- United States

- /

- Diversified Financial

- /

- NYSE:FIS

3 Stocks Possibly Priced At A Discount Of Up To 38.3%

Reviewed by Simply Wall St

As the U.S. stock market hits all-time highs with major indices like the Dow Jones, S&P 500, and Nasdaq surging, investors are keenly observing opportunities amid this bullish trend. In such a vibrant market environment, identifying undervalued stocks can be crucial for those looking to capitalize on potential discounts of up to 38.3%, offering a strategic entry point into promising equities.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SolarEdge Technologies (SEDG) | $34.11 | $67.83 | 49.7% |

| Northwest Bancshares (NWBI) | $12.34 | $24.41 | 49.5% |

| McGraw Hill (MH) | $14.02 | $27.17 | 48.4% |

| Investar Holding (ISTR) | $22.53 | $44.87 | 49.8% |

| Horizon Bancorp (HBNC) | $16.13 | $31.78 | 49.2% |

| Glaukos (GKOS) | $82.10 | $161.41 | 49.1% |

| Exact Sciences (EXAS) | $52.38 | $102.73 | 49% |

| AGNC Investment (AGNC) | $10.21 | $20.29 | 49.7% |

| Advanced Flower Capital (AFCG) | $4.39 | $8.76 | 49.9% |

| AbbVie (ABBV) | $220.81 | $441.30 | 50% |

Let's explore several standout options from the results in the screener.

Mobileye Global (MBLY)

Overview: Mobileye Global Inc. specializes in developing and deploying advanced driver assistance systems (ADAS) and autonomous driving technologies globally, with a market cap of approximately $11.53 billion.

Operations: The company's revenue primarily comes from its Mobileye segment, generating $1.88 billion.

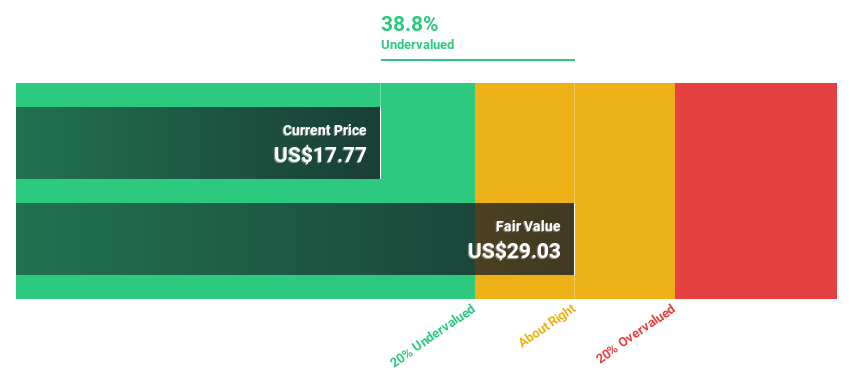

Estimated Discount To Fair Value: 38.3%

Mobileye Global's recent earnings report highlights a net loss reduction from US$86 million to US$67 million year-over-year, with revenue increasing to US$506 million. Despite ongoing losses, the company is trading at 38.3% below its estimated fair value of US$23.09 per share, suggesting potential undervaluation based on discounted cash flows. Revenue growth forecasts of 17.7% annually exceed the broader market average, and profitability is anticipated within three years amid strategic board appointments and equity offerings.

- The growth report we've compiled suggests that Mobileye Global's future prospects could be on the up.

- Click here to discover the nuances of Mobileye Global with our detailed financial health report.

Fidelity National Information Services (FIS)

Overview: Fidelity National Information Services, Inc. (FIS) operates as a global provider of technology solutions for merchants, banks, and capital markets firms with a market cap of $34.71 billion.

Operations: The company's revenue segments include Banking Solutions at $7.02 billion and Capital Market Solutions at $3.08 billion.

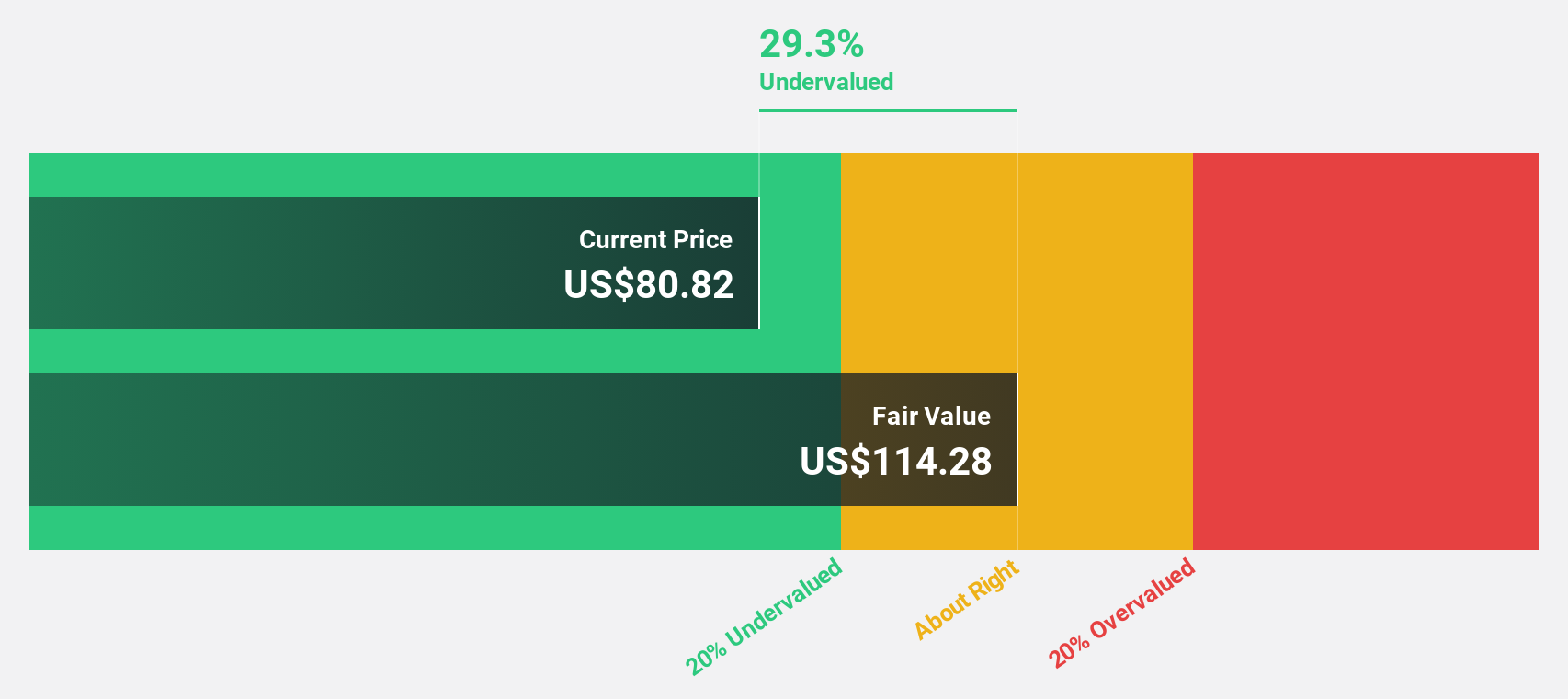

Estimated Discount To Fair Value: 35.3%

Fidelity National Information Services, trading at US$67.15, is significantly undervalued with a fair value estimate of US$103.81 based on discounted cash flows. Despite a forecasted high return on equity and rapid earnings growth of 44.4% annually, the company faces challenges with unsustainable dividends and high debt levels. Recent product innovations like FIS Neural Treasury aim to enhance cash flow management efficiency, supporting strategic growth amidst market volatility and technological advancements in treasury operations.

- Our expertly prepared growth report on Fidelity National Information Services implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Fidelity National Information Services.

Ryan Specialty Holdings (RYAN)

Overview: Ryan Specialty Holdings, Inc. is a service provider offering specialty products and solutions for insurance brokers, agents, and carriers across several countries including the United States, Canada, and the United Kingdom with a market cap of $13.87 billion.

Operations: The company's revenue primarily comes from its insurance brokers segment, which generated $2.75 billion.

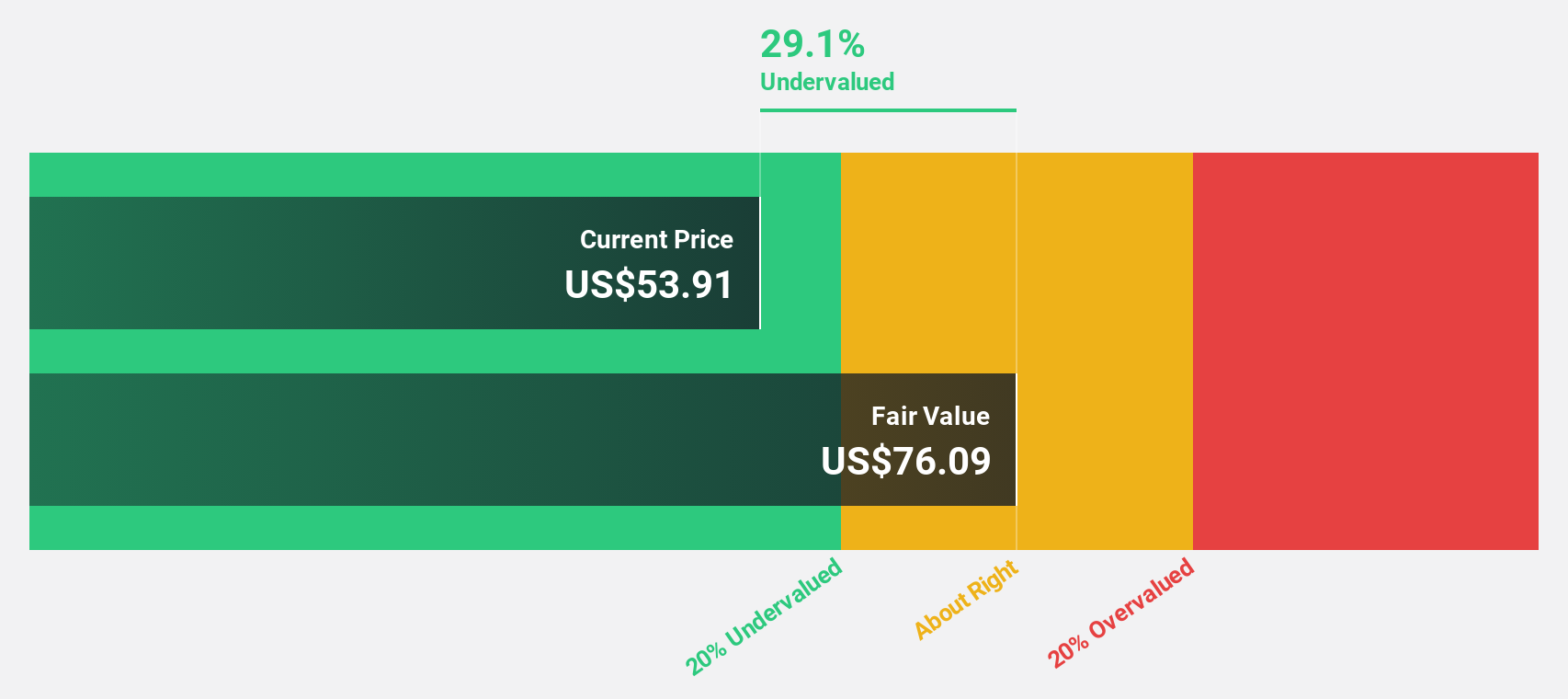

Estimated Discount To Fair Value: 29.8%

Ryan Specialty Holdings, trading at US$53.40, is undervalued with a fair value estimate of US$76.11 based on discounted cash flows. Despite lower profit margins compared to last year, earnings are forecast to grow significantly at 70% annually, surpassing the US market average. The company's strategic focus on mergers and acquisitions is supported by strong free cash flow and balance sheet flexibility, though debt coverage by operating cash flow remains a concern.

- According our earnings growth report, there's an indication that Ryan Specialty Holdings might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Ryan Specialty Holdings.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 188 Undervalued US Stocks Based On Cash Flows now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIS

Fidelity National Information Services

Fidelity National Information Services, Inc.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives