Last Update18 Oct 25

Analysts have maintained their price target for Banco Latinoamericano de Comercio Exterior S. A. at $55.50. This reflects stable expectations based on current financial metrics.

Valuation Changes

- Fair Value: remained unchanged at $55.50.

- Discount Rate: increased slightly from 10.50% to 10.50%.

- Revenue Growth: held steady at approximately 9.76%.

- Net Profit Margin: unchanged at about 68.70%.

- Future P/E: remained consistent at roughly 10.23 times.

Key Takeaways

- New digital trade finance platform and focus on structured transactions are expected to boost revenue growth, operational efficiency, and recurring, higher-margin fee income.

- Strong asset quality, prudent risk management, and shift to deposit-based funding enhance earnings stability, resilience, and ability to capture regional growth opportunities.

- Heavy reliance on exceptional transactions, regional economic volatility, and exposure to sovereign risk threaten sustainable revenue growth and increase the potential for earnings instability.

Catalysts

About Banco Latinoamericano de Comercio Exterior S. A- Banco Latinoamericano de Comercio Exterior, S.

- The rollout of a new digital trade finance platform positions Bladex to significantly increase transaction volumes, improve client retention, and expand service offerings to underbanked SMEs, which should drive fee income, boost revenue growth, and enhance operational efficiency over the coming 18 months.

- Structural growth in intra-Latin American trade and new regional trade agreements are expected to raise demand for cross-border financing, supporting loan book growth, increased fee income from letters of credit, and potential market share gains, positively impacting revenues and earnings.

- The bank's strategic focus on medium-term structured transactions and scaling up its factoring and accounts receivable financing operations is set to improve asset mix quality and increase recurring, higher-margin fee income, supporting sustainable earnings and reducing earnings' cyclicality.

- The continued shift towards deposit-based funding-now at 62% of total funding-lowers the cost of funds and improves net interest margin resilience in a competitive regional liquidity environment, strengthening future returns and earnings stability.

- Robust asset quality (nonperforming loans at near zero, high reserve coverage) and prudent risk management support ongoing earnings growth and capital adequacy, positioning Bladex to capture long-term regional opportunities while limiting downside risk to net margins.

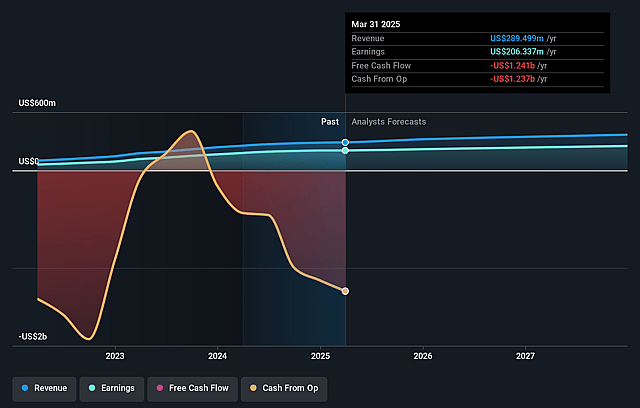

Banco Latinoamericano de Comercio Exterior S. A Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Banco Latinoamericano de Comercio Exterior S. A's revenue will grow by 9.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 72.0% today to 68.6% in 3 years time.

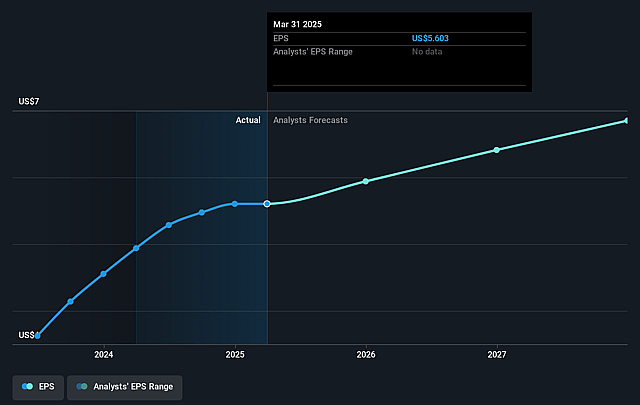

- Analysts expect earnings to reach $276.9 million (and earnings per share of $7.45) by about September 2028, up from $220.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.8x on those 2028 earnings, up from 7.8x today. This future PE is lower than the current PE for the US Diversified Financial industry at 16.5x.

- Analysts expect the number of shares outstanding to grow by 1.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.65%, as per the Simply Wall St company report.

Banco Latinoamericano de Comercio Exterior S. A Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The bank's strong recent performance was significantly boosted by a single, large, one-off syndication transaction (the Staatsolie deal), and while management claims underlying fee growth is strong, there remains risk that future quarters may not replicate this extraordinary income, potentially leading to less robust growth in fee revenues and net margins if the pipeline slows or large deals remain infrequent.

- The macroeconomic environment is described as increasingly volatile, with trade policy uncertainties, geopolitical risks, and signs of slowing growth in key economies like Brazil and Mexico, introducing the risk of weaker regional demand, credit losses, or margin compression-factors that could negatively impact revenues and earnings stability over the long term.

- Despite a growing and more diversified deposit base, the bank maintains relatively high exposure to Latin American sovereign and quasi-sovereign risk (e.g., significant involvement with state-owned enterprises and government-linked entities), which increases vulnerability to regional credit shocks and cyclical downturns, potentially impacting asset quality and increasing earnings volatility.

- There is competition-driven margin pressure, especially on financial institution lending and heightened liquidity across the region, which could continue to compress net interest margins, especially if the competitive or funding environment worsens or global interest rates rise, negatively affecting revenue and profitability over time.

- Reliance on scaling transactional fee income (especially through the new digital trade finance platform) faces risks from fintech disruption, changing regulatory requirements, and technology execution; if growth in high-margin transaction volumes underperforms or digital competitors erode market share, this could restrain revenue growth, depress fee income, and challenge earnings resilience in the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $47.333 for Banco Latinoamericano de Comercio Exterior S. A based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $37.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $403.4 million, earnings will come to $276.9 million, and it would be trading on a PE ratio of 8.8x, assuming you use a discount rate of 10.7%.

- Given the current share price of $46.57, the analyst price target of $47.33 is 1.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.