- United States

- /

- Insurance

- /

- NYSE:FAF

Exploring First American Financial's (FAF) Valuation After Recent Pressure on Shares

Reviewed by Kshitija Bhandaru

See our latest analysis for First American Financial.

Zooming out, First American Financial’s 1-year total shareholder return is down just under 5%, with recent weeks amplifying pressure as short-term momentum fades. At the same time, its 3-year total return of over 45% hints that the long-term story remains constructive, despite near-term volatility around sector sentiment.

If you’re watching insurance stocks but want to expand your search, this is a perfect chance to discover fast growing stocks with high insider ownership.

With First American Financial trading roughly 30% below average analyst price targets, is the recent weakness a value opportunity for investors? Alternatively, are markets accurately reflecting near-term challenges and the company’s future prospects?

Most Popular Narrative: 22.9% Undervalued

First American Financial closed at $59.34 while the widely followed narrative assigns it a fair value of $77. This implies significant upside from current levels. Enthusiasm rides on the belief that upcoming structural changes and market catalysts could materially reshape the earnings power of the business.

Accelerating adoption and rollout of proprietary technology platforms such as Endpoint and Sequoia, aimed at automation of title and refinance transactions, are expected to unlock operational efficiencies and reduce processing costs, supporting higher net margins over the next 2-3 years.

Curious about the bold quantitative leaps behind this optimistic price target? The narrative hinges on striking forecasts for profit expansion and margin transformation, fueled by strategic moves few expect. Uncover what makes this valuation stand apart from consensus.

Result: Fair Value of $77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent home affordability issues and signs of a peak in commercial activity could challenge these optimistic forecasts in the months ahead.

Find out about the key risks to this First American Financial narrative.

Another View: Multiples Raise Questions

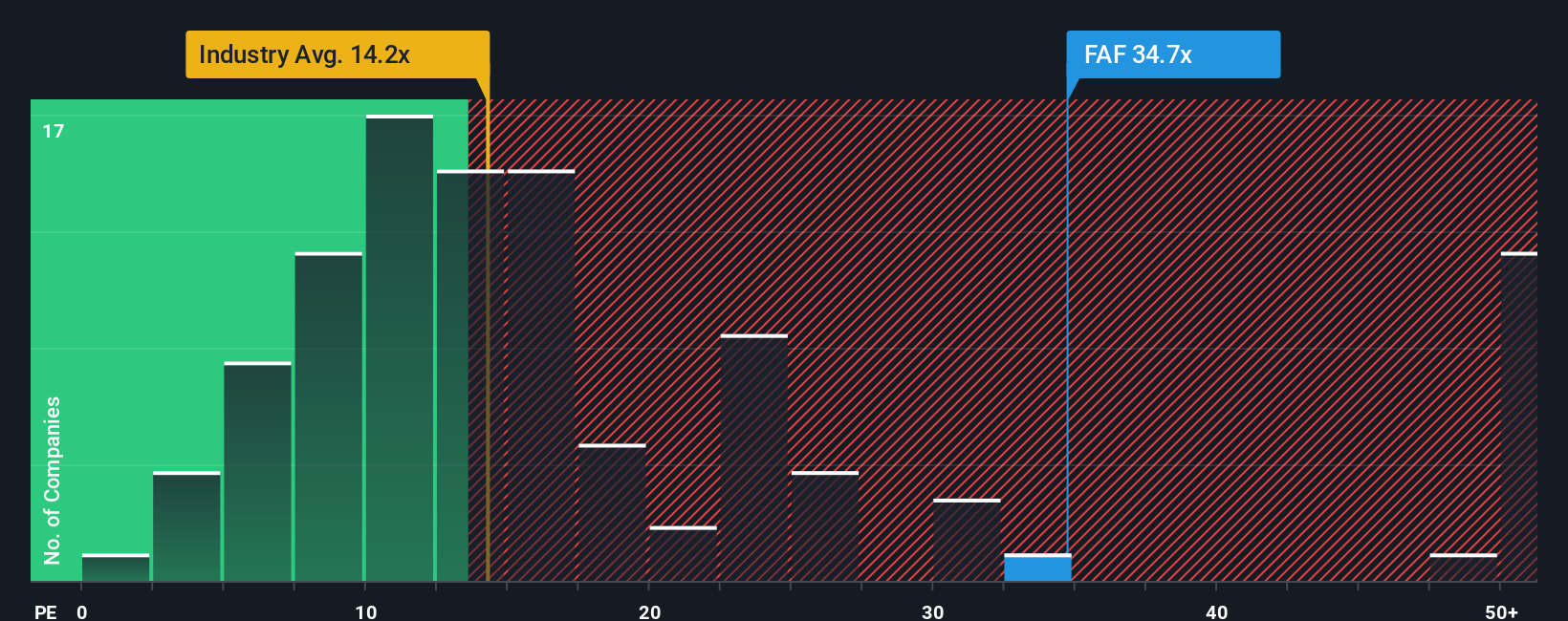

While fair value estimates suggest upside, looking at First American Financial’s price-to-earnings comparison tells another story. The stock trades at 32 times earnings, well above both its peer group average of 12.5x and the industry standard of 13.9x. Even compared to its own fair ratio of 27.4x, FAF appears on the pricier side. This premium suggests the market is factoring in significant future growth. Whether this optimism presents additional risk or reflects true potential remains to be seen.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First American Financial Narrative

If you want to challenge the prevailing view or simply dive into the numbers yourself, you can quickly shape your own perspective in just a few minutes. Do it your way with Do it your way.

A great starting point for your First American Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Confident moves set you apart. Join savvy investors who seize advantage by scanning new opportunities across sectors, themes, and tomorrow’s most promising trends before everyone else.

- Maximize your income potential by scanning these 19 dividend stocks with yields > 3% with yields exceeding 3% to pinpoint reliable returns.

- Tap into the growing influence of artificial intelligence and target next-generation leaders among these 24 AI penny stocks poised for outsized growth.

- Catch value ahead of the crowd by exploring these 898 undervalued stocks based on cash flows, which are primed for a re-rating based on strong cash flows and attractive entry points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FAF

First American Financial

Through its subsidiaries, provides financial services.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives