- United States

- /

- Metals and Mining

- /

- NYSE:CLF

Cleveland-Cliffs (CLF): Assessing Valuation After Efficiency Gains From Automation and Energy Management Upgrades

Reviewed by Simply Wall St

Cleveland-Cliffs (CLF) is getting attention after reporting improved steel output efficiency, driven by advanced automation, real-time monitoring, and tighter energy management. This shift could gradually reshape margins and reliability for its core customers.

See our latest analysis for Cleveland-Cliffs.

The efficiency gains land at a time when momentum is quietly rebuilding, with a roughly 33.7% year to date share price return and a more modest 5.7% one year total shareholder return. This hints that investors are cautiously re-rating operational progress.

If this kind of operational turnaround has your attention, it could be a good moment to explore fast growing stocks with high insider ownership for other under the radar ideas with strong insider conviction.

Yet with shares trading close to analyst targets and the business still recovering from prior losses, the real debate is whether Cleveland-Cliffs remains undervalued or whether the market has already priced in the next leg of growth.

Most Popular Narrative: 2.4% Overvalued

With the narrative fair value sitting just below Cleveland-Cliffs' last close of $12.75, the story hinges on a slow but meaningful earnings comeback.

Analysts are assuming Cleveland-Cliffs's revenue will grow by 6.8% annually over the next 3 years.

Analysts expect earnings to reach $590.0 million (and earnings per share of $1.07) by about September 2028, up from $-1.7 billion today.

Want to see what turns today’s heavy losses into future profits and a higher multiple, even with only moderate growth assumptions on the top line and margins?

Result: Fair Value of $12.45 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the bullish narrative could unravel if Section 232 tariffs ease or if decarbonization pressures force costly upgrades to Cleveland-Cliffs' legacy blast furnace footprint.

Find out about the key risks to this Cleveland-Cliffs narrative.

Another View: Sales Multiple Points to Value Gap

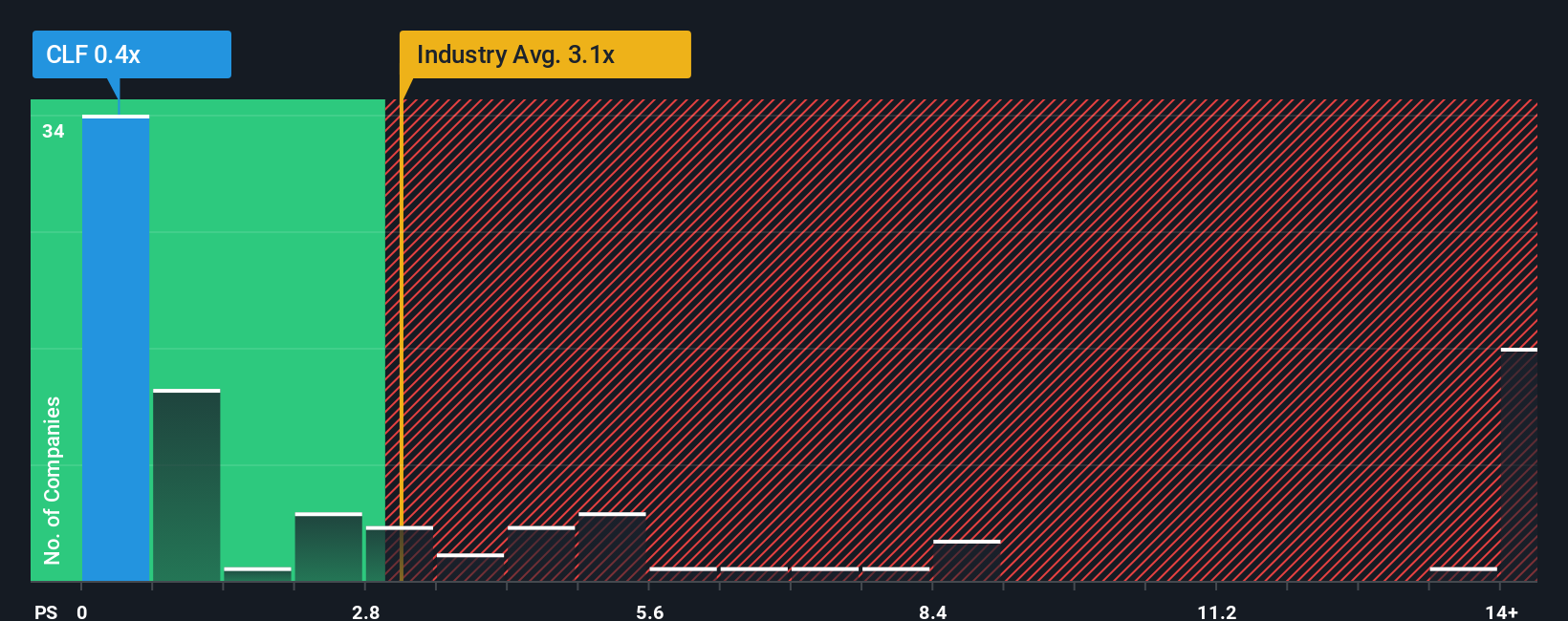

While the narrative fair value suggests Cleveland-Cliffs is modestly overvalued, the price to sales perspective tells a different story. At 0.4x sales versus 1.5x for peers and a 2.1x industry average, and below a 0.6x fair ratio, the market is pricing in real execution risk, but also leaving room for potential upside if margins normalise.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cleveland-Cliffs Narrative

If you see the story differently, or prefer to dig into the numbers yourself, you can build a personalized view in minutes with Do it your way.

A great starting point for your Cleveland-Cliffs research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before the market moves on without you, use the Simply Wall St Screener to uncover fresh opportunities that match your strategy and sharpen your edge.

- Capture potential breakout names by scanning these 3572 penny stocks with strong financials that already show strengthening financial foundations and improving business momentum.

- Position ahead of the next tech wave by targeting these 26 AI penny stocks that link real revenue traction to cutting edge artificial intelligence applications.

- Lock in value focused opportunities by tracking these 912 undervalued stocks based on cash flows where current prices sit well below estimated cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLF

Cleveland-Cliffs

Operates as a flat-rolled steel producer in the United States, Canada, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)