- United States

- /

- Metals and Mining

- /

- NasdaqGS:RGLD

3 Stocks That Might Be Trading Below Their Estimated Value By Up To 44.6%

Reviewed by Simply Wall St

As the U.S. stock market experiences a notable upswing, with major indexes on track for their best week since June, investors are keenly observing opportunities that may be flying under the radar. In this environment of rising indices and renewed optimism, identifying stocks that might be trading below their estimated value becomes crucial for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Webull (BULL) | $9.26 | $17.99 | 48.5% |

| Warrior Met Coal (HCC) | $78.72 | $155.07 | 49.2% |

| Super Group (SGHC) (SGHC) | $10.93 | $21.73 | 49.7% |

| Perfect (PERF) | $1.73 | $3.46 | 50% |

| Freshworks (FRSH) | $12.01 | $24.01 | 50% |

| Flutter Entertainment (FLUT) | $199.92 | $391.12 | 48.9% |

| Fifth Third Bancorp (FITB) | $43.33 | $83.54 | 48.1% |

| Elastic (ESTC) | $69.94 | $135.95 | 48.6% |

| Circle Internet Group (CRCL) | $72.64 | $140.58 | 48.3% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $18.98 | $37.29 | 49.1% |

Here we highlight a subset of our preferred stocks from the screener.

Hasbro (HAS)

Overview: Hasbro, Inc. is a global toy and game company operating in regions including the United States, Europe, and Asia, with a market cap of approximately $11.45 billion.

Operations: The company's revenue segments consist of Entertainment ($127.90 million), Consumer Products ($2.60 billion), and Wizards of The Coast & Digital Gaming ($2.08 billion).

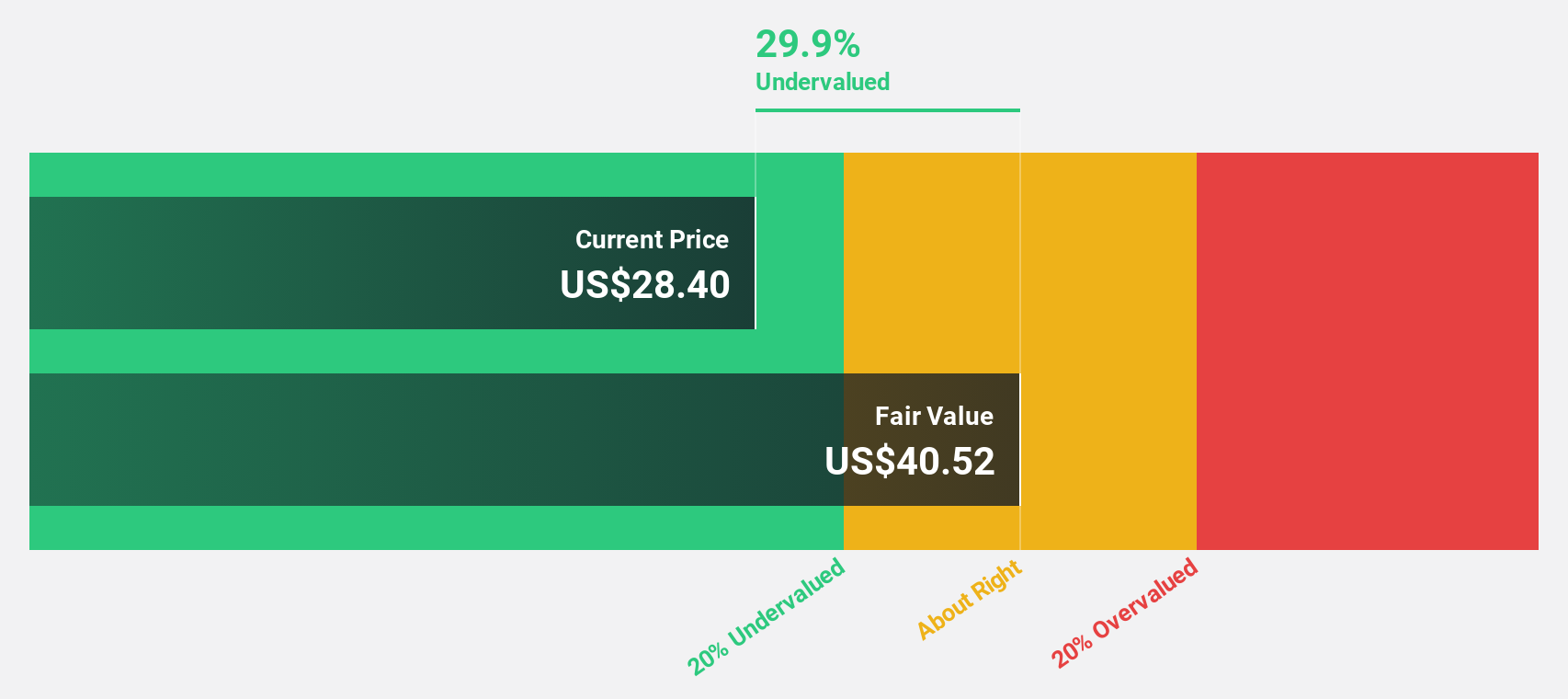

Estimated Discount To Fair Value: 44.6%

Hasbro is trading at US$82.67, significantly below its estimated fair value of US$149.12, suggesting it may be undervalued based on cash flows. Despite high debt levels and recent insider selling, the company's earnings are forecast to grow substantially at 54.37% annually over the next three years, with anticipated profitability above market averages. Recent collaborations and product launches could bolster revenue growth, although this is expected to lag behind broader market trends.

- Our growth report here indicates Hasbro may be poised for an improving outlook.

- Take a closer look at Hasbro's balance sheet health here in our report.

Royal Gold (RGLD)

Overview: Royal Gold, Inc. acquires and manages precious metal streams, royalties, and related interests with a market cap of approximately $16.24 billion.

Operations: The company's revenue is derived from stream interests amounting to $546.52 million and royalty interests totaling $302.74 million.

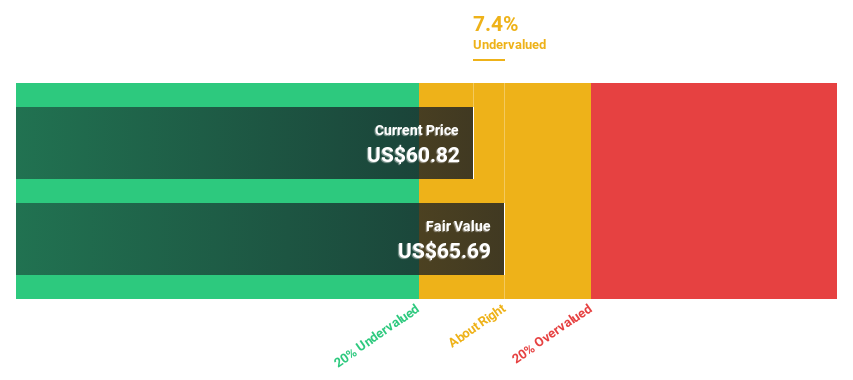

Estimated Discount To Fair Value: 10.4%

Royal Gold, trading at US$201.05, is below its estimated fair value of US$224.45, indicating potential undervaluation based on cash flows. The company reported strong earnings growth with net income rising to US$126.82 million in Q3 2025 from US$96.24 million a year ago and expects annual earnings growth of over 20% for the next three years. Despite shareholder dilution and modest undervaluation, revenue is forecasted to grow significantly faster than the market average.

- Upon reviewing our latest growth report, Royal Gold's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Royal Gold's balance sheet by reading our health report here.

Coupang (CPNG)

Overview: Coupang, Inc. operates a retail business through mobile applications and internet websites in South Korea and internationally, with a market cap of approximately $50.71 billion.

Operations: Coupang generates revenue from two main segments: Product Commerce, which contributes $29.07 billion, and Developing Offerings, which accounts for $4.60 billion.

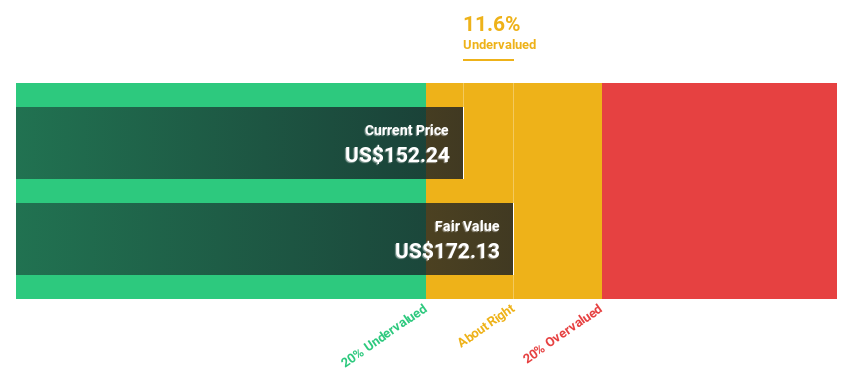

Estimated Discount To Fair Value: 27.8%

Coupang, trading at US$27.89, is significantly undervalued based on cash flow analysis with an estimated fair value of US$38.62. The company reported Q3 2025 revenue of US$9.27 billion and net income of US$95 million, reflecting solid growth from the previous year. Despite recent insider selling and a decline in profit margins to 1.2%, Coupang's earnings are expected to grow substantially above market averages over the next three years.

- In light of our recent growth report, it seems possible that Coupang's financial performance will exceed current levels.

- Navigate through the intricacies of Coupang with our comprehensive financial health report here.

Make It Happen

- Discover the full array of 211 Undervalued US Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGLD

Royal Gold

Acquires and manages precious metal streams, royalties, and related interests.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success