025 revealing a US$447 million net loss for Q4. This aligns with the challenges posed by declining sales in sectors such as steel.

Despite the losses, Cleveland-Cliffs' venture into business expansions, like initiating a new plant in West Virginia, demonstrates a commitment to addressing market needs. M&A rumors, including bids for United States Steel Corp, also suggest an ambition for growth. Still, Cleveland-Cliffs underperformed the US Metals and Mining industry over the last year, which gained 4.6%, revealing some discrepancies compared to broader industry trends.

- Unlock the insights behind Cleveland-Cliffs' valuation and discover its true investment potential

- Understand the uncertainties surrounding Cleveland-Cliffs' market positioning with our detailed risk analysis report.

- Already own Cleveland-Cliffs? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLF

Cleveland-Cliffs

Operates as a flat-rolled steel producer in North America.

Fair value with moderate growth potential.