- United States

- /

- Insurance

- /

- NYSE:MET

MetLife (MET): Evaluating the Stock’s Value as Cancer Support Benefit Expands Insurance Offering

Reviewed by Simply Wall St

MetLife (MET) just rolled out a major upgrade to its Critical Illness Insurance, introducing a new Cancer Support benefit in partnership with Private Health Management. This feature aims to provide personalized guidance for employees facing cancer, connecting them with top oncology specialists and hands-on care navigation from diagnosis through recovery. With cancer cases and treatment costs on the rise, this move not only responds to a growing need but could also expand MetLife’s appeal to employers looking for comprehensive benefit packages.

This product enhancement follows a steady stream of activity from MetLife, including a recent preferred stock redemption and a scheduled appearance at a global financial services conference. Over the past year, the stock has delivered an 8% total return to shareholders, while momentum over the past month has picked up with a 4% gain, though returns remain more modest year-to-date. For investors, the question is whether these advances signal compounding growth or just a steady hand in a mature market.

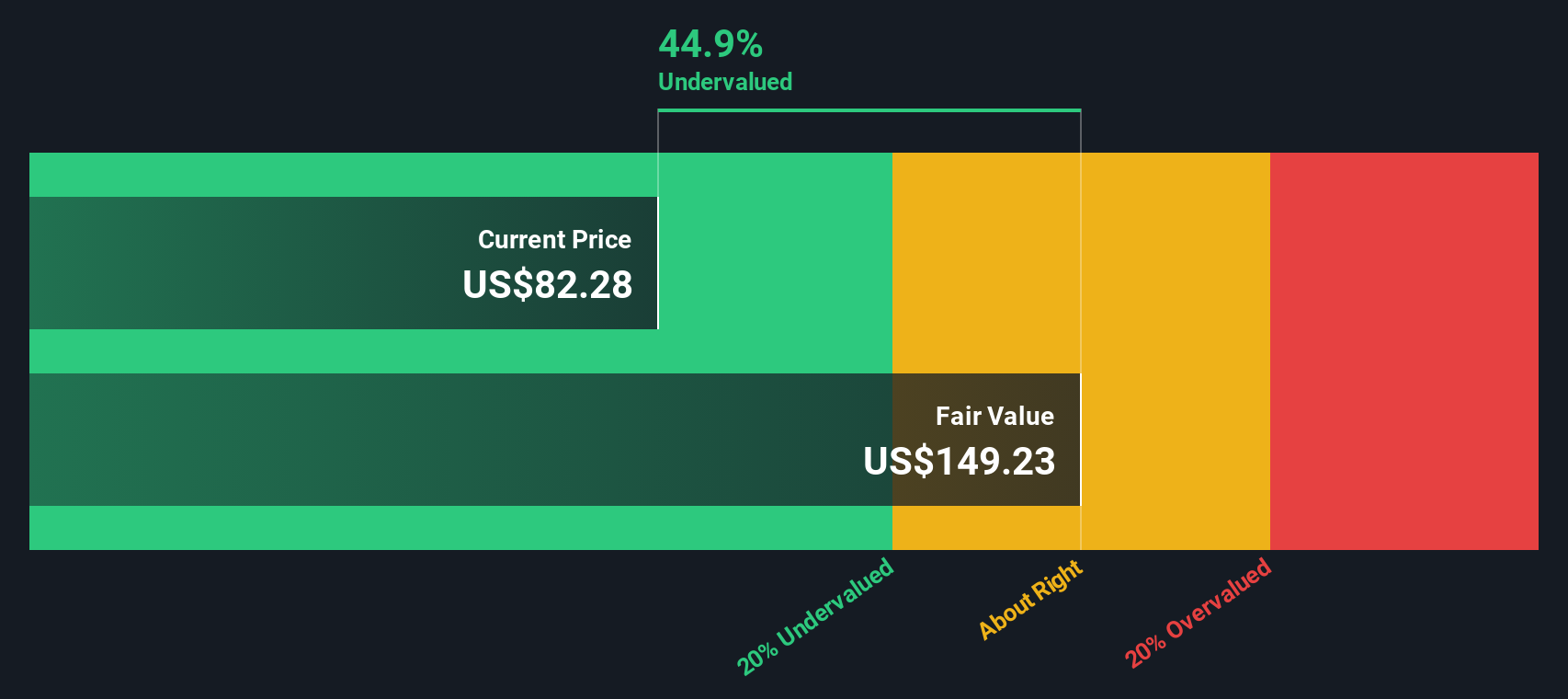

With this new benefit introduced and shares climbing lately, is MetLife trading at a bargain, or is the market already factoring future growth into the stock price?

Most Popular Narrative: 13.3% Undervalued

According to the most widely followed narrative, MetLife stock is trading at a notable discount to its calculated fair value. Analysts believe the company's strong fundamentals and future growth prospects are not yet fully priced into the current share price.

Ongoing investment in digital transformation, including AI-driven underwriting, process automation, embedded insurance partnerships, and tech-enabled distribution, enables MetLife to reduce acquisition and operating costs, improve customer engagement and retention, and, over time, boost net margins. Exposure to major secular shifts, such as the global aging population and the move away from government-provided retirement safety nets, positions MetLife to benefit from rising demand for life insurance, annuities, and private retirement solutions. This provides a durable tailwind for premium revenue and fee-based income growth.

Curious what is fueling this bold valuation call? Behind the scenes are ambitious projections for earnings acceleration and profitability, figures that could surprise even seasoned watchers. What do analysts see in MetLife’s future that might catch you off guard?

Result: Fair Value of $91.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing low interest rates and unpredictable investment returns could limit MetLife's profitability and present challenges to the optimism embedded in current analyst forecasts.

Find out about the key risks to this MetLife narrative.Another View: The SWS DCF Model Perspective

Looking at MetLife from our SWS DCF model perspective presents a similar picture, suggesting the stock could also be undervalued based on future cash flow projections. However, does this method truly capture the company's long-term potential or risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MetLife for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MetLife Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, creating your own view takes just a few minutes. Do it your way.

A great starting point for your MetLife research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let your next big win pass you by. Make your portfolio stand out and get ahead of trends by checking out these powerful investing themes:

- Tap into next-level innovation by spotting companies at the forefront of artificial intelligence with AI penny stocks, powering tomorrow’s breakthroughs.

- Grow your income stream by targeting stocks offering robust yields thanks to dividend stocks with yields > 3%, perfect for anyone seeking steady returns.

- Ride the wave of technological disruption by backing pioneers in the digital currency revolution with cryptocurrency and blockchain stocks in secure payment and blockchain solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:MET

MetLife

A financial services company, provides insurance, annuities, employee benefits, and asset management services worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)