- United States

- /

- Metals and Mining

- /

- NYSE:CLF

Cleveland-Cliffs (CLF): Five-Year Losses Deepen 35.8% Annually as Profitability Remains Elusive Heading Into Earnings

Reviewed by Simply Wall St

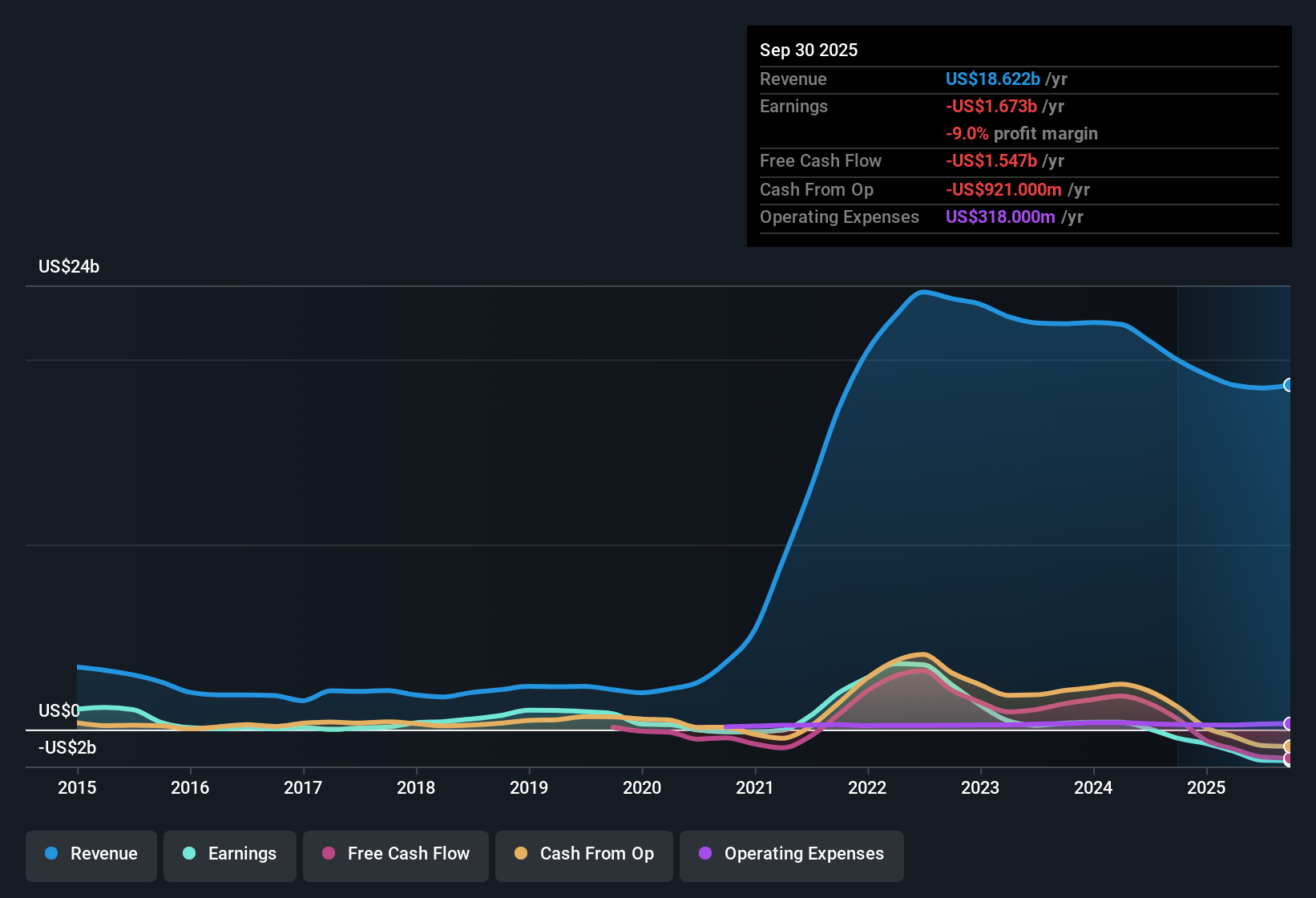

Cleveland-Cliffs (CLF) remains unprofitable, with losses widening at an annual rate of 35.8% over the past five years. Looking ahead, analysts forecast a dramatic turnaround, with earnings growth projected at 102.3% per year and revenue growth at 5.5% annually. However, revenue is set to lag the broader US market’s 10.1% rate. The company trades at a low 0.4x price-to-sales ratio compared to peers and industry averages, but its stock price of $16.18 is well above internal fair value estimates. Investors face a balancing act between these aggressive forward growth forecasts and ongoing financial stability concerns.

See our full analysis for Cleveland-Cliffs.Next, we’ll see how the latest numbers hold up when placed side by side with the prevailing narratives from the market and the Simply Wall St community.

See what the community is saying about Cleveland-Cliffs

Profit Margins Set to Swing Positive

- Consensus forecasts call for profit margins to rise from -9.0% today to 2.6% in three years, transforming Cleveland-Cliffs from deep losses to sustained profitability.

- Analysts' consensus view highlights that this margin shift is underpinned by several levers:

- Cost reductions and asset sales are trimming overhead. New investments in higher-margin specialty steels help expand the company's addressable market and support improved average selling prices.

- Structural gains are expected from reshoring trends and trade protections, allowing Cleveland-Cliffs to capture increased domestic steel demand. The company's reliance on legacy blast furnace technology remains a concern for long-term cost competitiveness.

- Analysts suggest that accelerating margin recovery is crucial for upside, especially as Cleveland-Cliffs navigates evolving industry dynamics and regulatory shifts.

Leverage and Cost Controls Under Scrutiny

- Recent asset sales and a disciplined approach to working capital aim to reduce leverage and lower interest costs, but Cleveland-Cliffs still faces financial pressure due to elevated debt from recent acquisitions.

- Analysts' consensus view notes critical risks tied to these points:

- If working capital releases or noncore divestiture proceeds weaken, the company’s ability to reduce debt and improve free cash flow could be constrained. This raises the stakes for management's financial discipline.

- Heavy exposure to automotive OEMs and legacy production methods creates added vulnerability if market conditions deteriorate or industry trends shift toward lighter, greener materials.

Valuation Discount Versus Peers

- Cleveland-Cliffs trades at a 0.4x price-to-sales ratio, substantially below peer (1.3x) and US metals and mining industry (3.1x) averages, despite ongoing financial instability.

- Analysts' consensus view contends this low multiple reflects market skepticism around the company’s lagging revenue growth forecast (5.5% vs. the US market’s 10.1%) and the need for a clear path to margin improvement:

- While the steep valuation discount suggests potential upside if earnings rebound materializes, wide disagreement among analysts over future price targets signals uncertainty about Cleveland-Cliffs’ ability to close the gap with stronger-performing competitors.

- The consensus price target sits at $12.35, well beneath the current $16.18 price. This reinforces concerns that the stock may be overvalued relative to its forward earnings and sector trends.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Cleveland-Cliffs on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the figures? Share your insight and build your own narrative in just a few minutes. Do it your way

A great starting point for your Cleveland-Cliffs research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Cleveland-Cliffs faces persistent financial instability, high leverage, and uncertain margin recovery, raising questions about its ability to deliver sustainable value compared to peers.

If balancing debt and weak fundamentals isn’t for you, check out solid balance sheet and fundamentals stocks screener (1985 results) to instantly spot companies with stronger financial health and resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLF

Cleveland-Cliffs

Operates as a flat-rolled steel producer in the United States, Canada, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)