- United States

- /

- Metals and Mining

- /

- NasdaqGS:METC

Ramaco Resources (METC): Valuation in Focus After Rare Earth Mine Launch and $200M Equity Raise

Reviewed by Kshitija Bhandaru

Ramaco Resources (METC) has been front and center among investors after launching operations at the Brook Mine, marking the first new rare earth mine in the United States in over 70 years. This move puts the company in a unique position as it diversifies away from its roots in metallurgical coal and embraces the potential of critical minerals.

See our latest analysis for Ramaco Resources.

Momentum around Ramaco Resources has clearly picked up following the launch of operations at Brook Mine and a $200 million equity raise, both of which signaled a major evolution in its business model. While the share price itself has posted a modest gain so far this year, up just over 2% year-to-date, Ramaco’s long-term total shareholder returns illustrate the compounding effect of its strategic moves, with a 15% return over five years. Recent steps such as the new stock dividend and board changes highlight the company’s confidence and help maintain investor interest, especially as it focuses on the rare earths transition.

If you’re interested in discovering which other companies are seeing strong momentum and insider backing, now is the perfect moment to see what’s possible with fast growing stocks with high insider ownership

With Ramaco’s share price showing steady but muted gains, investors are left wondering: Is Wall Street overlooking the company’s rare earth ambitions, or has the future upside already been priced into the stock?

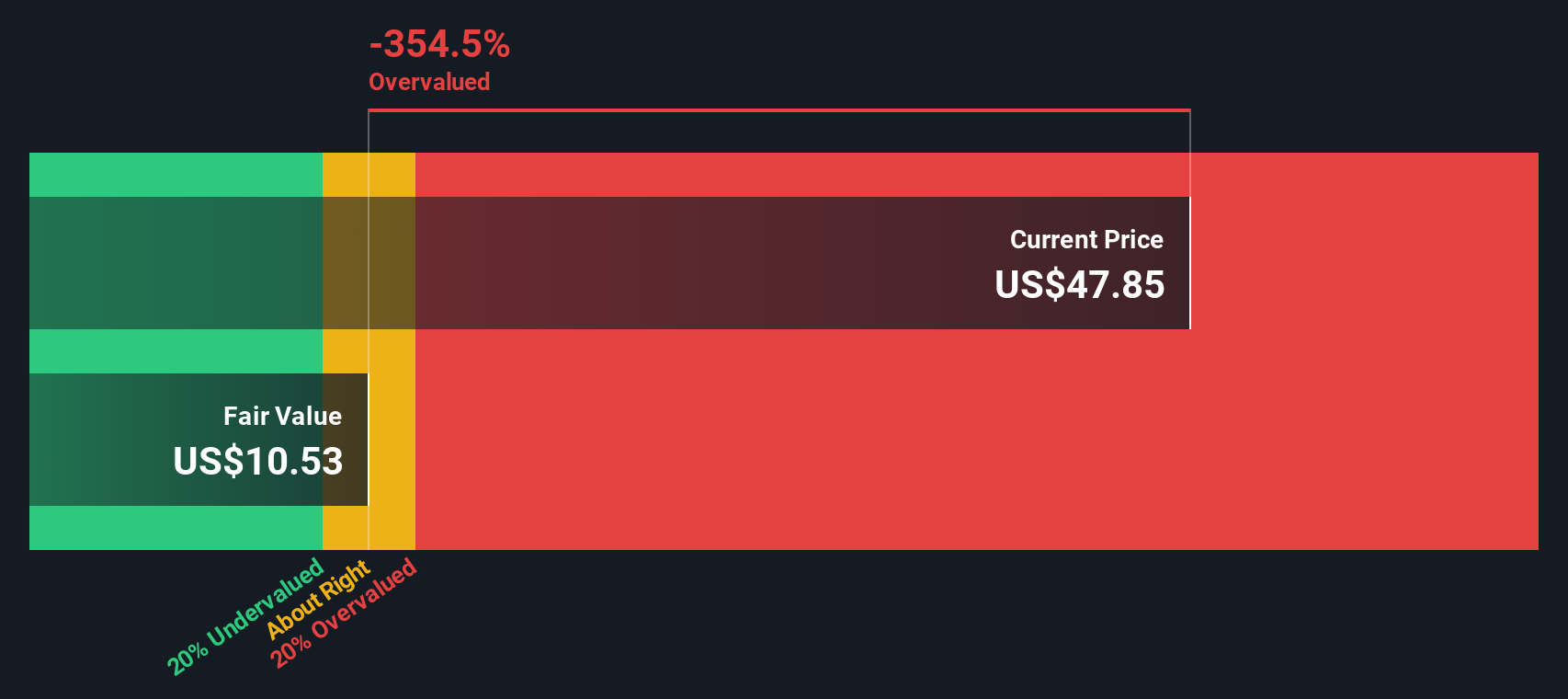

Most Popular Narrative: 13.5% Overvalued

Ramaco Resources’ most widely followed narrative pegs its fair value beneath the recent close, highlighting analyst caution as the stock pushes new territory. These valuation views set the foundation for a lively debate on whether rare earth ambitions will truly justify the current premium.

The company's cost leadership, operating in the first quartile of the U.S. met coal cost curve and ongoing investment in mining efficiency, enhances net margins and cash generation potential. This enables Ramaco to withstand weak market periods and capitalize robustly when prices recover.

Can Ramaco’s twin-engine growth story live up to the narrative’s premium valuation? The numbers rest on a transformation: efficiencies, future profits, and margin growth all rolled into one forecast. The real intrigue is in how much optimism analysts are baking into these assumptions; curious what those bold projections look like behind the scenes?

Result: Fair Value of $33.25 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, government support and rare earth pricing remain uncertain. This could challenge Ramaco's diversification efforts and impact future earnings if assumptions prove too optimistic.

Find out about the key risks to this Ramaco Resources narrative.

Another View: Discounted Cash Flow Says Undervalued

While analysts argue Ramaco Resources is trading above their price targets, our DCF model paints a more optimistic picture. The SWS DCF model estimates Ramaco’s fair value at $46.93 per share, which is notably higher than the current price. This suggests there may be untapped upside. Could discounted expectations be masking hidden value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ramaco Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ramaco Resources Narrative

If you see things differently or want to draw your own conclusions, you can easily craft a personalized narrative in just a few minutes. Do it your way

A great starting point for your Ramaco Resources research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next smart move by unlocking unique investment opportunities with the Simply Wall Street Screener. Don’t let valuable opportunities pass you by and expand your search beyond the obvious.

- Accelerate your search for market-defining innovation by checking out these 24 AI penny stocks with disruptive potential in artificial intelligence.

- Secure consistent income from companies that reward shareholders generously. Take a look at these 19 dividend stocks with yields > 3% for stable, high-yield possibilities.

- Tap into emerging trends and potential tech breakthroughs by reviewing these 26 quantum computing stocks featuring leaders at the edge of quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:METC

Ramaco Resources

Engages in the development, operation, and sale of metallurgical coal.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives