- United States

- /

- Metals and Mining

- /

- NasdaqGS:METC

Is Ramaco’s Brook Mine Critical Minerals Pivot Altering The Investment Case For Ramaco Resources (METC)?

Reviewed by Sasha Jovanovic

- On 1 December 2025, Ramaco Resources held a special call to discuss U.S. critical mineral initiatives and the development of its Brook Mine, highlighting progress on what could become a key rare earth asset.

- This focus on Brook Mine and critical minerals directly connects to Ramaco’s ambitions to expand beyond metallurgical coal into federally supported rare earth production.

- We’ll now explore how the Brook Mine-focused critical minerals call may reshape Ramaco’s investment narrative and longer-term growth mix.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Ramaco Resources Investment Narrative Recap

To own Ramaco Resources, you need to believe that its metallurgical coal cash flows can support the transition toward a U.S. focused critical minerals and rare earths platform. The Brook Mine call reinforces that rare earth execution timing and federal support remain the key near term catalyst, while policy and commercialization risk around these critical minerals still looks like the biggest swing factor for the equity story.

Among recent announcements, the October launch of the Strategic Critical Minerals Terminal at Brook Mine, with Goldman Sachs as exclusive structuring agent, feels most relevant. It connects directly to the December call by underscoring Ramaco’s effort to build a full critical minerals chain, from ore through potential stockpiling and tolling, which could become central to how investors weigh coal driven cash generation against future rare earth optionality.

Yet while Brook Mine could reshape Ramaco’s future, investors should also be aware of the risk that federal price supports or offtake agreements may not...

Read the full narrative on Ramaco Resources (it's free!)

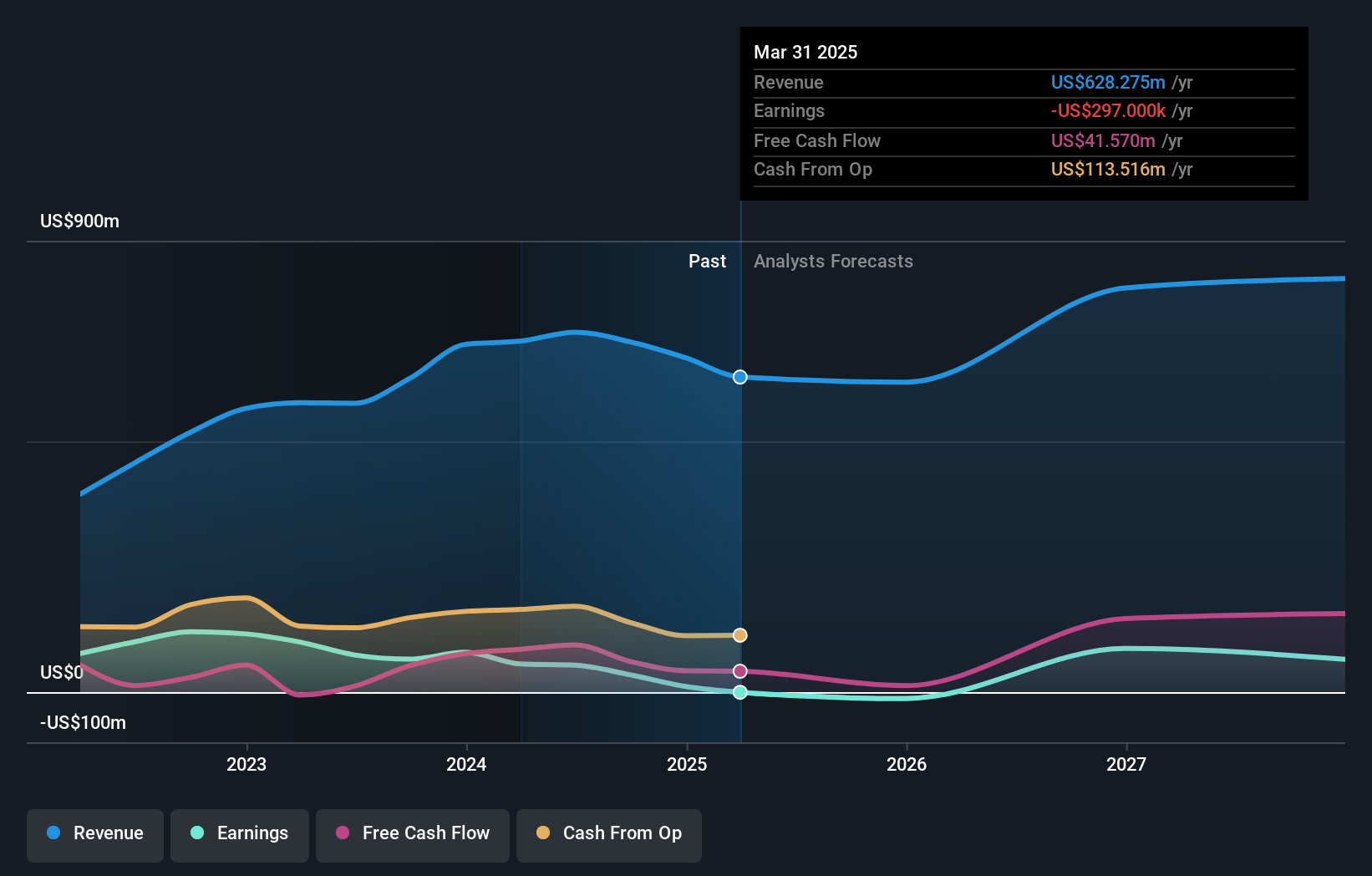

Ramaco Resources' narrative projects $877.8 million revenue and $134.6 million earnings by 2028. This requires 11.9% yearly revenue growth and an earnings increase of about $154.5 million from -$19.9 million today.

Uncover how Ramaco Resources' forecasts yield a $39.14 fair value, a 146% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community currently estimate Ramaco’s fair value between US$18.34 and US$39.14, reflecting wide disagreement on upside. Set against this, the heavy reliance of the rare earth business on uncertain future government support could materially affect how these different views on long term performance play out.

Explore 7 other fair value estimates on Ramaco Resources - why the stock might be worth just $18.34!

Build Your Own Ramaco Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ramaco Resources research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ramaco Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ramaco Resources' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:METC

Ramaco Resources

Engages in the development, operation, and sale of metallurgical coal.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026