- United States

- /

- Insurance

- /

- NYSE:UVE

Universal Insurance Holdings, Inc. (NYSE:UVE) Held Back By Insufficient Growth Even After Shares Climb 28%

Universal Insurance Holdings, Inc. (NYSE:UVE) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 33% in the last year.

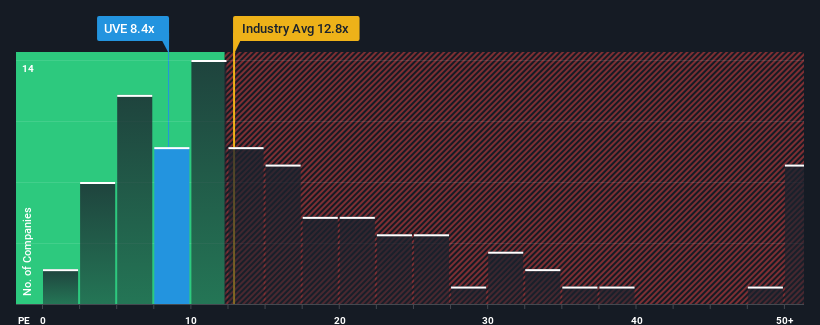

In spite of the firm bounce in price, Universal Insurance Holdings may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8.4x, since almost half of all companies in the United States have P/E ratios greater than 20x and even P/E's higher than 36x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Universal Insurance Holdings has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Universal Insurance Holdings

How Is Universal Insurance Holdings' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Universal Insurance Holdings' is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a worthy increase of 6.5%. This was backed up an excellent period prior to see EPS up by 58% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the only analyst covering the company suggest earnings growth is heading into negative territory, declining 5.4% over the next year. With the market predicted to deliver 15% growth , that's a disappointing outcome.

In light of this, it's understandable that Universal Insurance Holdings' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Universal Insurance Holdings' P/E?

Shares in Universal Insurance Holdings are going to need a lot more upward momentum to get the company's P/E out of its slump. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Universal Insurance Holdings' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with Universal Insurance Holdings.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:UVE

Universal Insurance Holdings

Operates as an integrated insurance holding company in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives