- United States

- /

- Insurance

- /

- NYSE:FAF

How Strong Q2 Results and a $300 Million Buyback Will Impact First American Financial (FAF) Investors

Reviewed by Simply Wall St

- Earlier this week, First American Financial reported better-than-expected second-quarter 2025 earnings, buoyed by strong commercial business, higher title insurance revenues, and margin improvement, alongside the announcement of a new US$300 million share buyback program.

- The company also benefited from positive Federal Reserve commentary, which eased concerns about prolonged high interest rates and contributed to broader market strength for housing-related stocks.

- We’ll examine how First American’s robust quarterly results and share buyback program could impact its investment narrative and future prospects.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

First American Financial Investment Narrative Recap

First American Financial appeals to investors who believe in an eventual rebound in U.S. home purchases, sustained commercial momentum, and a resilient title insurance market. The latest earnings beat, supported by robust commercial business and stronger title revenues, was significant; however, the biggest short-term risk remains the potential normalization of commercial transaction volumes, which could reduce margins as the current unusual surge fades. The immediate market impact of this news is positive, but the underlying risk of commercial activity reverting to historical levels is still material.

Of the recent announcements, the launch of a new US$300 million share buyback program stands out. This move underscores the company’s confidence in its financial position and may provide near-term support for the stock, but its direct effect on mitigating the risk of declining commercial activity is likely limited.

On the other hand, investors should be aware that if commercial revenue surges were to subside faster than expected...

Read the full narrative on First American Financial (it's free!)

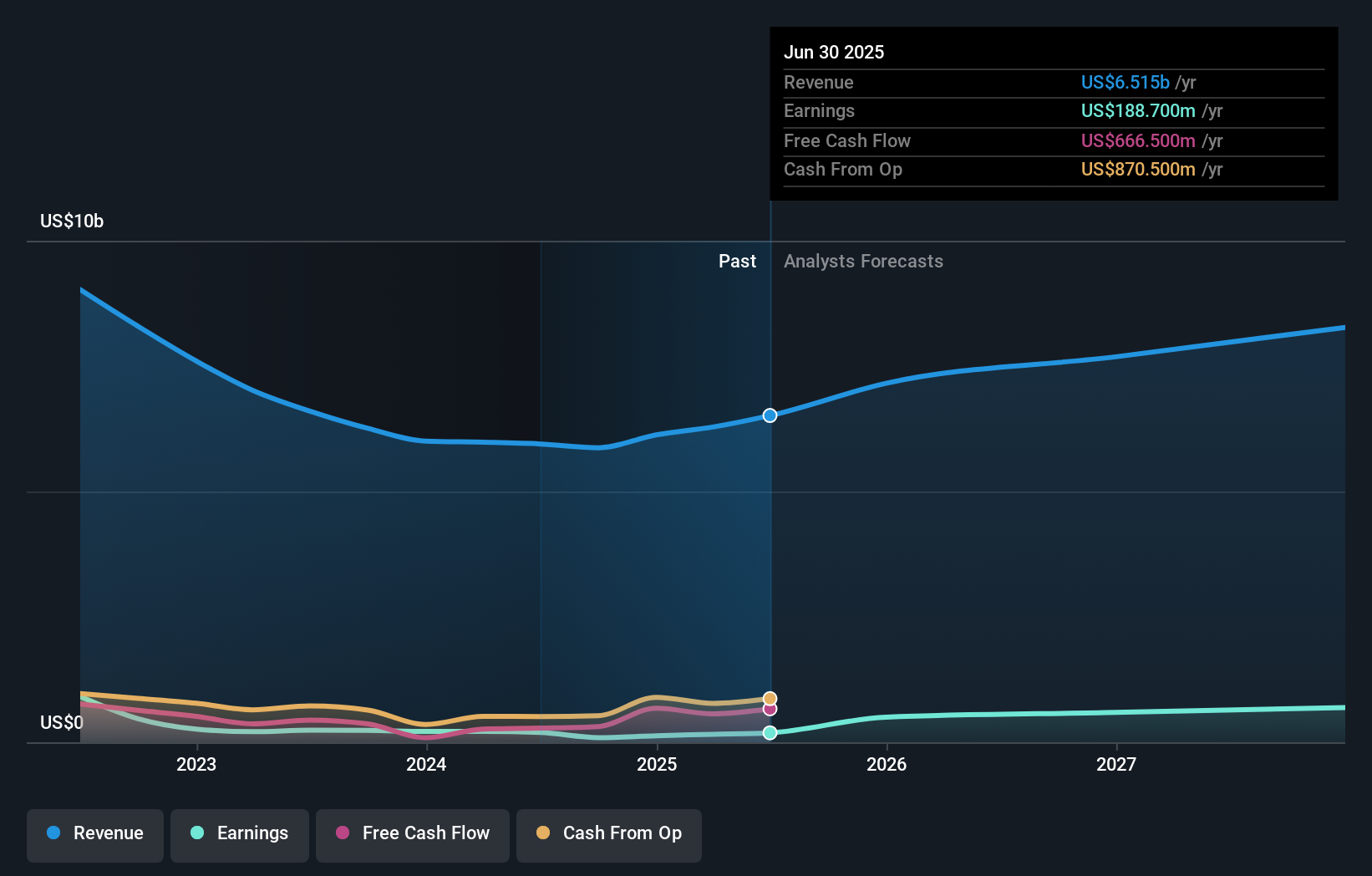

First American Financial's narrative projects $8.7 billion in revenue and $888.8 million in earnings by 2028. This requires 10.2% yearly revenue growth and an increase in earnings of $700.1 million from the current $188.7 million.

Uncover how First American Financial's forecasts yield a $77.00 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community provided fair value estimates for First American Financial stock, ranging from US$16.51 to US$77. While commercial segment strength remains a driving force, many recognize the company’s exposure to cyclical risks. Review these alternative viewpoints to broaden your understanding.

Explore 3 other fair value estimates on First American Financial - why the stock might be worth as much as 16% more than the current price!

Build Your Own First American Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First American Financial research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free First American Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First American Financial's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FAF

First American Financial

Through its subsidiaries, provides financial services.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives