- United States

- /

- Diversified Financial

- /

- NYSE:BLX

3 Undiscovered Gems In The US Market

Reviewed by Simply Wall St

As the U.S. market navigates through renewed trade tensions with China and fluctuating economic indicators, small-cap stocks are feeling the pressure, reflected in recent movements of indices like the S&P 600. Despite these challenges, opportunities to identify promising investments remain, especially among lesser-known companies that demonstrate resilience and potential for growth amidst uncertainty.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Southern Michigan Bancorp | 117.38% | 8.87% | 4.89% | ★★★★★★ |

| Tri-County Financial Group | 82.51% | 3.15% | -17.04% | ★★★★★★ |

| Morris State Bancshares | 9.38% | 4.01% | 3.59% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| NameSilo Technologies | 14.73% | 14.50% | -1.32% | ★★★★★☆ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Caledonia Mining (CMCL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Caledonia Mining Corporation Plc primarily operates a gold mine in Jersey and has a market capitalization of $678.37 million.

Operations: Caledonia Mining generates revenue primarily from its Blanket gold mine, contributing $200.71 million, with additional income from operations in South Africa and the Bilboes Oxide Mine. The company's net profit margin is 22%, reflecting its profitability within the mining sector.

Caledonia Mining, a nimble player in the mining sector, showcases both promise and caution. Its recent earnings growth of 433.7% outpaces industry peers, while its price-to-earnings ratio of 19.5x remains attractive against the sector's 26x average. The company reported net income of US$20.49 million for Q2 2025, up from US$8.28 million year-over-year, with sales climbing to US$65.31 million from US$50.11 million in the same period last year. However, reliance on Zimbabwe's economic climate and production concentration at Blanket Mine pose risks amidst rising costs and fluctuating gold demand trends.

Banco Latinoamericano de Comercio Exterior S. A (BLX)

Simply Wall St Value Rating: ★★★★★☆

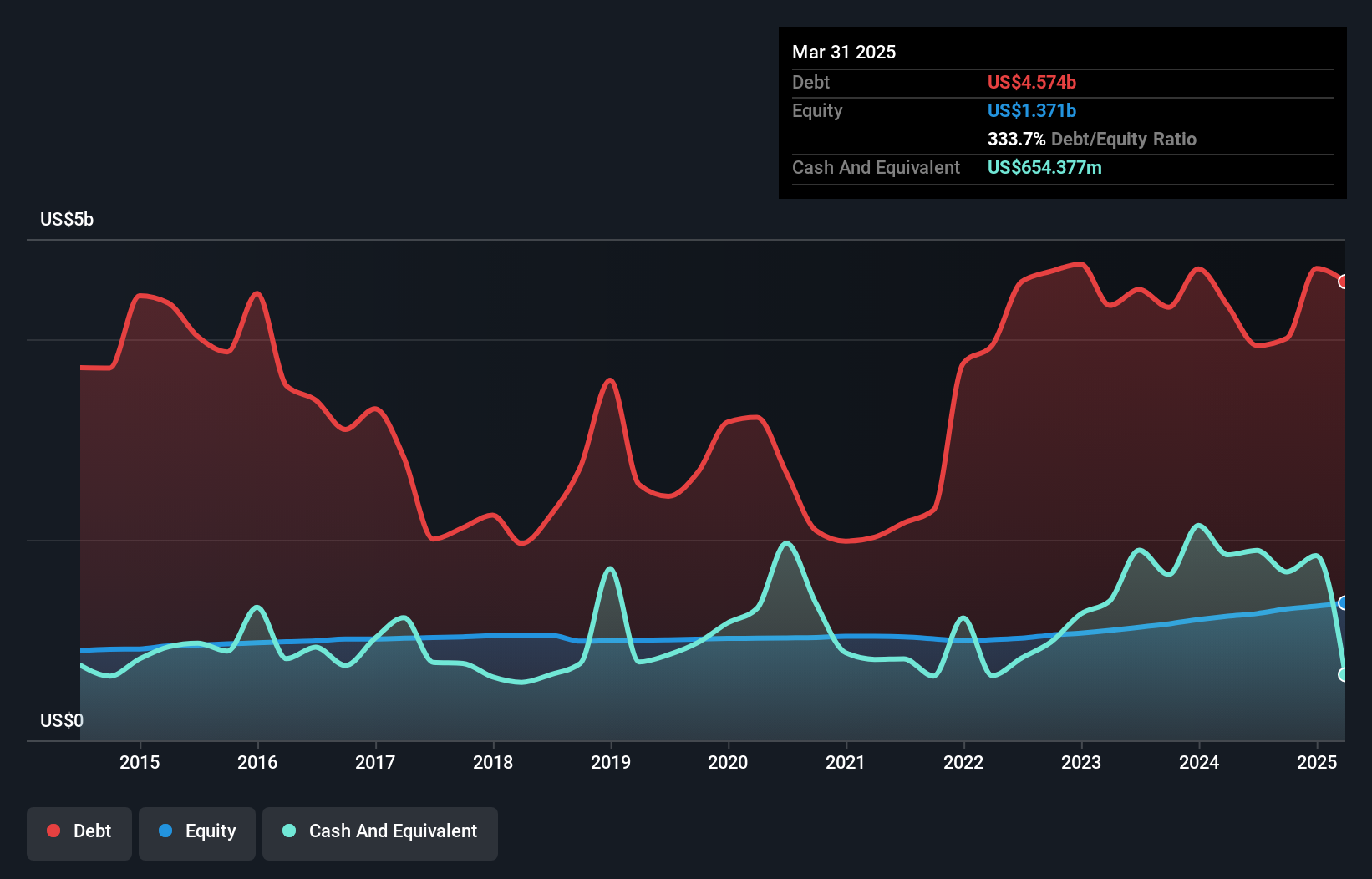

Overview: Banco Latinoamericano de Comercio Exterior S.A. (BLX) is a financial institution focused on providing trade financing solutions primarily in Latin America and the Caribbean, with a market capitalization of approximately $1.65 billion.

Operations: BLX generates revenue primarily from its Commercial segment, which accounts for $274.85 million, and its Treasury segment, contributing $31.33 million. The net profit margin shows an interesting trend at 39%.

Bladex, with assets totaling $12.7 billion and equity of $1.4 billion, is trading at a notable 28.6% below its fair value estimate. Its earnings have grown by 13.9%, outpacing the Diversified Financial industry growth of 8.4%. The bank's robust allowance for bad loans stands at an impressive 437%, while non-performing loans are minimal at just 0.2%. Recent strategic moves include a digital trade finance platform aimed at boosting transaction volumes and client retention among SMEs, alongside a successful $200 million AT1 capital offering that attracted significant global interest, indicating strong market confidence in Bladex's future prospects.

Stewart Information Services (STC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Stewart Information Services Corporation operates through its subsidiaries to offer title insurance and real estate transaction-related services both in the United States and internationally, with a market capitalization of approximately $1.90 billion.

Operations: Stewart Information Services generates revenue primarily from its Title segment, including mortgage services, amounting to $2.28 billion, and Real Estate Solutions contributing $393.20 million.

Stewart Information Services, a notable player in the title insurance industry, has demonstrated resilience with a 102.9% earnings growth over the past year, outpacing its peers. The company's debt to equity ratio rose from 12.9% to 30.8% over five years, yet remains manageable with interest payments well-covered by EBIT at 7.6 times coverage. Recent strategic moves include launching FINCEN Reporting Services and securing a $300 million credit facility extending to October 2030, enhancing financial flexibility by $100 million more than prior arrangements. Stewart's commitment to shareholder returns is evident in its recent dividend increase from US$2 to US$2.10 per share annually.

Where To Now?

- Gain an insight into the universe of 290 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Banco Latinoamericano de Comercio Exterior S. A might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLX

Banco Latinoamericano de Comercio Exterior S. A

Banco Latinoamericano de Comercio Exterior, S.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)