- United States

- /

- Insurance

- /

- NYSE:PRU

Prudential Financial (NYSE:PRU) Leverages Product Innovation and Strategic M&A to Drive Growth

Reviewed by Simply Wall St

Prudential Financial (NYSE:PRU) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include a significant 67% increase in retirement strategy sales and innovative product launches, juxtaposed against a higher-than-average Price-To-Earnings Ratio and forecasted revenue decline. In the discussion that follows, we will explore Prudential Financial's competitive advantages, internal limitations, future prospects, and market volatility to provide a comprehensive overview of the company's current business situation.

Dive into the specifics of Prudential Financial here with our thorough analysis report.

Competitive Advantages That Elevate PRU

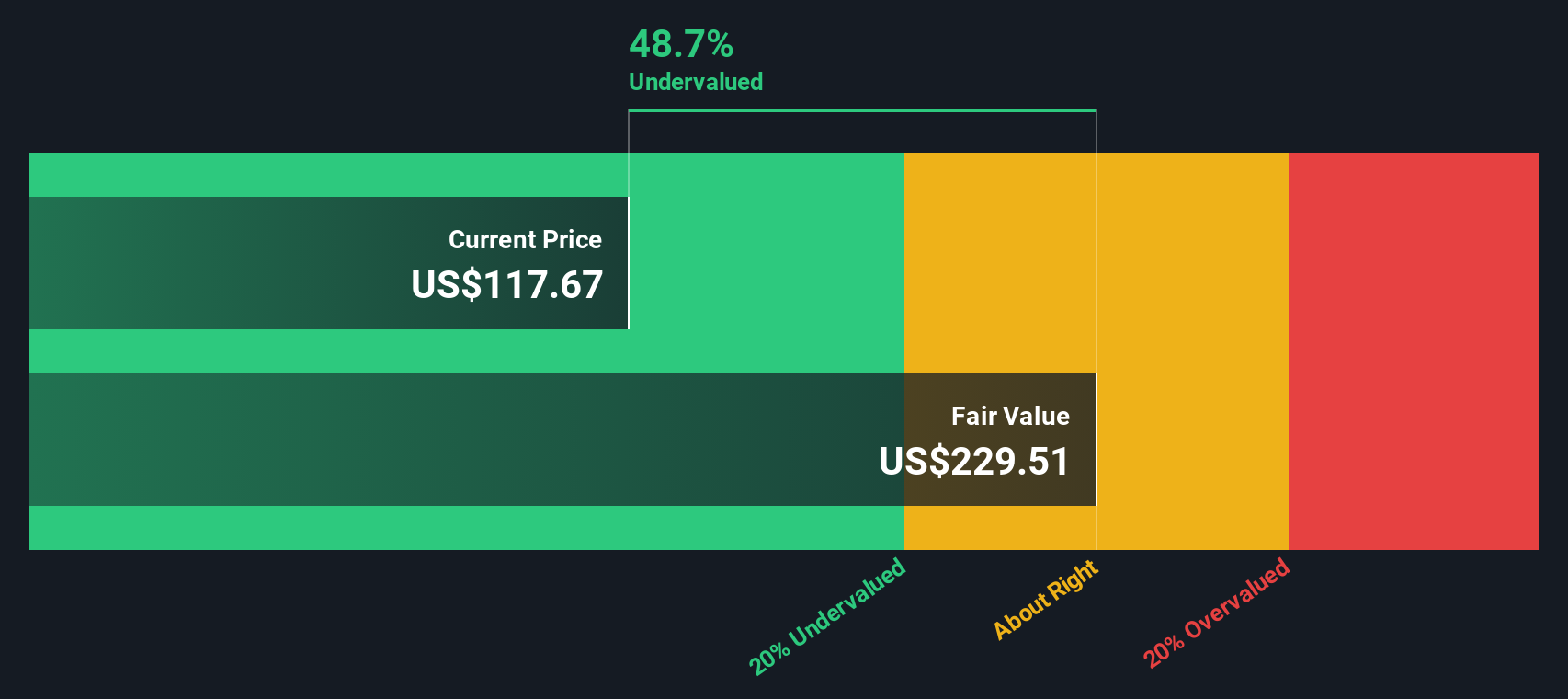

Prudential Financial (PRU) has demonstrated significant strengths through its diversified business mix and effective risk and capital management framework. The company's market leadership is evident with nearly $22 billion in retirement strategy sales in the first half of the year, representing a 67% increase from the prior year. This growth is complemented by a pretax adjusted operating income of $1.6 billion, or $3.39 per share on an after-tax basis, up 10% from the previous year. Additionally, PRU's financial health is solid with cash and liquid assets of $4.4 billion within its liquidity target range. The company is trading below its estimated fair value of $230.68, indicating potential undervaluation despite a higher Price-To-Earnings Ratio compared to industry averages. The experienced management team, with an average tenure of 5 years, and a seasoned board of directors, averaging 8.6 years, further bolster PRU's strategic goals.

Internal Limitations Hindering PRU's Growth

PRU faces several internal challenges. The company's reliance on joint ventures, as highlighted by Robert Falzon, Vice Chairman, may indicate weaknesses in core operations. Additionally, PRU's Price-To-Earnings Ratio of 15.2x is higher than both the US Insurance industry average of 13.9x and the peer average of 14.2x, suggesting it is expensive compared to its peers. The company's Return on Equity (ROE) is forecasted to be low at 13% in three years, and its revenue is expected to decline by 1% per year over the next three years. Furthermore, PRU's earnings growth rate of 11.4% per year is slower than the US market average of 15.2% per year. These factors, combined with a debt-to-equity ratio of 143.4%, highlight financial challenges that could hinder growth.

Future Prospects for PRU in the Market

PRU has several opportunities to enhance its market position and capitalize on emerging trends. The company has introduced new products, such as the Stop Loss Insurance aimed at protecting companies with self-funded employee medical plans, and the Prudential Momentum IUL, an indexed universal life product. These product-related announcements align with the increasing global demand for retirement product solutions and advice, a market expected to reach $137 trillion in the US and $26 trillion in Japan by 2050. PRU's focus on expanding third-party distribution and leveraging high-quality life planners further supports its growth strategy. The company is also open to opportunistic programmatic M&A to accelerate growth in selective markets, as stated by Andrew Sullivan, Head of International Businesses.

Market Volatility Affecting PRU's Position

PRU faces several external threats that could impact its market position. The variability in PGIM's flows, as noted by Andrew Sullivan, Head of International Businesses, indicates potential risks in the market. Additionally, the company is navigating turbulent times, as highlighted by Charles Lowrey, Chairman and CEO, with less favorable underwriting and lower guaranteed universal life surrender experience post-COVID. Competitive pressures also pose a threat, with the possibility of competitors becoming aggressive in the marketplace. PRU remains focused on meeting the long-term demand for protected income, although uncertainty in market conditions and competitive threats could affect its growth trajectory.

Conclusion

Prudential Financial's diversified business mix and effective risk management have driven substantial growth, evidenced by a significant increase in retirement strategy sales and improved operating income. However, internal challenges such as a higher Price-To-Earnings Ratio compared to peers and a forecasted decline in revenue growth highlight potential hurdles. The introduction of innovative products and strategic M&A opportunities position the company well to capitalize on the growing demand for retirement solutions. Trading below its estimated fair value of $230.68, Prudential Financial presents a compelling investment opportunity, suggesting potential for future performance improvements as it navigates market volatility and competitive pressures.

Seize The Opportunity

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:PRU

Prudential Financial

Provides insurance, investment management, and other financial products and services in the United States and internationally.

Undervalued established dividend payer.