- United States

- /

- Insurance

- /

- NYSE:FNF

Rising Expenses and Flat Premiums Might Change the Case for Investing in Fidelity National Financial (FNF)

Reviewed by Sasha Jovanovic

- In recent news, Fidelity National Financial reported stagnant net premiums earned over the past five years and rising expenses as a percentage of revenue, leading to a decline in pre-tax profit margins.

- This trend highlights ongoing profitability concerns for the company as cost pressures continue despite a flat top-line performance.

- We’ll explore how rising operating expenses may reshape Fidelity National Financial’s investment narrative and future outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Fidelity National Financial Investment Narrative Recap

To be a shareholder of Fidelity National Financial, you have to believe in the company’s ability to defend its profit margins and adapt to changing real estate market dynamics. The recent news of stagnant net premiums earned and rising expense ratios directly targets the most important short-term catalyst, the firm's push to improve operational efficiency, while reinforcing the current risk of sustained margin compression from ongoing cost pressures. This development makes near-term profitability a key question, but does not immediately disrupt the long-term thesis built on recovery in transaction volumes and digital gains.

Among recent announcements, FNF’s partnership with CLEAR to bolster transaction security stands out as a meaningful technology investment. While this move aligns with efforts to boost operational efficiency and potentially address margin headwinds, its direct impact on reversing rising expenses and defending profitability is yet to be seen.

But with profitability now under pressure, investors should also be aware that if elevated costs continue to outpace revenue growth…

Read the full narrative on Fidelity National Financial (it's free!)

Fidelity National Financial's narrative projects $15.9 billion in revenue and $2.1 billion in earnings by 2028. This requires 5.3% yearly revenue growth and a $1.0 billion increase in earnings from the current $1.1 billion.

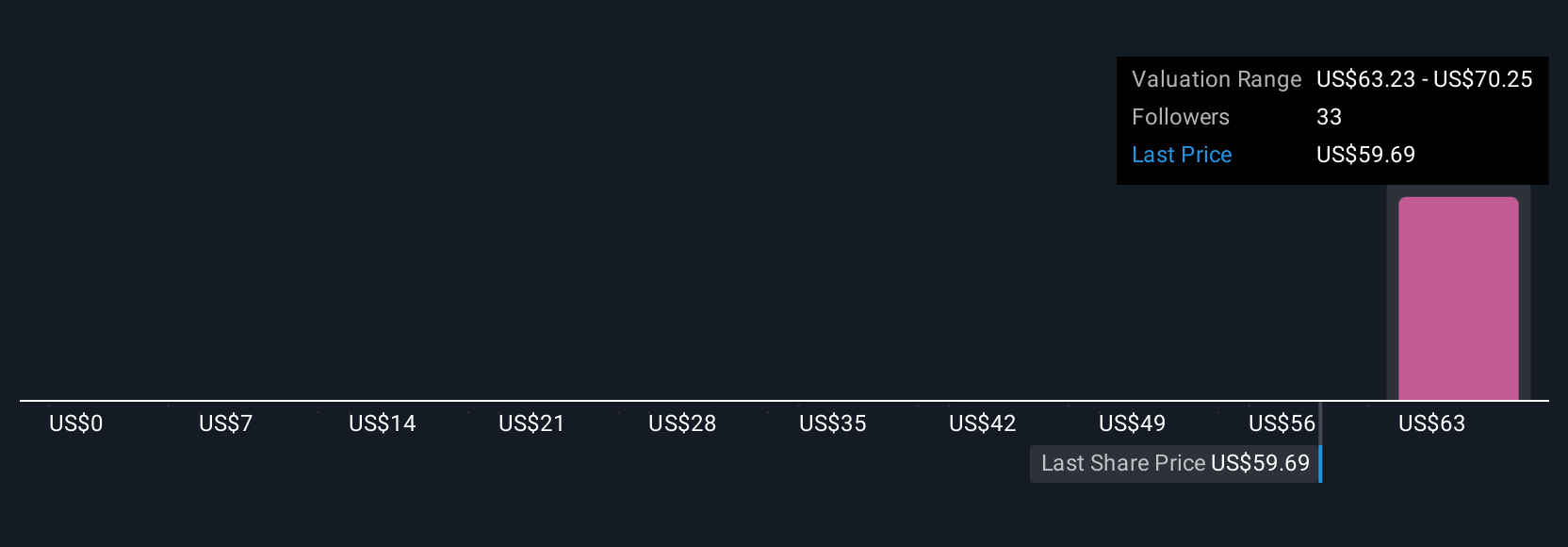

Uncover how Fidelity National Financial's forecasts yield a $70.25 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Six different fair value estimates from the Simply Wall St Community for FNF range widely from US$7.03 to US$70.25 per share. While opinions vary, the risk that margin pressures remain unresolved could weigh on future market confidence and earnings performance, so explore a variety of viewpoints from other investors.

Explore 6 other fair value estimates on Fidelity National Financial - why the stock might be worth less than half the current price!

Build Your Own Fidelity National Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fidelity National Financial research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Fidelity National Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fidelity National Financial's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FNF

Fidelity National Financial

Provides various insurance products in the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives