Key Takeaways

- Reliance on Latin American trade and traditional banking exposes the company to risks from political volatility, protectionism, and accelerating digital disruption.

- ESG mandates and regulatory pressures threaten future loan growth, profitability, and revenue diversification, particularly in key sectors like energy.

- Diversified client base, digital innovation, strong credit practices, and broadened funding sources are driving stable, scalable growth and resilient earnings despite market volatility.

Catalysts

About Banco Latinoamericano de Comercio Exterior S. A- Banco Latinoamericano de Comercio Exterior, S.

- As protectionist policies and declining globalization continue to increase worldwide, Latin America's cross-border trade flows face long-term stagnation or decline, which could significantly reduce demand for trade finance and loan growth at Banco Latinoamericano de Comercio Exterior S.A., putting strong downward pressure on both revenue and net interest income despite the current record results.

- Accelerating advances in digital banking from global banks and nimble fintechs threaten Bladex's traditional business model, raising the risk that the recent technology platform investment will require further heavy spending or fail to deliver a sufficient efficiency or revenue uplift, therefore compressing net margins and driving up long-run operating costs.

- The institution's concentration in Latin American markets exposes it to recurring episodes of political and economic volatility, which over time could degrade credit quality, increase non-performing loans, and force elevated provisioning, directly undermining future earnings stability even after this period of pristine asset quality.

- Growing ESG investment mandates risk restricting Bladex's lending capacity to sectors critical to its profitability, such as oil and gas and extractive industries, thereby curbing both loan book expansion and fee income from large syndication deals like the recent Staatsolie transaction, with adverse effects on long-term revenue diversification.

- Intensifying regulatory requirements and compliance costs, combined with mounting competition in trade finance and the risk of increased fraud or money laundering scrutiny, are likely to erode profitability through higher expenses and tighter margins, limiting the sustainability of currently elevated returns on equity and efficiency ratios.

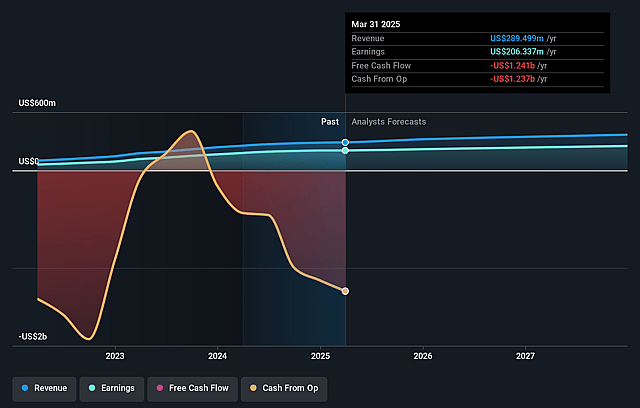

Banco Latinoamericano de Comercio Exterior S. A Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Banco Latinoamericano de Comercio Exterior S. A compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Banco Latinoamericano de Comercio Exterior S. A's revenue will grow by 8.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 72.0% today to 68.4% in 3 years time.

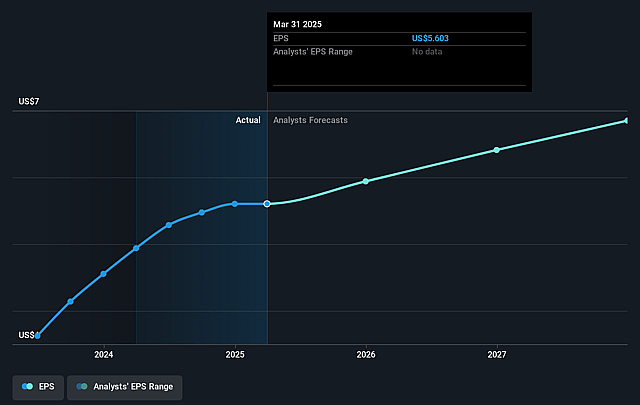

- The bearish analysts expect earnings to reach $268.7 million (and earnings per share of $7.23) by about September 2028, up from $220.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 7.1x on those 2028 earnings, down from 7.8x today. This future PE is lower than the current PE for the US Diversified Financial industry at 16.5x.

- Analysts expect the number of shares outstanding to grow by 1.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.65%, as per the Simply Wall St company report.

Banco Latinoamericano de Comercio Exterior S. A Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The expansion of intra-regional trade flows and ongoing supply chain diversification in Latin America are creating sustained demand for cross-border trade finance, which supports robust loan origination, strengthens client engagement, and can drive sustained revenue growth for Banco Latinoamericano de Comercio Exterior S.A.

- The successful rollout of a new digital trade finance platform is rapidly increasing operational efficiency, enabling a higher volume of transactions at improved margins and fostering scalable growth in both fee income and net interest income, which can lead to higher bottom-line earnings.

- The bank is broadening its client base beyond traditional financial institutions to include a rising share of corporates and entering expanding niches such as factoring and portfolio solutions, which is reducing revenue concentration risk and supporting more diversified and stable revenue streams over time.

- Enhanced credit quality, evidenced by near-zero nonperforming loans and disciplined underwriting, is supporting lower provisions for credit losses and translating into resilient net margins and predictable earnings even in volatile market conditions.

- Growing diversification of funding sources, including a rising share of low-cost, stable deposits and successful local bond issuance, is lowering funding costs, underpinning solid net interest margins, and strengthening the bank's capital position-factors that support future earnings stability and long-term share price resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Banco Latinoamericano de Comercio Exterior S. A is $37.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Banco Latinoamericano de Comercio Exterior S. A's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $37.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $393.0 million, earnings will come to $268.7 million, and it would be trading on a PE ratio of 7.1x, assuming you use a discount rate of 10.7%.

- Given the current share price of $46.93, the bearish analyst price target of $37.0 is 26.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.