- United States

- /

- Insurance

- /

- NYSE:FNF

Fidelity National Financial (FNF) Partners With CLEAR For Enhanced Real Estate Transaction Security

Reviewed by Simply Wall St

Fidelity National Financial (FNF) recently announced a partnership with CLEAR Secure to bolster security in real estate transactions, employing biometric identity verification to tackle fraud. This development complements FNF's WireSafe program and inHere platform aimed at reducing impersonation risks. During the last quarter, FNF's share price increased by 8%, mirroring overall market strength and benefiting from broader economic conditions such as record highs in the S&P 500 and Nasdaq. The company's progress in fraud prevention strategies and recent announcements might have added weight to its performance despite mixed earnings results during the same period.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

The recent partnership between Fidelity National Financial (FNF) and CLEAR Secure underscores the company's commitment to leveraging biometric technology to enhance security in real estate transactions. This development is projected to bolster FNF's broader digital transformation initiatives aimed at streamlining processes and driving operational efficiencies. Such technological investments are vital for maintaining competitive advantage as the industry increasingly shifts towards digital solutions. Although the partnership could support future revenue growth by attracting tech-oriented clients, it also represents ongoing efforts to mitigate fraud risks, potentially leading to improved earnings over time.

Over the past five years, FNF's total shareholder return was a substantial 130.59%, highlighting significant long-term value creation for its shareholders. In the shorter term, FNF's one-year return matched the US insurance industry with a 1.3% increase, though it underperformed the broader US market, which returned 20.5%. This underperformance relative to the overall market may reflect challenges in the real estate sector and competitive pressures within the insurance industry.

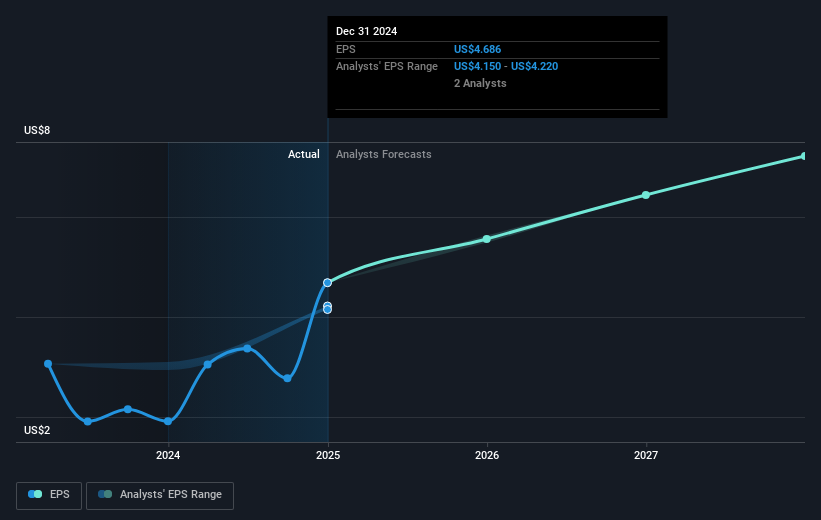

The share price, currently at US$59.97, remains below the consensus analyst price target of US$70.25, indicating potential upside as per analysts. Investors may view the discounted share price as an opportunity, provided industry catalysts materialize favorably. The expected impact of biometric integration and digital advancements on FNF's revenue and earnings forecasts will be closely watched, as they aim to transition towards a more efficient and profitable operating model. As FNF continues to diversify its revenue streams and invest in technology, the company's strategic directions could influence its ability to meet or exceed market expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FNF

Fidelity National Financial

Provides various insurance products in the United States.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives