- United States

- /

- Insurance

- /

- NYSE:STC

Uncovering January 2025's Hidden Gems in the US Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it boasts a remarkable 23% increase over the past year with earnings forecast to grow by 15% annually. In this dynamic environment, identifying stocks that are poised for growth involves looking beyond the surface to uncover those hidden gems that align with these promising trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Tompkins Financial (NYSEAM:TMP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tompkins Financial Corporation is a financial holding company that offers a range of services including commercial and consumer banking, leasing, trust and investment management, financial planning and wealth management, and insurance services, with a market cap of $965.24 million.

Operations: Tompkins Financial generates revenue primarily from its banking segment, contributing $229.63 million, followed by insurance services at $39.07 million and wealth management at $19.81 million. The company's net profit margin is 27%, reflecting efficiency in managing its costs relative to income generated across these segments.

Tompkins Financial, a financial entity with total assets of US$8 billion and equity of US$721.3 million, is trading at 53.3% below its estimated fair value. Its earnings surged by 373.6% last year, outpacing the industry average of -8%. The company holds US$6.6 billion in deposits and has loans totaling US$5.8 billion, with a net interest margin of 2.8%. Despite having an appropriate level of non-performing loans at 1.1%, it shows insufficient allowance for bad loans at 89%. With primarily low-risk funding from customer deposits, Tompkins demonstrates high-quality past earnings and positive free cash flow potential.

- Get an in-depth perspective on Tompkins Financial's performance by reading our health report here.

Evaluate Tompkins Financial's historical performance by accessing our past performance report.

SITE Centers (NYSE:SITC)

Simply Wall St Value Rating: ★★★★★☆

Overview: SITE Centers is an owner and manager of open-air shopping centers located primarily in suburban, high household income communities, with a market cap of $813.72 million.

Operations: SITE Centers generates revenue primarily from leasing retail spaces in its open-air shopping centers. The company focuses on optimizing rental income and managing property-related expenses to enhance profitability.

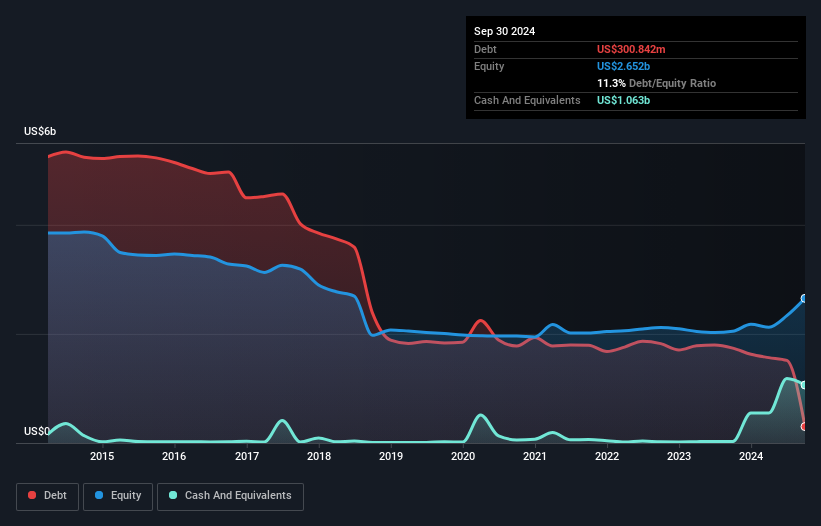

SITE Centers, a nimble player in the retail real estate space, has seen its earnings skyrocket by 741% over the past year, largely due to a one-off gain of US$677 million. Despite this boost, their EBIT covers interest payments just 2.4 times, indicating potential financial strain. The firm’s debt-to-equity ratio has impressively dropped from 91% to 11% over five years, showcasing effective debt management. However, significant insider selling recently raises some eyebrows about internal confidence. Trading at a P/E ratio of just 1x compared to the market's average of 19x suggests undervaluation despite looming challenges ahead.

Stewart Information Services (NYSE:STC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Stewart Information Services Corporation operates through its subsidiaries to offer title insurance and real estate transaction services both in the United States and internationally, with a market capitalization of approximately $1.78 billion.

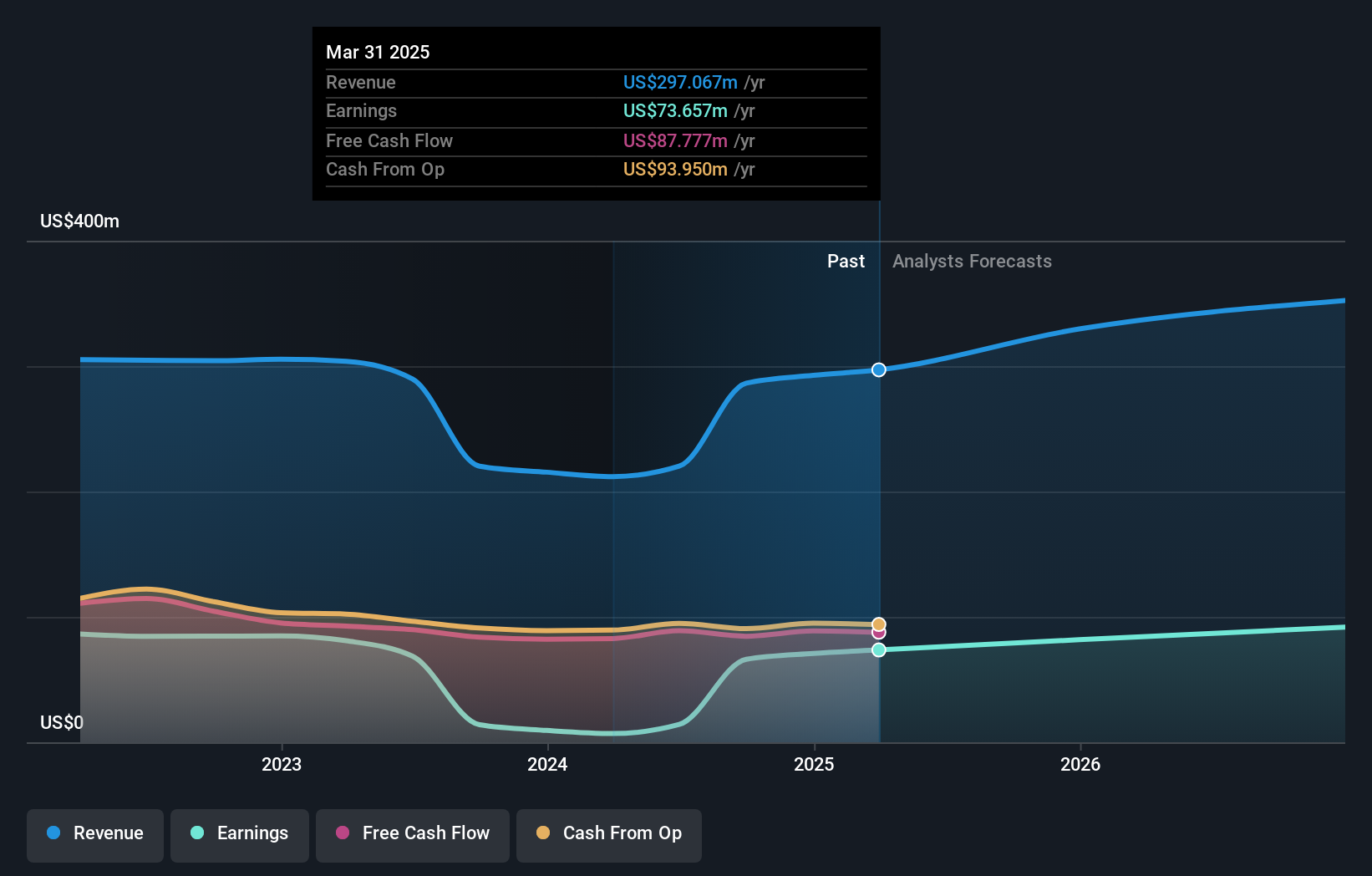

Operations: Stewart Information Services generates revenue primarily from its Title segment, including mortgage services, which accounts for $2.05 billion, and Real Estate Solutions contributing $333.08 million.

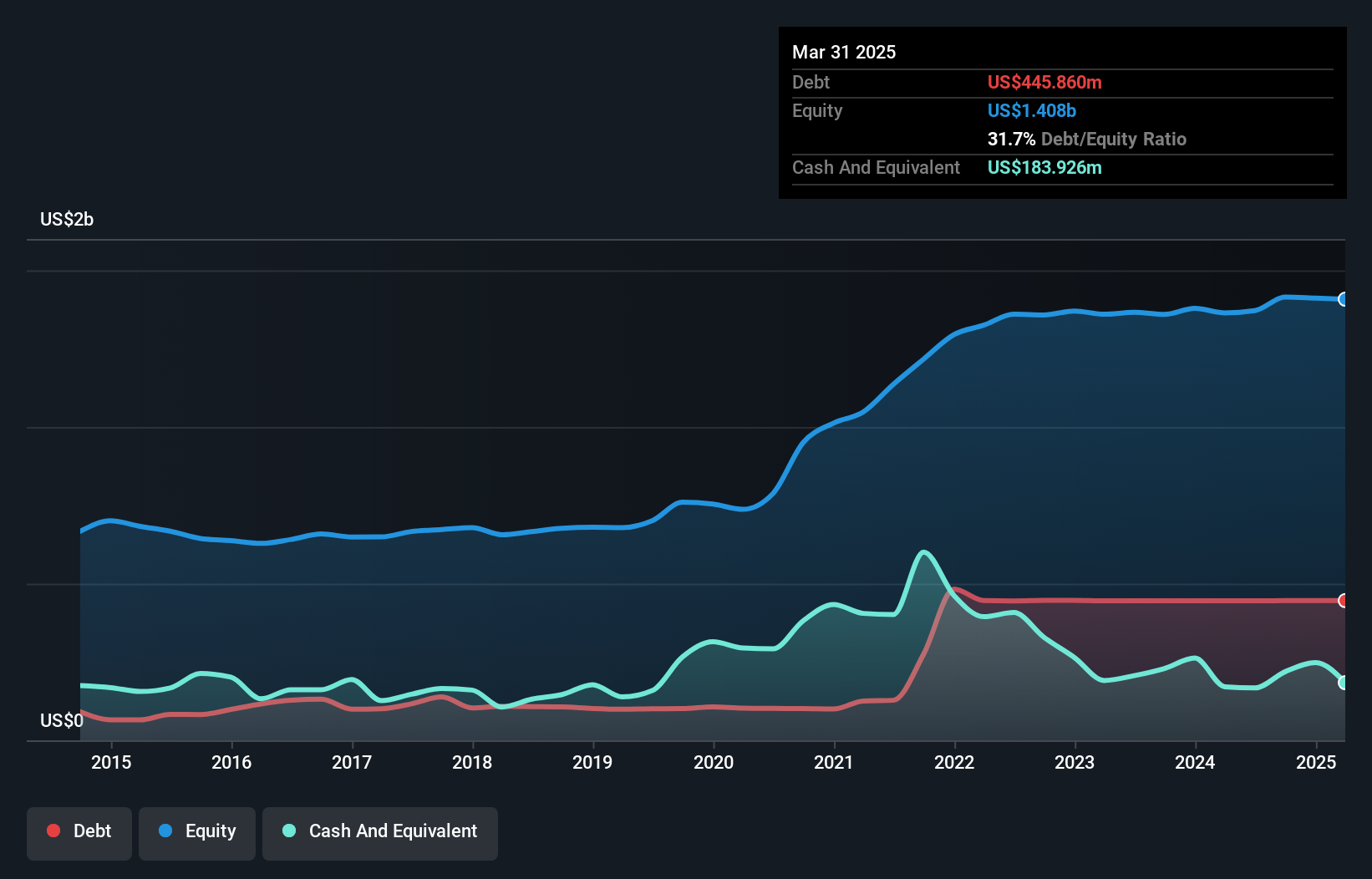

Stewart Information Services, a promising player in the title insurance sector, is making strides with a 70% earnings growth over the past year, outpacing its industry. Trading at 21.2% below estimated fair value and boasting high-quality earnings, it seems well-positioned for future gains. The debt to equity ratio has risen from 13.3% to 31.5% over five years but remains satisfactory with interest payments covered by EBIT at 6.1x. Recent leadership changes aim to strengthen underwriting capacity while strategic tech investments target operational efficiency and customer experience enhancements amidst evolving market conditions in housing and insurance sectors.

Seize The Opportunity

- Reveal the 269 hidden gems among our US Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STC

Stewart Information Services

Through its subsidiaries, provides title insurance and real estate transaction related services in the United States and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives