Key Takeaways

- Accelerating fee-based revenue, expanding deposit base, and digitalization efforts are significantly improving margins, efficiency, and net income beyond market expectations.

- Increased regional trade and investment are creating long-term opportunities in trade and structured finance, strengthening the bank's competitive position and future earnings growth potential.

- Rising competition, regulatory pressures, and limited diversification heighten risks to profitability, revenue stability, and long-term growth for Bladex amid evolving market dynamics.

Catalysts

About Banco Latinoamericano de Comercio Exterior S. A- Banco Latinoamericano de Comercio Exterior, S.

- Analyst consensus expects fee and non-interest income to rise due to the new trade finance platform, but with the platform already fully operational and gaining traction, the acceleration in transactional throughput and improved client experience could drive a much steeper and longer-lasting increase in fee-based revenue than currently anticipated.

- While analysts broadly agree on expanding and diversifying the deposit base to stabilize funding costs and maintain margins, the scale and speed of deposit growth

- with corporate deposits up more than 30% year-over-year and clear momentum from central banks and institutional clients

- positions Bladex to compress funding costs further, leading to substantial upside in net interest margins and net income.

- The digitalization of Bladex's operations has resulted in a record-low efficiency ratio of 23 percent; as digitization and automation expand, ongoing cost discipline coupled with higher transaction volumes will drive structural improvements in net margins and efficiency, unlocking superior operating leverage.

- Rising intra-regional trade and deepening Latin American integration, paired with Bladex's proven multi-country origination and distribution capacity, will expand the bank's commercial and fee income opportunities far beyond current market expectations, supporting robust long-term revenue and asset growth.

- The surge in foreign direct investment, especially into infrastructure, energy, and supply chain realignment across Latin America, will sharply increase long-term demand for trade, working capital, and structured finance solutions in which Bladex has established expertise, positioning the bank to capture a disproportionate share of high-margin deals and structurally elevate its earnings base.

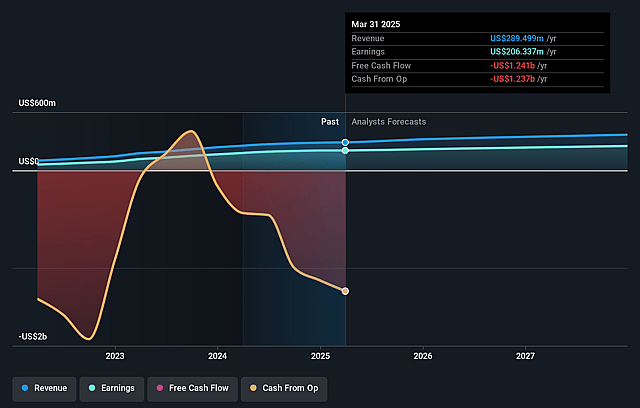

Banco Latinoamericano de Comercio Exterior S. A Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Banco Latinoamericano de Comercio Exterior S. A compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Banco Latinoamericano de Comercio Exterior S. A's revenue will grow by 10.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 72.0% today to 68.1% in 3 years time.

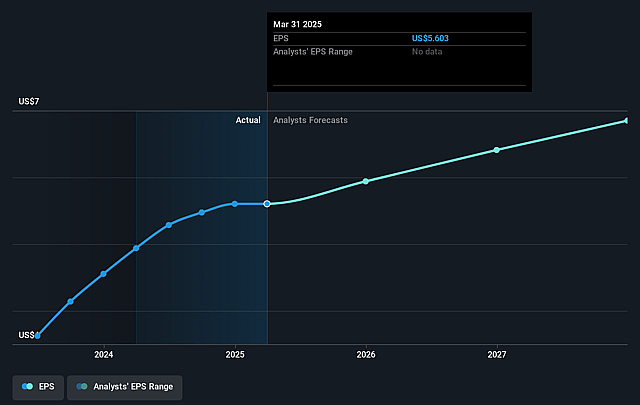

- The bullish analysts expect earnings to reach $279.2 million (and earnings per share of $7.51) by about September 2028, up from $220.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 10.1x on those 2028 earnings, up from 7.8x today. This future PE is lower than the current PE for the US Diversified Financial industry at 16.5x.

- Analysts expect the number of shares outstanding to grow by 1.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.65%, as per the Simply Wall St company report.

Banco Latinoamericano de Comercio Exterior S. A Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating global de-globalization and regional trade fragmentation could result in lower cross-border trade flows across Latin America, reducing long-term demand for Bladex's core trade finance products and causing pressure on revenue growth.

- Heightened competition from fintechs and digital players, in addition to regional and international banks, may drive ongoing margin compression in trade finance, making it more difficult for Bladex to maintain historical net interest margins and net earnings.

- Increasing regulatory and ESG demands will likely raise compliance and operating costs for the bank as more resources must be dedicated to meet global standards, further squeezing future profitability and potentially limiting lending to certain sectors or clients.

- Persistently high client and geographic concentration leaves Bladex exposed to political or economic disruptions in its primary markets such as Brazil, Mexico and Guatemala, which raises the risk of revenue volatility and increases the likelihood of nonperforming loans, directly impacting the bank's asset quality and earnings.

- Bladex's slower pace of product and geographical diversification, despite recent digital investment, may leave it vulnerable as clients shift to more innovative or sophisticated solutions provided by digital-first competitors, potentially capping future fee income and earnings expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Banco Latinoamericano de Comercio Exterior S. A is $55.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Banco Latinoamericano de Comercio Exterior S. A's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $37.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $409.9 million, earnings will come to $279.2 million, and it would be trading on a PE ratio of 10.1x, assuming you use a discount rate of 10.7%.

- Given the current share price of $46.57, the bullish analyst price target of $55.0 is 15.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.