- United States

- /

- Insurance

- /

- NYSE:GL

Does Globe Life's (GL) Strong Q3 and Upbeat Outlook Mark a Turning Point for Its Growth Story?

Reviewed by Sasha Jovanovic

- Globe Life Inc. recently reported its third quarter 2025 results, posting revenue of US$1.51 billion and net income of US$387.84 million, along with updated guidance indicating expectations for continued earnings growth through 2026.

- Management credited improved mortality experience and assumption updates for reduced policy obligations, while highlighting advantages in serving lower middle to middle income markets using proprietary data and long-term experience.

- We’ll explore how Globe Life’s robust earnings growth and positive guidance could influence its investment narrative and operational outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Globe Life Investment Narrative Recap

To be a shareholder in Globe Life, you need to believe that the company can sustain premium growth through both agent-driven and direct channels while expanding margins in its core insurance markets. The recent earnings news affirms short-term momentum as a catalyst, but it does not materially reduce the longer-term risk from the industry’s pivot toward digital sales and potential pressure on agent productivity.

Among Globe Life’s latest updates, the reaffirmed and raised earnings guidance for both 2025 and 2026 stands out. This directly speaks to investor focus on near-term profit visibility, offsetting some concern about execution in digital distribution and supporting the company’s catalyst of improving underwriting results and margin stability.

On the other hand, investors should be aware of the persistent risk that as digital adoption accelerates, Globe Life’s heavy reliance on agency distribution could...

Read the full narrative on Globe Life (it's free!)

Globe Life's outlook anticipates $6.8 billion in revenue and $1.3 billion in earnings by 2028. This is based on a forecasted annual revenue growth rate of 5.1% and an earnings increase of $0.2 billion from the current $1.1 billion.

Uncover how Globe Life's forecasts yield a $166.27 fair value, a 26% upside to its current price.

Exploring Other Perspectives

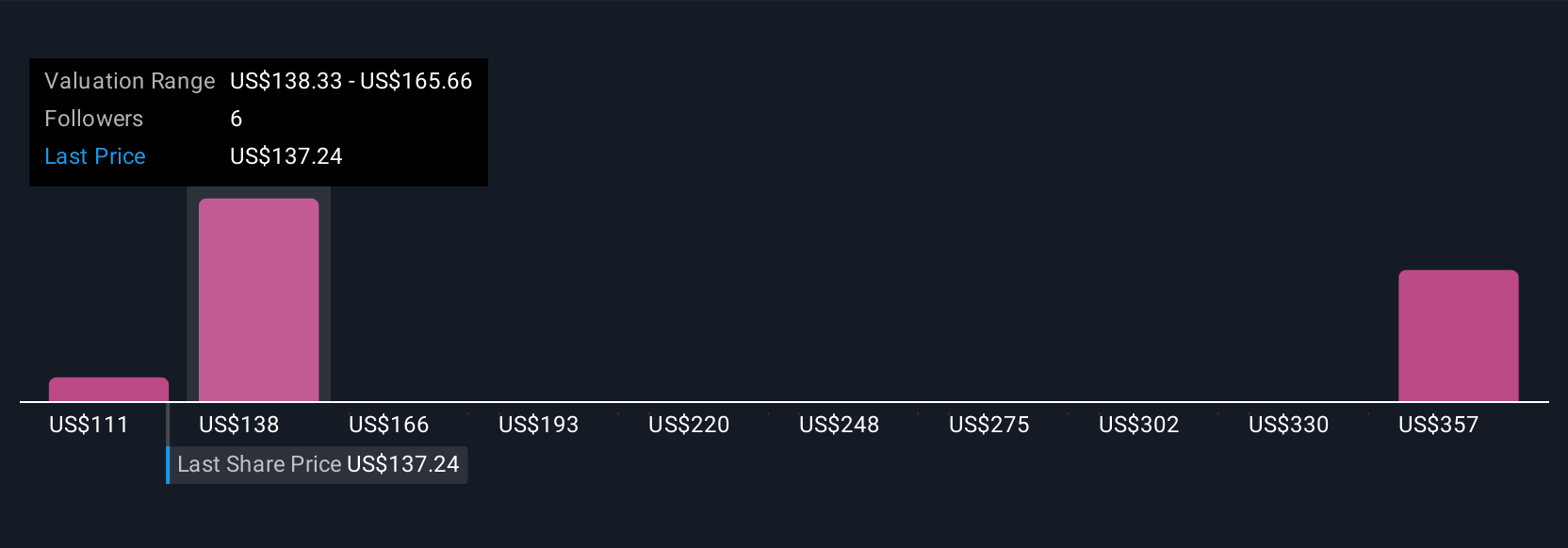

Simply Wall St Community members have published two fair value estimates for Globe Life, spanning from US$166 to US$366 per share. While opinions vary widely, keep in mind that ongoing margin expansion remains a focus and may shape future outcomes differently for each participant.

Explore 2 other fair value estimates on Globe Life - why the stock might be worth just $166.27!

Build Your Own Globe Life Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Globe Life research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Globe Life research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Globe Life's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GL

Globe Life

Through its subsidiaries, provides various life and supplemental health insurance products, and annuities to lower middle- and middle-income families in the United States.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)