- United States

- /

- Insurance

- /

- NYSE:OSCR

Oscar Health (OSCR) Updates 2025 Guidance with Revenue at US$12 Billion

Reviewed by Simply Wall St

Oscar Health (OSCR) recently revised its earnings guidance for 2025, highlighting expected revenue between $12 billion and $12.2 billion and operational losses of $200 million to $300 million. This revision coincided with the company’s shares gaining 22% over the last quarter, amidst a backdrop of increased optimism in the broader markets exemplified by the S&P 500 reaching record highs. The company’s strong first-quarter results and clear financial guidance likely bolstered investor confidence, aligning with the broader market's upward trend, although market optimism in general played a significant role.

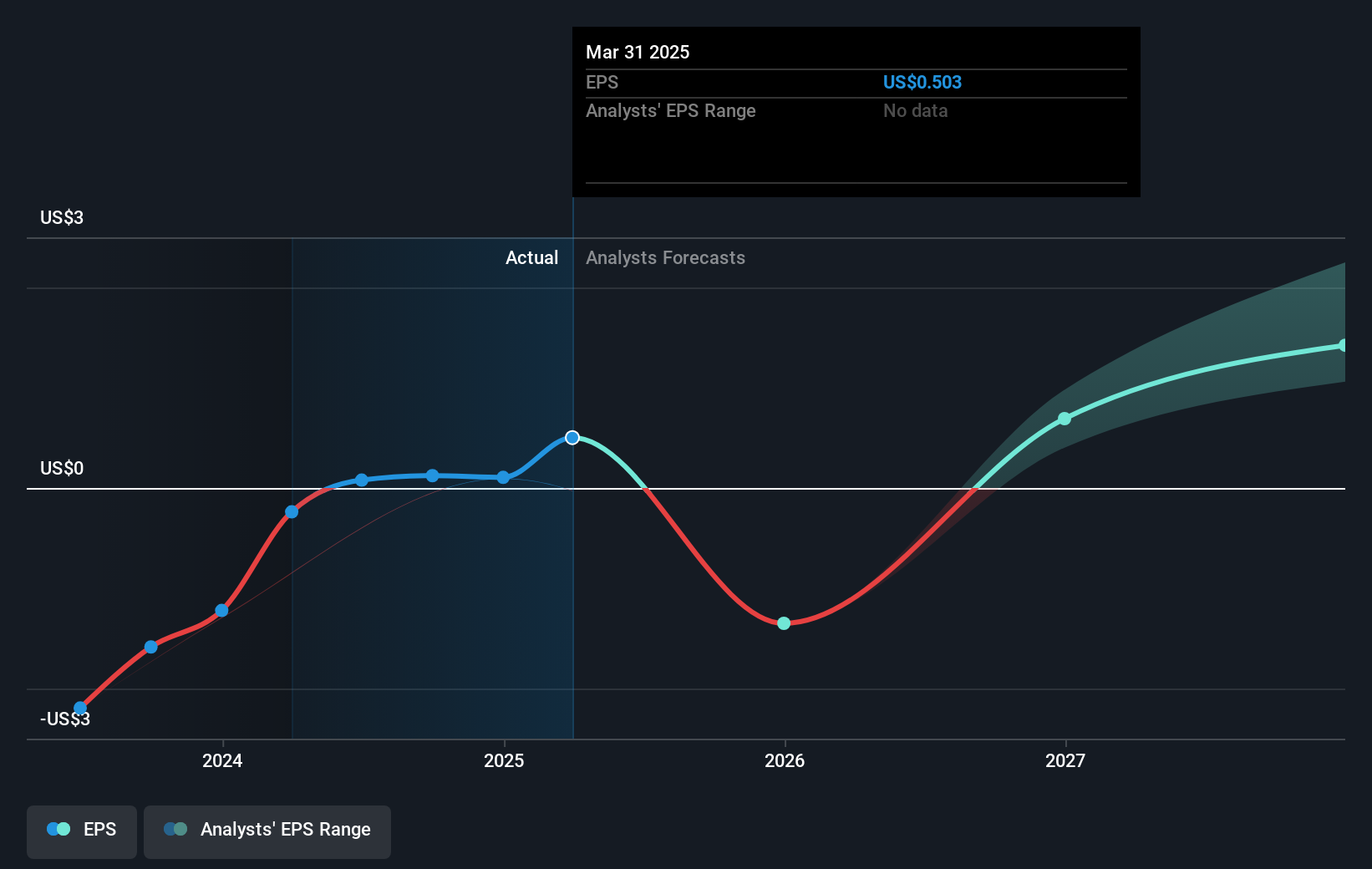

The recent revision of Oscar Health's earnings guidance, projecting US$12 to US$12.2 billion in revenue alongside operational losses of US$200 to US$300 million for 2025, underscores both opportunities and challenges. This guidance may support the narrative of AI integration and ICHRA enrollment improving efficiency, although it also highlights the company's operational hurdles. While shares saw a short-term increase of 22% over the last quarter, long-term performance has been remarkable, with a total return of 180% over three years. This substantial growth suggests strong investor engagement, despite OSCR's underperformance compared to the US Insurance industry's 9.3% return over the past year.

Looking ahead, the updated forecasts might impact revenue and earnings projections by emphasizing the potential for improved operational performance through administrative cost efficiencies and medical loss ratio refinement. However, achieving these gains requires overcoming market and regulatory risks. The current share price of US$14.70, contrasted with the price target of US$14.24, implies a slight discount, yet it remains below the consensus analyst target of US$19.36, reflecting discrepancies in market expectations and projected earnings growth. Investors should consider these dynamics when evaluating Oscar Health's potential trajectory and market positioning.

Evaluate Oscar Health's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OSCR

Oscar Health

Operates as a healthcare technology company in the United States.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives