- United States

- /

- Insurance

- /

- NYSE:GL

Globe Life Inc. (NYSE:GL) Might Not Be As Mispriced As It Looks After Plunging 33%

The Globe Life Inc. (NYSE:GL) share price has fared very poorly over the last month, falling by a substantial 33%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 28% share price drop.

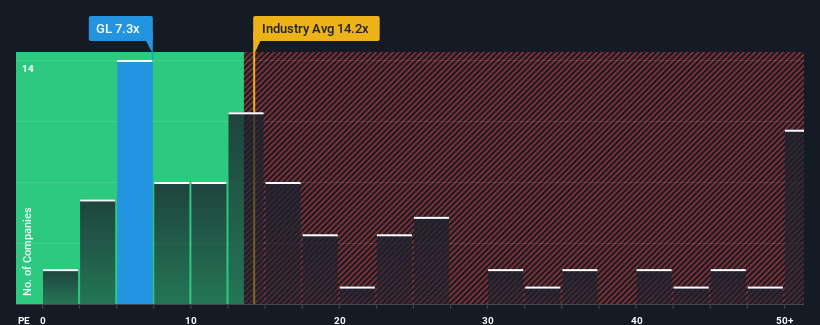

Even after such a large drop in price, Globe Life may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 7.3x, since almost half of all companies in the United States have P/E ratios greater than 17x and even P/E's higher than 32x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Globe Life has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Globe Life

How Is Globe Life's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Globe Life's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 42% gain to the company's bottom line. The latest three year period has also seen an excellent 50% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 10% per year during the coming three years according to the eight analysts following the company. That's shaping up to be similar to the 11% each year growth forecast for the broader market.

With this information, we find it odd that Globe Life is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Shares in Globe Life have plummeted and its P/E is now low enough to touch the ground. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Globe Life currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Globe Life (at least 1 which is significant), and understanding them should be part of your investment process.

If you're unsure about the strength of Globe Life's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GL

Globe Life

Through its subsidiaries, provides various life and supplemental health insurance products, and annuities to lower middle- and middle-income families in the United States.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives