- United States

- /

- Banks

- /

- NasdaqGS:PFBC

3 Dividend Stocks On US Exchanges Yielding Up To 3.8%

Reviewed by Simply Wall St

As the U.S. stock market approaches record highs, buoyed by strong earnings reports and easing tariff concerns, investors are increasingly looking at dividend stocks as a reliable income source amid fluctuating economic conditions. In this environment, selecting stocks with robust dividend yields can provide stability and potential growth, making them an attractive option for those seeking consistent returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.07% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.72% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.81% | ★★★★★★ |

| FMC (NYSE:FMC) | 6.46% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.48% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.28% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.48% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.69% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.62% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.47% | ★★★★★★ |

Click here to see the full list of 133 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Preferred Bank (NasdaqGS:PFBC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Preferred Bank offers a range of commercial banking products and services to small and mid-sized businesses, entrepreneurs, real estate developers, investors, professionals, and high net worth individuals, with a market cap of approximately $1.21 billion.

Operations: Preferred Bank generates its revenue primarily from its commercial banking segment, amounting to $274.09 million.

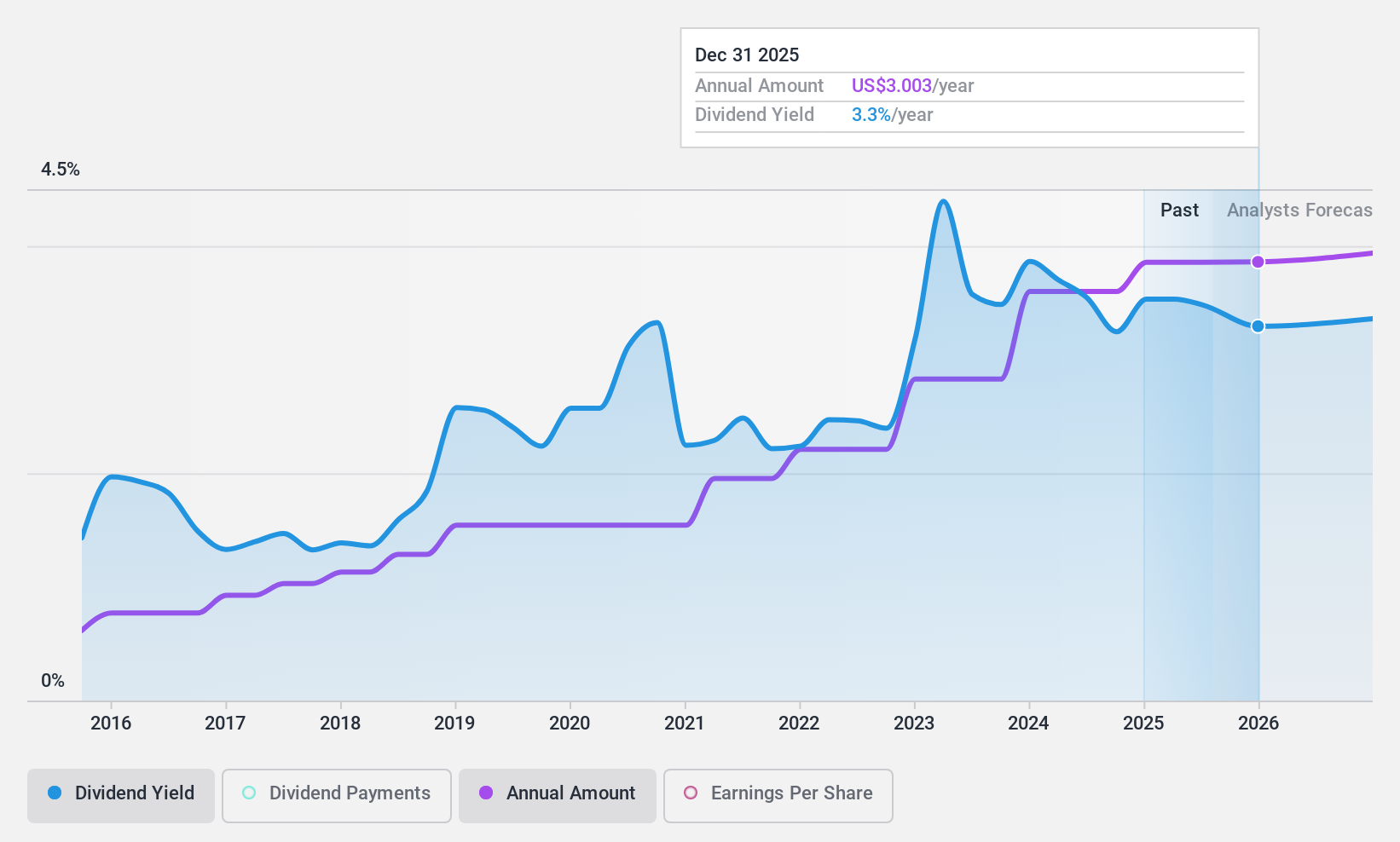

Dividend Yield: 3.3%

Preferred Bank's dividend is well-covered with a payout ratio of 29.1%, ensuring sustainability and reliability over the past decade. Despite its 3.28% yield being below top-tier US dividend payers, dividends have grown steadily and remain stable. The bank trades at a significant discount to estimated fair value, enhancing its appeal as a value investment. Recent activities include a $0.75 per share dividend increase and share buybacks totaling $84.95 million since June 2023, demonstrating strong capital management practices despite recent net charge-offs of $6.6 million in Q4 2024 being fully reserved for previously.

- Click here to discover the nuances of Preferred Bank with our detailed analytical dividend report.

- Our valuation report unveils the possibility Preferred Bank's shares may be trading at a discount.

Bar Harbor Bankshares (NYSEAM:BHB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bar Harbor Bankshares, with a market cap of $495.22 million, operates as the holding company for Bar Harbor Bank & Trust, offering a range of banking and nonbanking products and services to consumers and businesses.

Operations: Bar Harbor Bankshares generates revenue from its Community Banking Industry segment, amounting to $148.79 million.

Dividend Yield: 3.7%

Bar Harbor Bankshares offers a reliable dividend, supported by a stable 10-year growth history and a low payout ratio of 42%, ensuring sustainability. The current yield of 3.7% is below the top US dividend payers but remains attractive due to its consistency. Trading at nearly half its estimated fair value, it presents potential value for investors. Recent earnings show improved financial health with net income rising to US$11 million in Q4 2024 from US$9.95 million the previous year.

- Get an in-depth perspective on Bar Harbor Bankshares' performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Bar Harbor Bankshares' share price might be too pessimistic.

Universal Insurance Holdings (NYSE:UVE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Universal Insurance Holdings, Inc., with a market cap of $554.13 million, operates as an integrated insurance holding company in the United States through its subsidiaries.

Operations: Universal Insurance Holdings generates revenue primarily through its Property & Casualty insurance segment, which accounts for $1.51 billion.

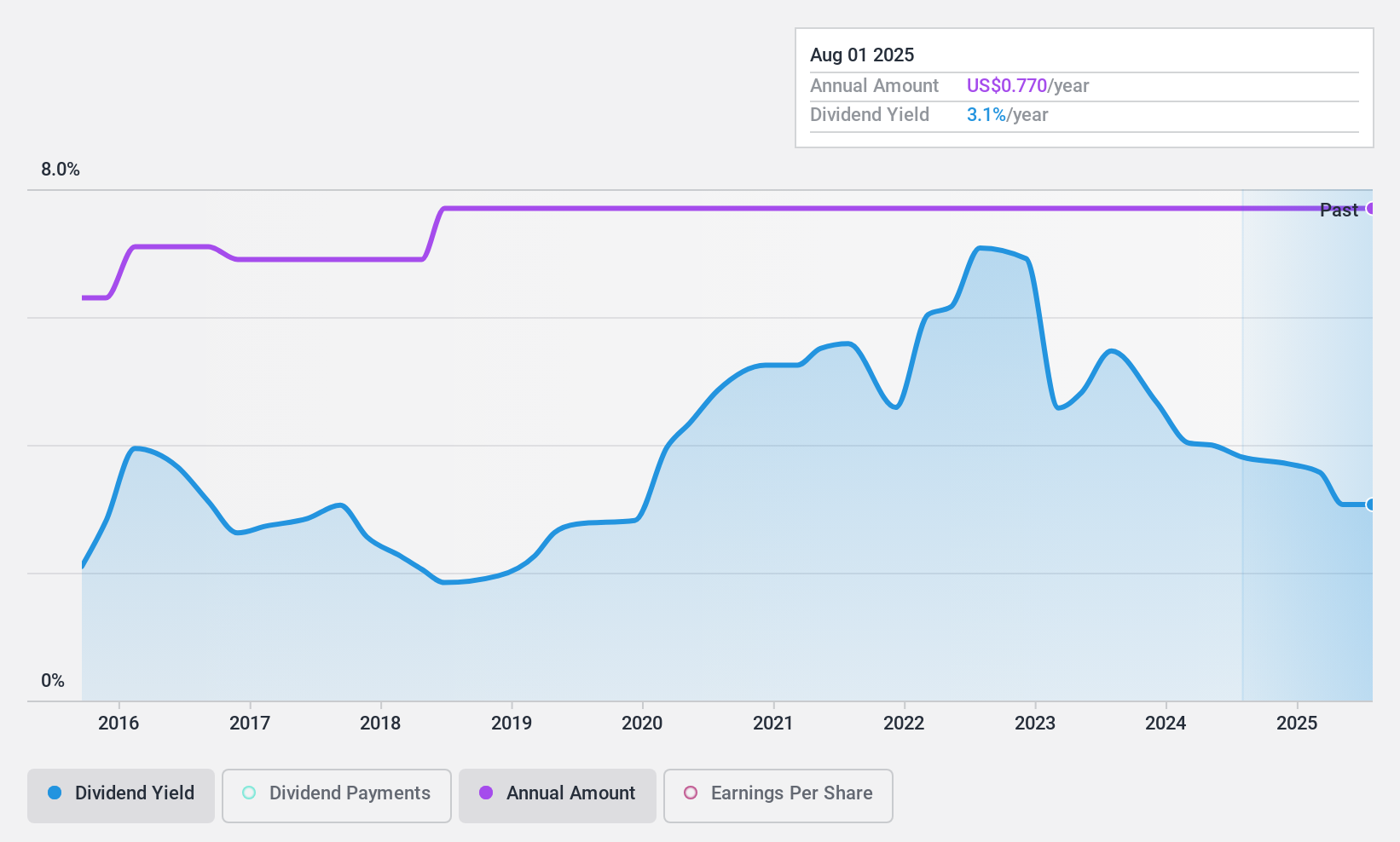

Dividend Yield: 3.9%

Universal Insurance Holdings maintains a sustainable dividend with a low payout ratio of 25.2% and cash payout ratio of 9.4%, ensuring coverage by earnings and cash flows. The dividend yield stands at 3.85%, below the top US payers, yet reliable over the past decade with consistent growth. Recent announcements include a total dividend of US$0.77 per share for 2024, indicating continued commitment to shareholder returns amidst favorable valuation metrics like a P/E ratio of 7.8x.

- Dive into the specifics of Universal Insurance Holdings here with our thorough dividend report.

- Our expertly prepared valuation report Universal Insurance Holdings implies its share price may be lower than expected.

Where To Now?

- Unlock more gems! Our Top US Dividend Stocks screener has unearthed 130 more companies for you to explore.Click here to unveil our expertly curated list of 133 Top US Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PFBC

Preferred Bank

Provides various commercial banking products and services to small and mid-sized businesses and their owners, entrepreneurs, real estate developers and investors, professionals, and high net worth individuals.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives