- United States

- /

- Metals and Mining

- /

- NasdaqGS:METC

Assessing Ramaco Resources Shares After a 34% Weekly Surge and Rare Earths Expansion News

Reviewed by Bailey Pemberton

Thinking about what to do with Ramaco Resources stock? You are definitely not alone. With numbers like these, it is no surprise that the market has been buzzing. If you had held shares just a week ago, you would have seen them soar by 34%. Over the last month, that figure jumps to 124.9%. Going back a year, the return jumps off the charts at 419.1%, and for those patient enough to hold for five years, the result is a remarkable 2,411.9% return. It is tough to find numbers that tell a story more dramatic than this one.

Much of this eye-popping growth can be traced to shifts in global demand and shifting market sentiment around coal producers. As alternative energy and commodity cycles ebb and flow, Ramaco has benefitted from renewed interest in the sector, driving up both price and attention. This elevated risk appetite has been clear across the industry, but Ramaco’s run has been one of the standouts.

However, surging prices often spark the next big question: is it too late to buy, or is there value left on the table? According to traditional valuation checks, Ramaco currently scores 0 out of 6, signaling that by those measures, it is not deemed undervalued. Of course, that is just one lens to look through. Next, we will dig into each valuation approach and show where Ramaco stands. By the end, we will explore an even more insightful approach to truly gauge its value opportunity.

Ramaco Resources scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ramaco Resources Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates how much a company's future cash flows are worth in today's dollars. This approach projects Ramaco Resources' cash flow for the coming years, applies a sensible annual growth forecast, and then discounts those figures back to the present using an appropriate rate. This process helps investors gauge the company's intrinsic value based on its actual cash-generating potential.

For Ramaco Resources, the latest reported Free Cash Flow (FCF) stands at -$9.15 million. According to analysts, FCF is expected to rise sharply in the next several years, with projections reaching $71.8 million by 2028. Beyond these analyst-supported years, further FCF estimates are extrapolated through to 2035, ultimately showing a continued but tapering growth in free cash generation. All projections are detailed in millions and reported in US dollars.

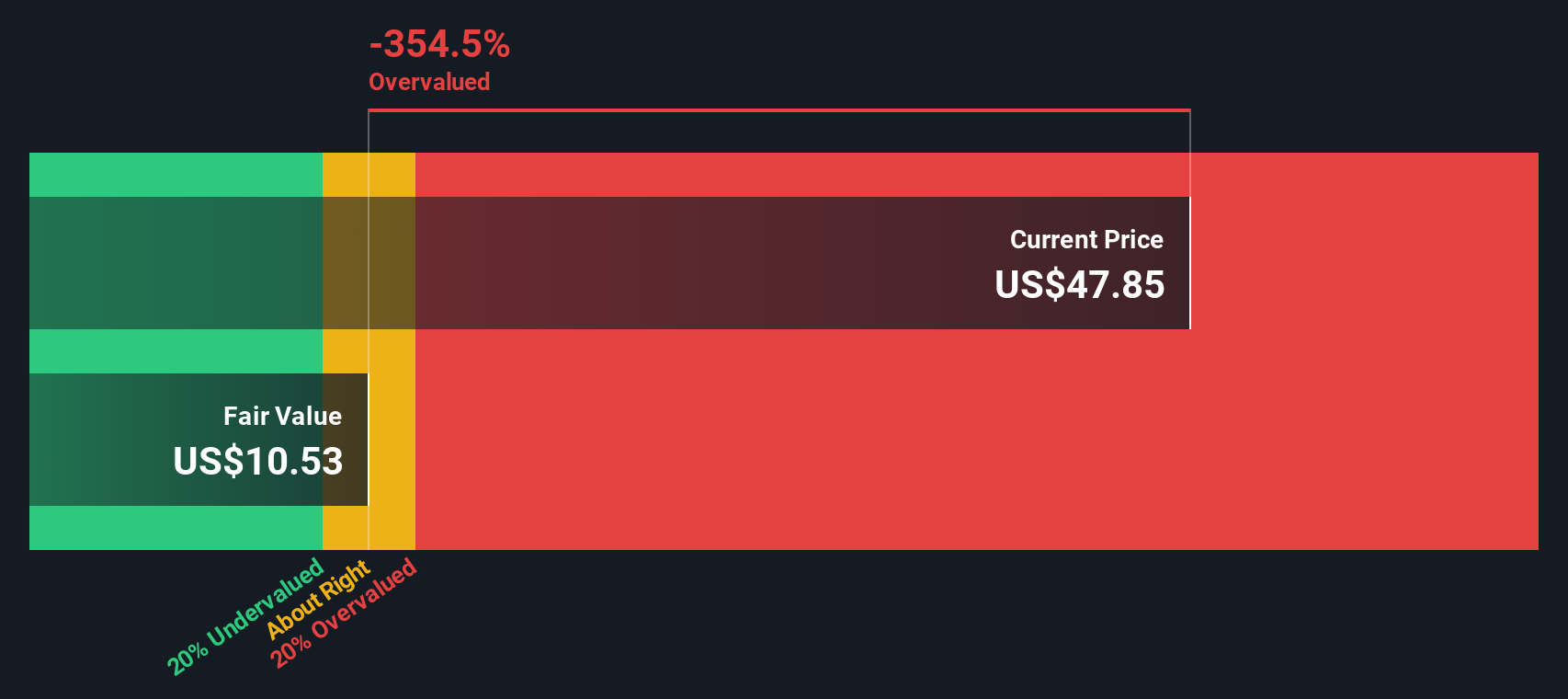

By applying the two-stage Free Cash Flow to Equity model, which separates cash flows into distinct growth phases, the DCF analysis arrives at a fair value of $10.54 per share. Currently, Ramaco Resources trades far above this estimate, with the market price reflecting a 417.4% premium to the calculated intrinsic value. This suggests the stock is substantially overvalued based on future cash flow expectations alone.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ramaco Resources may be overvalued by 417.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Ramaco Resources Price vs Sales

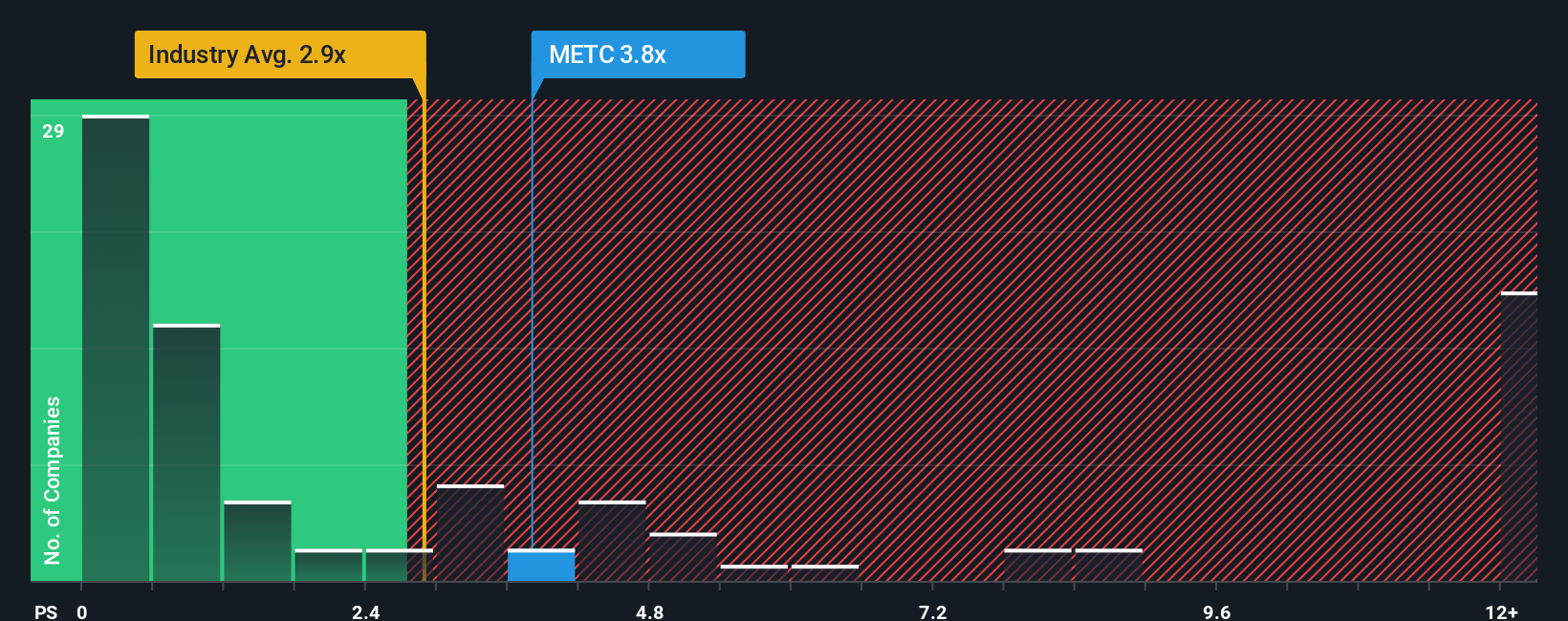

Another valuable way to assess Ramaco Resources’ valuation is the Price-to-Sales (P/S) ratio. This multiple is a practical yardstick, especially for companies in cyclical sectors like metals and mining, where profitability can swing with the commodity cycle. The P/S ratio focuses on the company’s sales rather than profits, making it less vulnerable to short-term fluctuations. It is a solid barometer for investors when profits are volatile or temporarily negative.

Not all “normal” multiples are created equal. What may look expensive for one company could be justified for another with higher growth potential, stronger margins, or lower risk. Riskier or slower-growing companies tend to deserve lower ratios, while those with robust growth or market advantages might command a premium.

Currently, Ramaco Resources trades at a substantial 5.75x P/S, which is elevated compared to the metals and mining industry average of 3.26x and a peer average of 1.18x. Simply Wall St’s proprietary “Fair Ratio,” which accounts for company-specific growth prospects, margin, risk, and size, estimates a fair multiple of 2.60x. Unlike a basic industry or peer comparison, the Fair Ratio adapts to Ramaco’s unique situation. It takes into account the nuanced factors that should impact valuation. This approach delivers a more reliable assessment for investors seeking to cut through the noise.

With Ramaco’s actual P/S multiple standing well above its Fair Ratio, the conclusion is straightforward: the stock appears overvalued based on this metric.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ramaco Resources Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are a simple, powerful concept that puts you, rather than the market, in control of the story driving your investment decisions. Instead of just crunching numbers, Narratives let you define your own assumptions about Ramaco Resources’ future revenue, earnings, and margins. This allows you to shape a financial forecast based on your view of the company’s journey.

A Narrative connects your perspective on Ramaco’s prospects, transforms those beliefs into a transparent financial model, and delivers a fair value that is personal and dynamic. Narratives are available on the Simply Wall St Community page, making it easy for millions of investors to access and share their opinions side by side. With this approach, you can decide when to buy or sell by comparing your Narrative’s fair value directly to today’s share price. As new company news or earnings are released, your Narrative will update automatically to reflect the latest information.

For example, some investors are optimistic about Ramaco’s rare earths opportunity and see a fair value of $45 per share, while others focus on operational risks and set their target at just $14. Narratives let you compare all perspectives and choose the story and valuation that fits your convictions.

Do you think there's more to the story for Ramaco Resources? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:METC

Ramaco Resources

Engages in the development, operation, and sale of metallurgical coal.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives