- United States

- /

- Chemicals

- /

- NYSE:ASPN

Aspen Aerogels (NYSE:ASPN shareholders incur further losses as stock declines 6.6% this week, taking three-year losses to 61%

If you love investing in stocks you're bound to buy some losers. But long term Aspen Aerogels, Inc. (NYSE:ASPN) shareholders have had a particularly rough ride in the last three year. So they might be feeling emotional about the 61% share price collapse, in that time. Shareholders have had an even rougher run lately, with the share price down 41% in the last 90 days.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Aspen Aerogels

Given that Aspen Aerogels only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over three years, Aspen Aerogels grew revenue at 42% per year. That is faster than most pre-profit companies. In contrast, the share price is down 17% compound, over three years - disappointing by most standards. This could mean hype has come out of the stock because the losses are concerning investors. When we see revenue growth, paired with a falling share price, we can't help wonder if there is an opportunity for those who are willing to dig deeper.

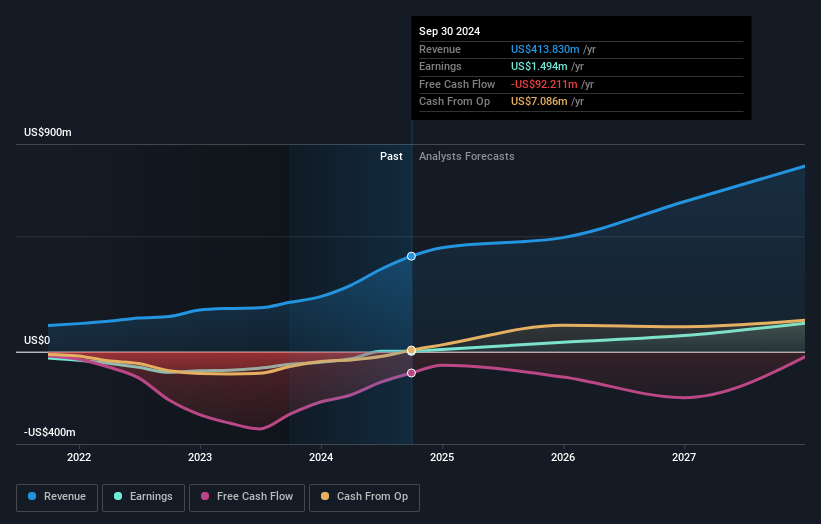

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Aspen Aerogels is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Aspen Aerogels stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Investors in Aspen Aerogels had a tough year, with a total loss of 6.4%, against a market gain of about 26%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 6%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Aspen Aerogels better, we need to consider many other factors. For instance, we've identified 1 warning sign for Aspen Aerogels that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ASPN

Aspen Aerogels

An aerogel technology company, designs, develops, manufactures, and sells aerogel materials primarily for use in the energy industrial, sustainable insulation materials, and electric vehicle (EV) markets in the United States, Canada, Asia, Europe, and Latin America.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives