- United States

- /

- Metals and Mining

- /

- NasdaqGS:STLD

Steel Dynamics (NasdaqGS:STLD) Reports Year-Over-Year Sales Decline to US$4,369 Million

Reviewed by Simply Wall St

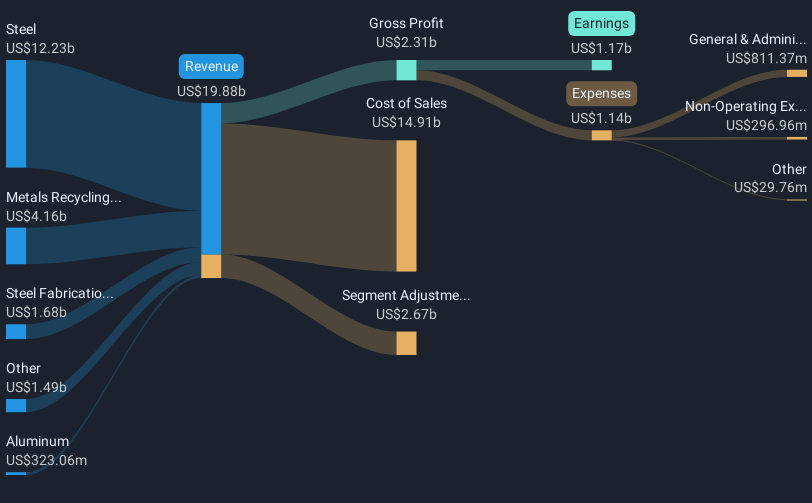

Steel Dynamics (NasdaqGS:STLD) reported a 12% increase in its share price over the last week, a period that coincided with the release of its first-quarter earnings and updates on its share buyback program. Despite a year-over-year decline in sales to $4,369 million and net income falling to $217 million, the company's active stock repurchase efforts continue to enhance shareholder value, repurchasing 645,869 shares for $82 million. This strategic buyback initiative, set against a market backdrop where major indices like the Dow Jones and S&P 500 lost ground, underscored the resilience in Steel Dynamics’ stock performance.

Steel Dynamics has 2 weaknesses we think you should know about.

Steel Dynamics' strategic initiatives, particularly the stock repurchase program, underline its commitment to enhancing shareholder value. Over a recent five-year span, the company has achieved an impressive total return of 475.45%, underscoring its positioning amid market fluctuations. Despite the 12% share price increase coinciding with recent earnings announcements, Steel Dynamics has faced short-term underperformance against the broader US Metals and Mining industry, which experienced a 3.1% decline over the past year. This contrast highlights the potential resilience of its business strategy over the longer term.

The company's current endeavors, including the ramp-up at the Sinton Mill and new coating lines, are crucial in diversifying its product mix and tapping into higher-margin opportunities, which could bolster future revenue and earnings. Analysts forecast a 22.6% annual earnings growth for the company, suggesting room for substantial growth. However, integration and input cost risks could present challenges, influencing these projections. With the current share price at US$117.39 compared to a consensus analyst price target of US$144.86, there's an implied potential upside, aligning with expectations of future financial gains as new ventures commence. This context affirms the importance of closely monitoring operational executions and market conditions impacting Steel Dynamics' projected growth trajectory.

Evaluate Steel Dynamics' prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STLD

Steel Dynamics

Operates as a steel producer and metal recycler in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives