- United States

- /

- Insurance

- /

- NYSE:PGR

Progressive (PGR) Declares US$0.10 Dividend for October 2025 Payment

Reviewed by Simply Wall St

The Progressive Corporation (PGR) recently declared a $0.10 per common share dividend, with shareholders of record as of October 2, 2025, set to receive payment in October. This announcement may have provided support to the company's share price, which experienced a 1% move over the last week. During the same period, the broader market, marked by significant gains in major indexes such as the S&P 500 and Nasdaq Composite reaching all-time highs, similarly saw price increases across various sectors. Overall market sentiment was buoyed by expectations of potential interest rate cuts, aligning with the company's positive price movement.

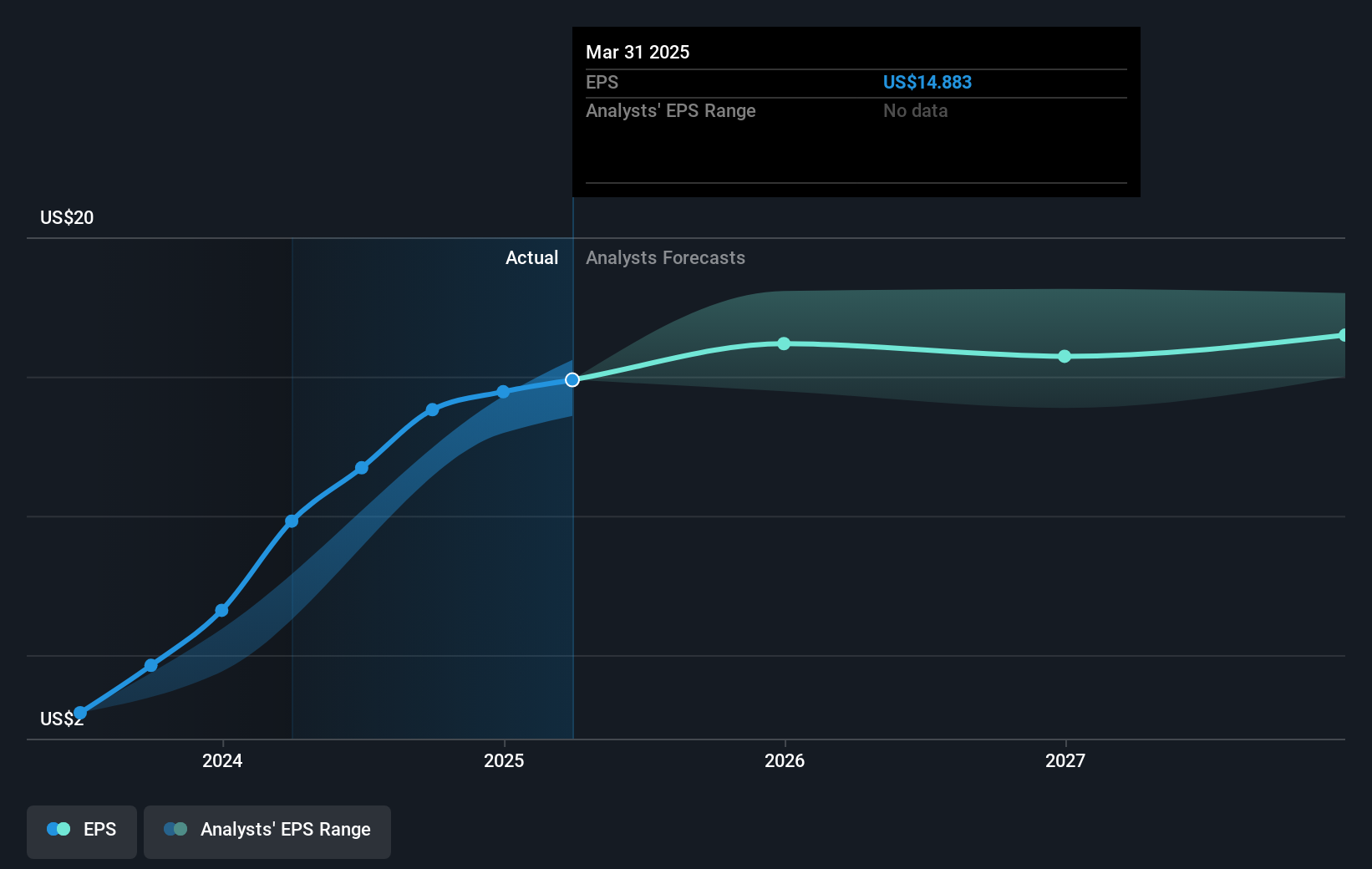

The Progressive Corporation's recent dividend declaration could bolster investor confidence, aligning with technology-driven advantages highlighted in the company's narrative. As Progressive continues to leverage advanced analytics and data-driven distribution for customer acquisition and premium growth, the dividend could reinforce perceived stability, especially amid competitive pressures and regulatory changes. Over the past five years, Progressive's total shareholder return was 204.41%, illustrating substantial growth compared to a 52% increase in earnings over the past year alone. While the company's shares have underperformed the broader US market, which returned 19.4% over the past year, they exceeded the US Insurance industry's 7.1% return, emphasizing its resilience.

The dividend announcement may not directly impact near-term revenue or earnings forecasts; however, it highlights the company's commitment to shareholder value, potentially boosting sentiment. Analysts forecast a revenue growth of 8.8% per year and predict earnings to decline by 3.7% annually over the next three years. With a current share price of $244.88, Progressive trades at a 17.13% discount to the consensus price target of $286.82, reflecting differing expectations regarding its long-term growth potential. This price target suggests confidence in the company's ability to navigate potential competition and industry changes, further cementing its market position despite expected earnings declines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PGR

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives