- United States

- /

- Insurance

- /

- NYSE:HCI

Are Robust Financials Driving The Recent Rally In HCI Group, Inc.'s (NYSE:HCI) Stock?

HCI Group (NYSE:HCI) has had a great run on the share market with its stock up by a significant 29% over the last three months. Since the market usually pay for a company’s long-term fundamentals, we decided to study the company’s key performance indicators to see if they could be influencing the market. Specifically, we decided to study HCI Group's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for HCI Group

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for HCI Group is:

35% = US$164m ÷ US$468m (Based on the trailing twelve months to September 2024).

The 'return' is the yearly profit. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.35 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

HCI Group's Earnings Growth And 35% ROE

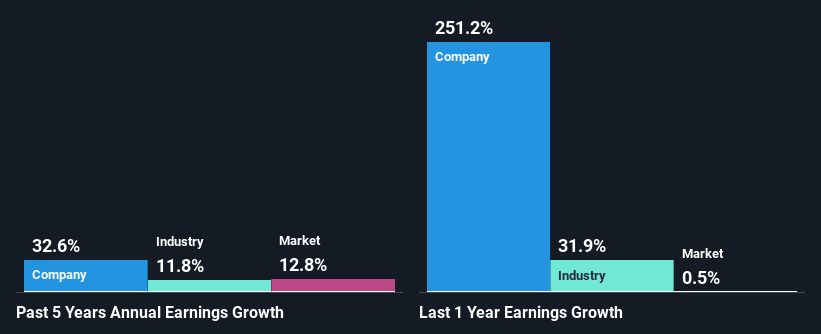

Firstly, we acknowledge that HCI Group has a significantly high ROE. Second, a comparison with the average ROE reported by the industry of 13% also doesn't go unnoticed by us. As a result, HCI Group's exceptional 33% net income growth seen over the past five years, doesn't come as a surprise.

As a next step, we compared HCI Group's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 12%.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Is HCI Group fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is HCI Group Efficiently Re-investing Its Profits?

HCI Group's three-year median payout ratio to shareholders is 9.9%, which is quite low. This implies that the company is retaining 90% of its profits. So it seems like the management is reinvesting profits heavily to grow its business and this reflects in its earnings growth number.

Additionally, HCI Group has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 12%. As a result, HCI Group's ROE is not expected to change by much either, which we inferred from the analyst estimate of 36% for future ROE.

Conclusion

In total, we are pretty happy with HCI Group's performance. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. Having said that, the company's earnings growth is expected to slow down, as forecasted in the current analyst estimates. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Valuation is complex, but we're here to simplify it.

Discover if HCI Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HCI

HCI Group

Engages in the property and casualty insurance, insurance management, reinsurance, real estate, and information technology businesses in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives