- United States

- /

- Insurance

- /

- NYSE:HCI

Does HCI Group's 64% Rally Signal More Gains After Strong Q1 Earnings?

Reviewed by Bailey Pemberton

If you’re standing at the crossroads wondering what to do about HCI Group stock, you’re not alone. The last few years have been something of a roller coaster for investors, but lately, it seems like the ride has been mostly uphill. Over the past week, HCI Group shares ticked up 3.5%, bringing the one-month climb to a solid 14.5%. Maybe more impressively, the stock is up 63.9% year-to-date and has returned a staggering 76.3% over the last twelve months. Zoom out a bit further, and the picture gets even brighter. We’re talking 408.7% gains over three years, and 329.1% over five years. Clearly, there’s some serious momentum here.

Much of this enthusiasm can be traced to broader market shifts, including increased interest in property and casualty insurance and companies with a strong tech backbone. Investors seem to believe HCI Group is well positioned to capitalize on those trends, which might help explain the sharp run-up in price. But the central question remains: are shares still undervalued after all this growth?

For those who care about the numbers, HCI Group scores a 4 out of 6 on our value checklist, meaning it passes four key undervaluation tests. This suggests there’s substance to back up the recent excitement. Next, let’s break down exactly how we arrived at that valuation score and explore what traditional metrics are saying about the company. And stick around, because we’ll also reveal a smarter, more nuanced approach to valuation a bit further on.

HCI Group delivered 76.3% returns over the last year. See how this stacks up to the rest of the Insurance industry.Approach 1: HCI Group Excess Returns Analysis

The Excess Returns valuation model measures how much value a company can generate above its cost of equity, focusing on the return earned from reinvesting profits. For HCI Group, this approach uses several key financial metrics to assess value creation and shareholder returns.

Currently, HCI Group boasts a Book Value of $58.55 per share and a Stable Earnings Per Share (EPS) of $16.11, calculated from the median return on equity over the past five years. With a Cost of Equity at $4.87 per share, the company achieves an Excess Return of $11.25 per share. This highlights strong profitability well beyond what shareholders could expect from other investments in the market. The average Return on Equity stands out at 22.43%, suggesting HCI Group effectively turns equity capital into sizeable earnings. In addition, a Stable Book Value projection of $71.83 per share, based on analyst estimates, points to sustained growth from a robust capital base.

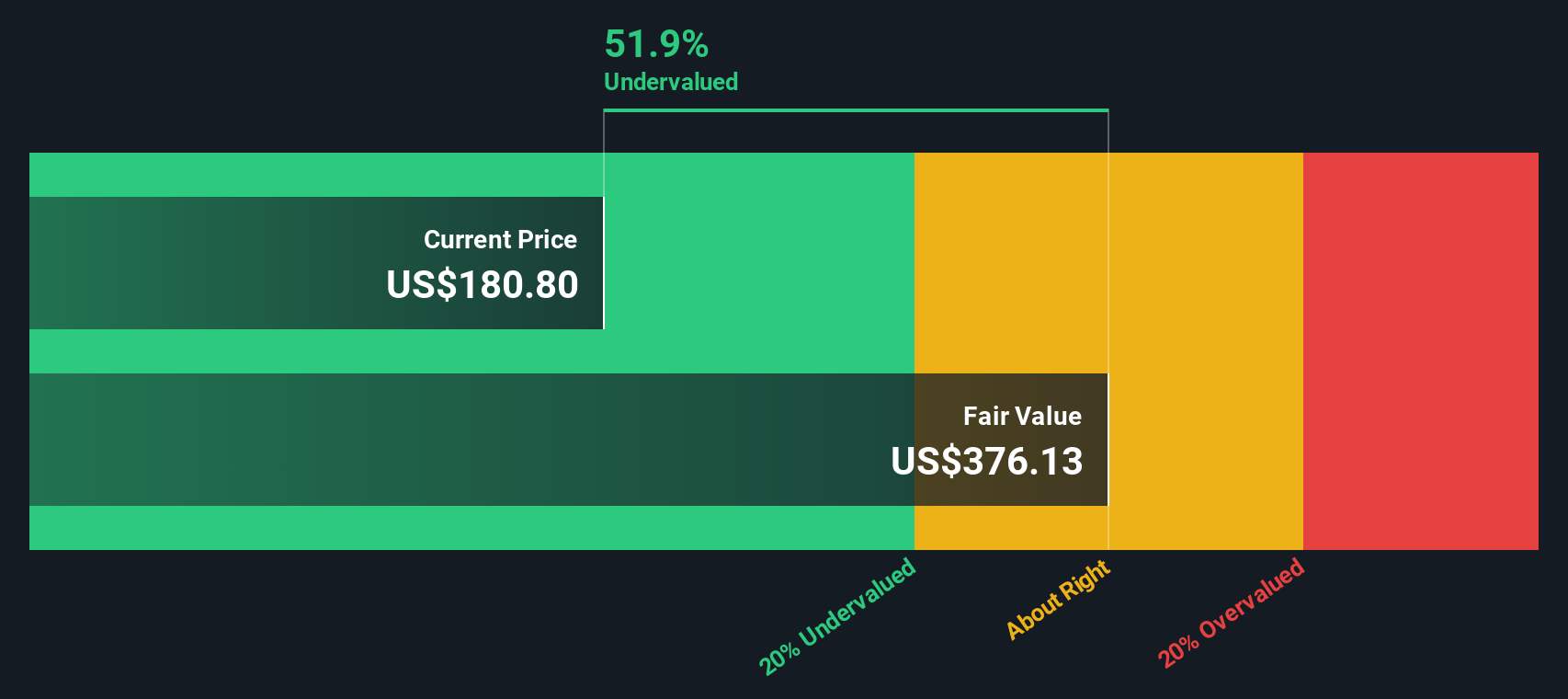

According to the model, the estimated intrinsic value for HCI Group shares is $376.13. This implies the stock is currently 50.1% undervalued based on excess returns, which may signal room for further upside.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for HCI Group.

Approach 2: HCI Group Price vs Earnings

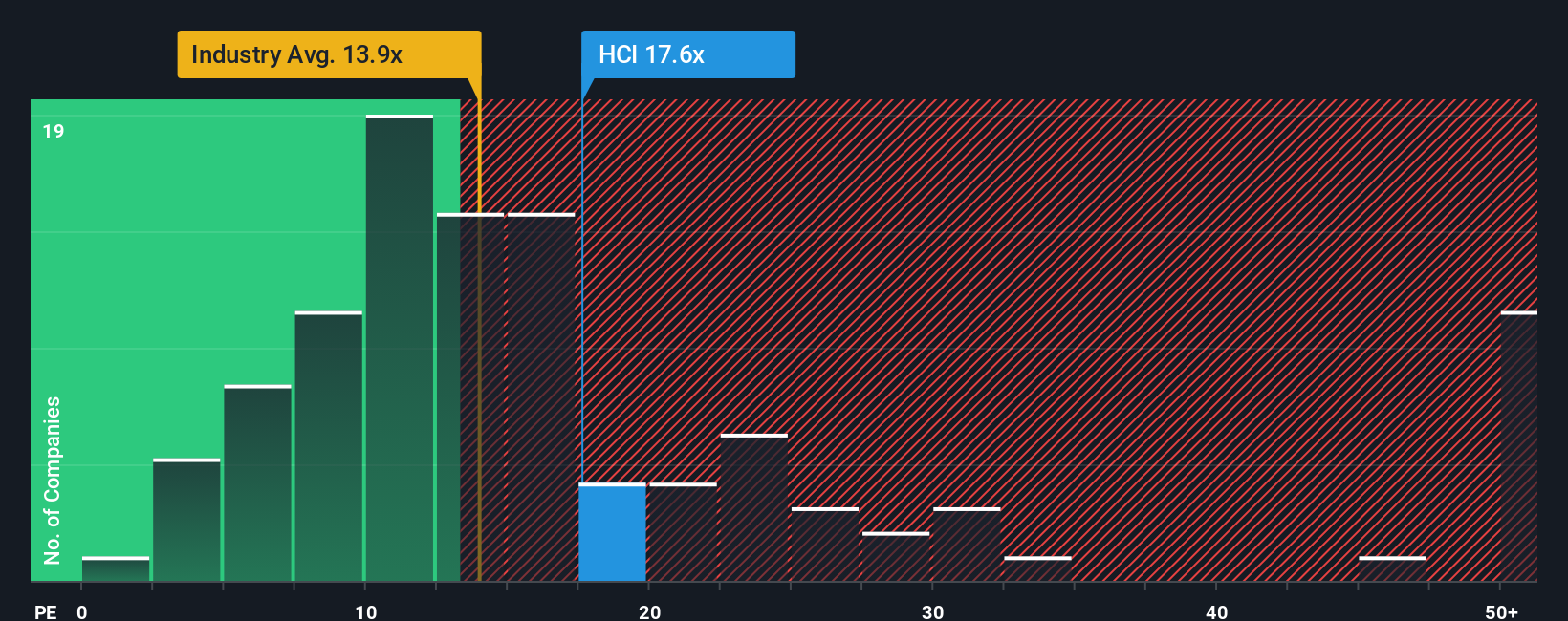

Price-to-Earnings (PE) is the preferred valuation metric for companies like HCI Group that are consistently profitable. The PE ratio is widely used because it offers a quick snapshot of how much investors are willing to pay for each dollar of earnings, making it particularly relevant for businesses with stable or growing profits.

However, what counts as a “normal” PE ratio is not one-size-fits-all. Higher growth expectations or lower risk typically justify higher PE multiples. Slower growth or higher risk tend to pull them down. For HCI Group, the current PE stands at 17.7x. This is notably higher than the insurance industry average of 13.6x, but well below the peer average of 52.8x.

To get a more tailored perspective, Simply Wall St’s “Fair Ratio” comes into play. The Fair Ratio for HCI Group is calculated as 18.8x, based on detailed consideration of the company’s earnings growth, profit margins, market size, risk profile, and its position within the insurance industry. Unlike simple peer or industry comparisons, the Fair Ratio paints a more complete picture because it weighs in the factors most relevant to HCI Group’s outlook and risk level, rather than just comparing headlines.

Since HCI Group’s actual PE ratio of 17.7x is within a 0.10 range of its Fair Ratio, the stock looks fairly valued using this approach.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your HCI Group Narrative

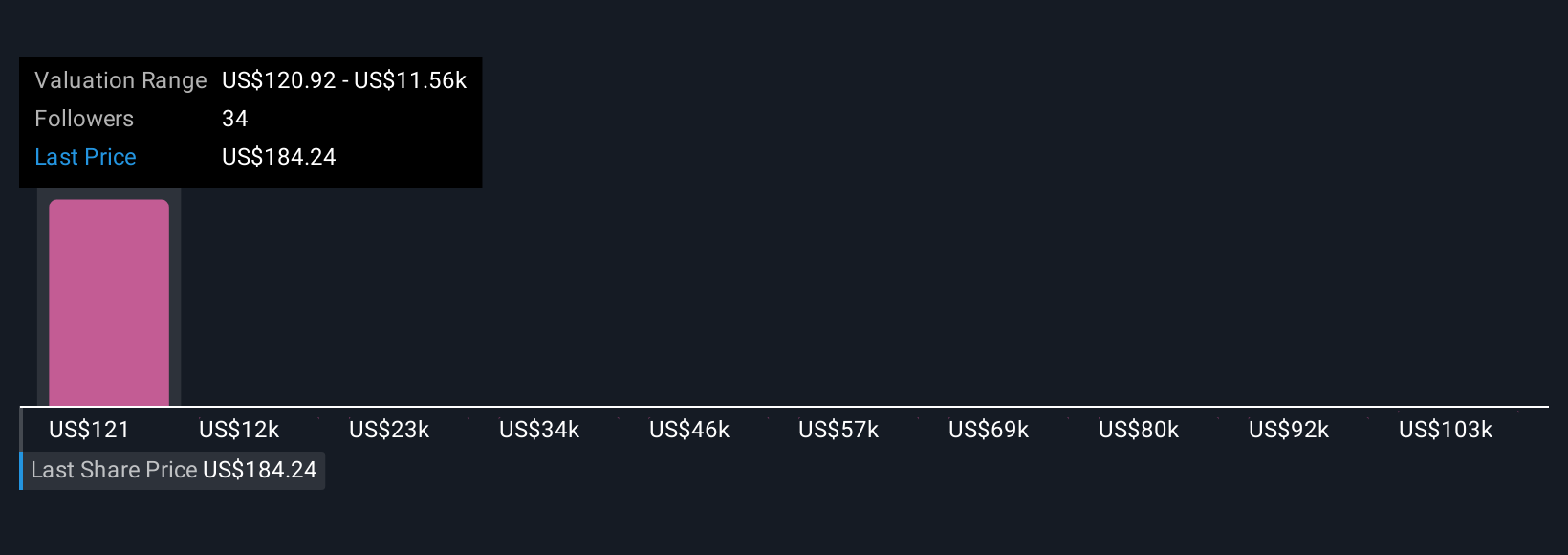

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about where HCI Group is headed and why, expressed through your own assumptions for things like fair value, future revenues, earnings, and profit margins. It connects the company's unique journey, such as technology bets, market strategy, or risks, to a forward-looking forecast and, ultimately, a fair value estimate.

Narratives are a simple and powerful tool available to all investors right on Simply Wall St's Community page, used by millions to share and refine their outlooks. They make it much easier to decide when to buy or sell, since you can clearly see how your own fair value stacks up against the current market price and how your logic differs from others. Plus, Narratives auto-update whenever something important changes, whether it's breaking news or fresh earnings.

For instance, some investors might have an optimistic view on HCI Group, basing their Narrative on rapid tech adoption and successful geographic expansion, leading to a $225 price target. Others, more cautious about insurance market risks, set their fair value closer to $190. Narratives make these perspectives transparent, dynamic, and actionable for better decision making.

Do you think there's more to the story for HCI Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HCI Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCI

HCI Group

Engages in the property and casualty insurance, insurance management, reinsurance, real estate, and information technology businesses in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives