- United States

- /

- Metals and Mining

- /

- NYSE:CLF

Cleveland-Cliffs (CLF): Assessing Valuation After Fund Spotlight, Efficiency Gains and a Price Target Upgrade

Reviewed by Simply Wall St

Efficiency Gains Drive Fresh Attention to Cleveland-Cliffs

Cleveland-Cliffs (CLF) is back on investors' radar after Voya MI Dynamic Small Cap Fund spotlighted the stock, crediting efficiency gains in its auto platform and a 12% share jump for boosting portfolio performance.

See our latest analysis for Cleveland-Cliffs.

That efficiency story has landed on a backdrop of strong momentum, with a roughly 33% year to date share price return to $12.71 even though the five year total shareholder return is still slightly negative. This suggests sentiment is improving, but the longer cycle is not fully repaired.

If the move in Cleveland-Cliffs has caught your attention, this could be a good moment to explore other auto exposed manufacturing names through auto manufacturers.

With shares already rallying on efficiency gains and a recent price target upgrade, the key question now is whether Cleveland-Cliffs is still trading below its true worth or if the market is already pricing in the next leg of growth?

Most Popular Narrative: 2.1% Overvalued

With the most followed narrative putting Cleveland-Cliffs fair value slightly below the recent 12.71 close, the debate shifts to how realistic its recovery path looks.

Strategic footprint optimization, internal coke and feedstock integration, and direct moves to lower fixed costs and SG&A have already resulted in unit cost reductions. Ongoing initiatives are expected to deliver further cost savings, driving enhanced free cash flow, lower leverage, and a structurally higher earnings profile through improved operating margins.

Want to see the math behind this turnaround pitch, the projected revenue climb, margin reset, and future earnings multiple that anchor this fair value view?

Result: Fair Value of $12.45 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this thesis could unravel if steel tariffs fade or if automakers accelerate a shift toward lighter, lower emission materials instead of traditional steel.

Find out about the key risks to this Cleveland-Cliffs narrative.

Another Lens on Valuation

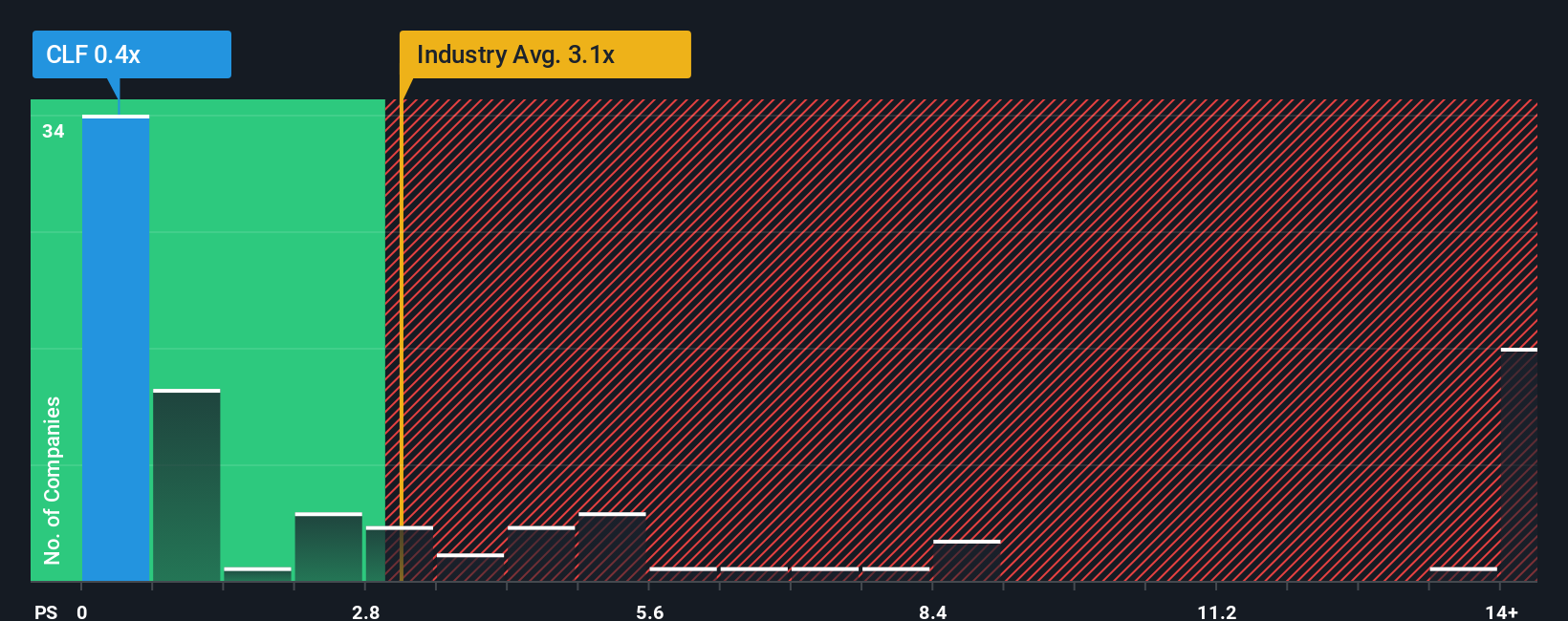

While the narrative model flags Cleveland-Cliffs as about 2% overvalued, a simple sales based lens tells a different story. At roughly 0.4 times revenue, the stock trades at a steep discount to both the U.S. Metals and Mining average of 2 times and peer levels near 1.5 times, and even below a 0.6 times fair ratio that the market could drift toward over time. Is the market underestimating how much operating leverage and tariff support could still re rate that revenue base?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cleveland-Cliffs Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized Cleveland-Cliffs narrative in just minutes: Do it your way.

A great starting point for your Cleveland-Cliffs research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Give your portfolio an edge by using the Simply Wall St Screener to uncover focused ideas you might miss if you stick to headline names alone.

- Capture high potential early by targeting these 3606 penny stocks with strong financials that pair small share prices with solid underlying fundamentals and room to surprise on growth.

- Ride the structural shift toward automation and data with these 26 AI penny stocks that are building real revenue from artificial intelligence instead of just hype.

- Lock in quality at a discount through these 907 undervalued stocks based on cash flows that current cash flows suggest the market has not fully priced in yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLF

Cleveland-Cliffs

Operates as a flat-rolled steel producer in the United States, Canada, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)