- United States

- /

- Insurance

- /

- NYSE:WRB

Does WRB’s 2025 Special Dividend Stack Up To A Durable Capital Return Strategy?

Reviewed by Sasha Jovanovic

- Earlier this month, W. R. Berkley Corporation declared a $1.00 per share special cash dividend alongside its regular $0.09 quarterly dividend, both payable on December 29, 2025 to shareholders of record on December 15, 2025, bringing total special cash dividends in 2025 to $1.50 per share.

- The fresh special dividend, combined with management’s decision to maintain the regular payout and present at Goldman Sachs’ 2025 U.S. Financial Services Conference, underlines an emphasis on returning capital while engaging the market on its outlook.

- We’ll now examine how this additional $1.00 per share special dividend influences W. R. Berkley’s investment narrative and capital allocation profile.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

W. R. Berkley Investment Narrative Recap

To own W. R. Berkley, you need to be comfortable with a property and casualty insurer that relies heavily on disciplined underwriting in competitive and evolving markets. The fresh US$1.00 per share special dividend and affirmation of the regular payout do not materially change the near term catalyst, which still hinges on sustaining underwriting profitability in the face of pricing pressure, while the biggest risk remains rising loss costs from social and economic inflation that could squeeze margins.

The December 2025 special dividend announcement is most relevant here, because it sits alongside solid recent earnings and reinforces how current profit levels translate into cash returned to shareholders. For investors watching catalysts, the key question is whether W. R. Berkley can keep underwriting performance resilient enough, amid competitive and inflationary pressures, to support similar capital returns over time without compromising its balance sheet or flexibility.

Yet investors should also be aware that if social and economic inflation accelerate faster than pricing adjustments, underwriting results could...

Read the full narrative on W. R. Berkley (it's free!)

W. R. Berkley’s narrative projects $14.3 billion revenue and $2.0 billion earnings by 2028. This implies a 0.0% yearly revenue decline and an earnings increase of about $0.2 billion from $1.8 billion today.

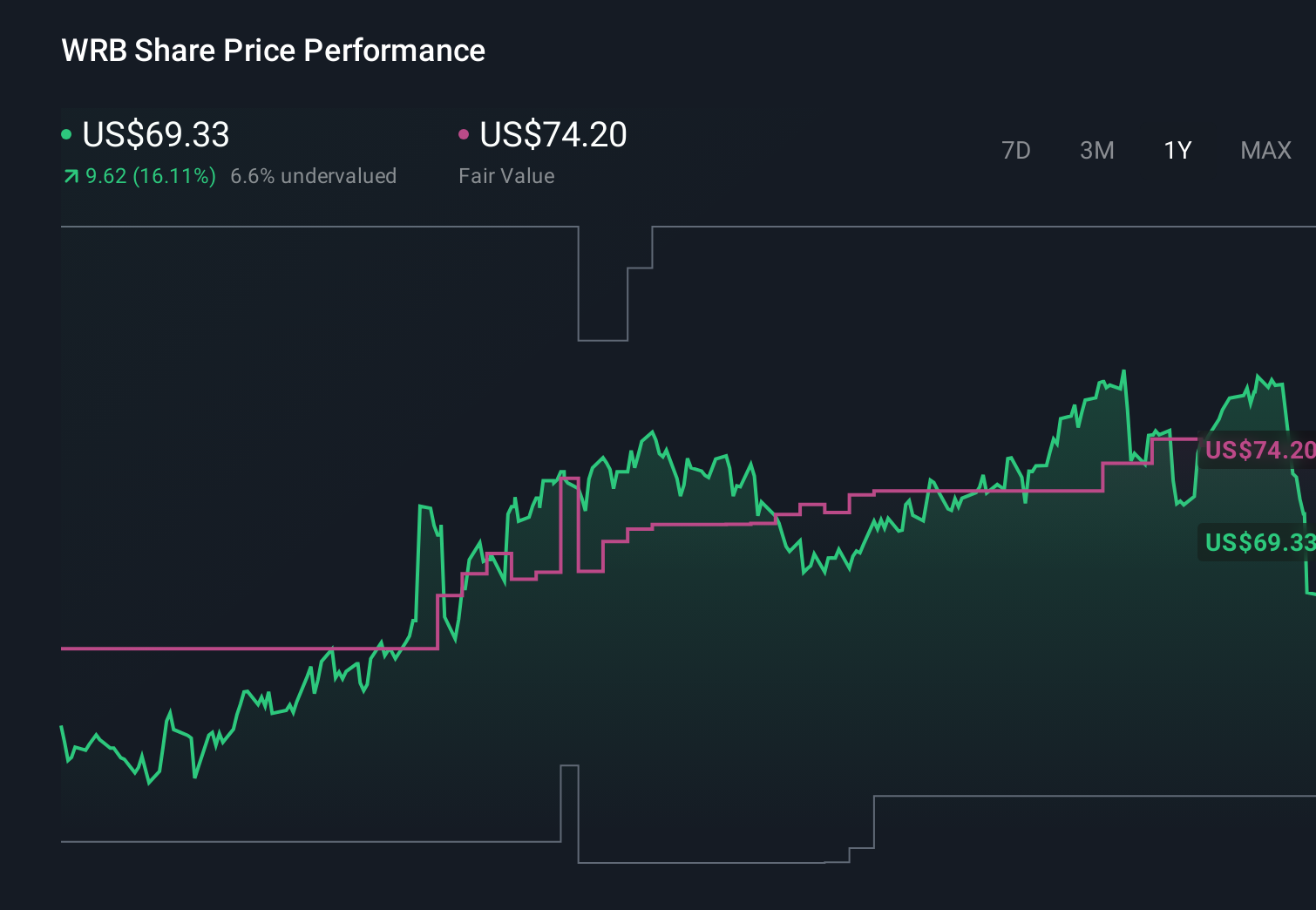

Uncover how W. R. Berkley's forecasts yield a $74.20 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members put W. R. Berkley’s fair value anywhere from US$26.69 to US$118.71, highlighting very different expectations. Against that backdrop, the risk that rising social and economic inflation pressures loss trends and margins becomes even more important to weigh when you compare these alternative viewpoints.

Explore 4 other fair value estimates on W. R. Berkley - why the stock might be worth as much as 71% more than the current price!

Build Your Own W. R. Berkley Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your W. R. Berkley research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free W. R. Berkley research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate W. R. Berkley's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if W. R. Berkley might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRB

W. R. Berkley

An insurance holding company, operates as a commercial line writer worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)