- United States

- /

- Insurance

- /

- NYSE:HCI

How Investors Are Reacting To HCI Group (HCI) Strong Market Share Gains Ahead of Earnings

Reviewed by Sasha Jovanovic

- HCI Group recently attracted investor attention due to strong market share gains, a robust balance sheet, and projected growth in book value ahead of its anticipated earnings report.

- Anticipation is building as analysts expect HCI Group to post a very large year-over-year increase in earnings per share, further strengthening sentiment around its operational performance.

- We'll examine how momentum surrounding HCI Group's robust financial position ahead of earnings may reshape its broader investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

HCI Group Investment Narrative Recap

To buy into HCI Group’s story, you have to believe the company’s ability to grow book value and maintain operational momentum will outweigh challenges from a shrinking pool of profitable Citizens Insurance takeouts and Florida market concentration. The latest news about market share gains and a strong balance sheet line up well with expectations for surging earnings, but don’t fundamentally change the short-term catalyst, upcoming results, and the persistent risk from overreliance on Florida and depopulation strategies.

Among recent company moves, the restructuring into separate insurance and technology units, highlighted by the newly focused Exzeo Group Inc., best captures the optimism around catalysts tied to tech-driven margin improvement and geographic expansion. While not directly triggered by this week’s news, this separation provides a clearer framework for shareholders assessing growth opportunities beyond Florida, especially as attention remains on near-term earnings strength and valuation metrics.

However, investors should also keep in mind the flip side: as competition grows and the pipeline of attractive depopulation policies shrinks, the risk to future revenue growth remains something that …

Read the full narrative on HCI Group (it's free!)

HCI Group's narrative projects $1.1 billion revenue and $342.7 million earnings by 2028. This requires 13.5% yearly revenue growth and a $205.1 million earnings increase from $137.6 million currently.

Uncover how HCI Group's forecasts yield a $202.50 fair value, a 10% upside to its current price.

Exploring Other Perspectives

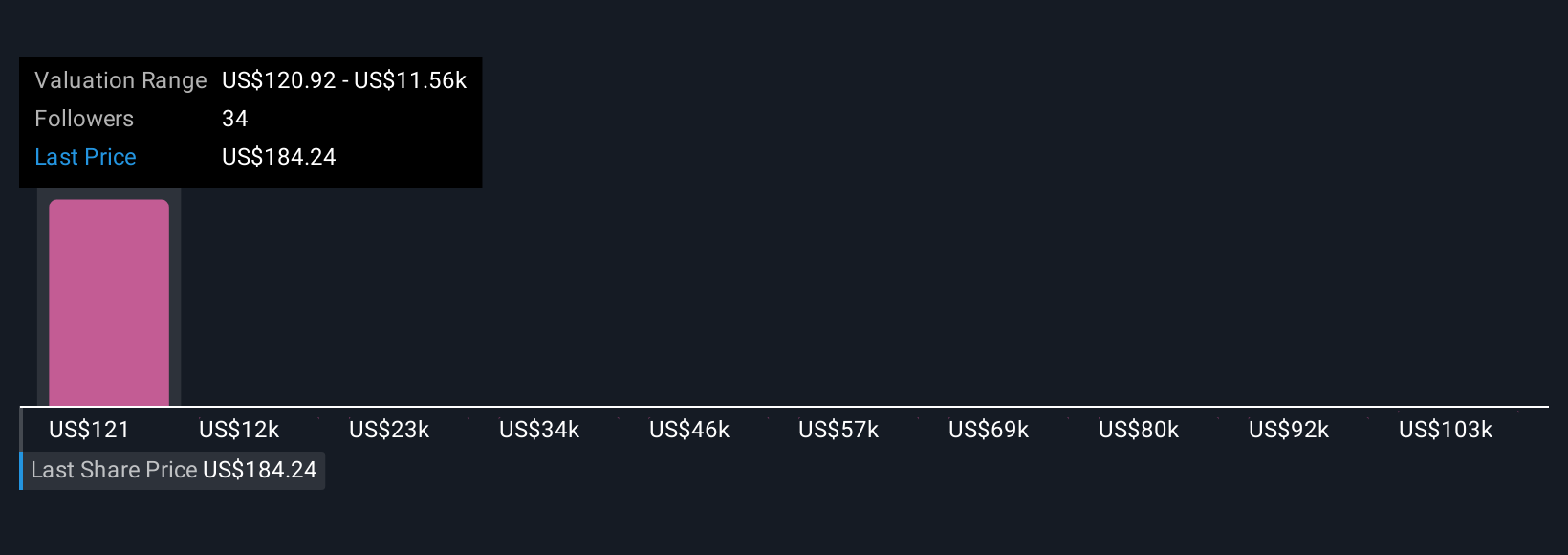

Simply Wall St Community members submitted seven fair value estimates for HCI Group, spanning a huge range from US$120.92 to over US$114,561. In light of such diverging views, keep in mind that a shrinking pool of profitable policies may weigh on future growth, which could explain part of the wide disparity in expectations.

Explore 7 other fair value estimates on HCI Group - why the stock might be a potential multi-bagger!

Build Your Own HCI Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HCI Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free HCI Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HCI Group's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HCI Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCI

HCI Group

Engages in the property and casualty insurance, insurance management, reinsurance, real estate, and information technology businesses in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives