- United States

- /

- Insurance

- /

- NYSE:CNA

CNA Financial (CNA): Valuation in Focus as Canadian Leadership Shift and Analyst Optimism Drive Investor Interest

Reviewed by Kshitija Bhandaru

CNA Financial (CNA) has been making waves with the appointment of Catherine Roe as President of CNA Canada, signaling fresh ambitions for its Canadian business. This move, together with recent positive analyst attention, is drawing renewed interest from investors.

See our latest analysis for CNA Financial.

Following the leadership announcement, CNA Financial’s share price momentum has been mixed, with a recent pullback offset by a 7.3% gain over the past three months. While the 1-year total shareholder return sits at 1.7%, the strong 49% three-year total return and 128% five-year return suggest a solid long-term trajectory that is supporting continued investor confidence.

If you’re interested in broadening your investment search, now could be the perfect time to discover fast growing stocks with high insider ownership.

This raises a key question for investors: Is CNA Financial trading at a price that still offers meaningful upside, or has the market already factored in its growth prospects and new leadership move?

Price-to-Earnings of 14.3x: Is it justified?

At a price-to-earnings (P/E) ratio of 14.3x, CNA Financial shares appear a touch more expensive than their US insurance peers, given the last close of $46.48. This signals investors may be paying a slight premium for anticipated earnings growth or perceived stability.

The P/E ratio measures how much investors are willing to pay for a dollar of company earnings, reflecting expectations for future profitability. In the insurance sector, it is a common benchmark for comparing valuations across companies with similar risk profiles.

The current P/E of 14.3x stands above the industry average of 13.8x and also slightly above peer companies at 14x. However, when viewed against the estimated fair price-to-earnings ratio of 20.3x, CNA’s valuation could have room to expand if future growth materializes as expected. This could bring it closer to levels justified by fundamentals.

Explore the SWS fair ratio for CNA Financial

Result: Price-to-Earnings of 14.3x (ABOUT RIGHT)

However, CNA Financial's recent price dip and proximity to its analyst target price may indicate modest near-term upside, as well as possible risk if expectations shift.

Find out about the key risks to this CNA Financial narrative.

Another View: Discounted Cash Flow Analysis

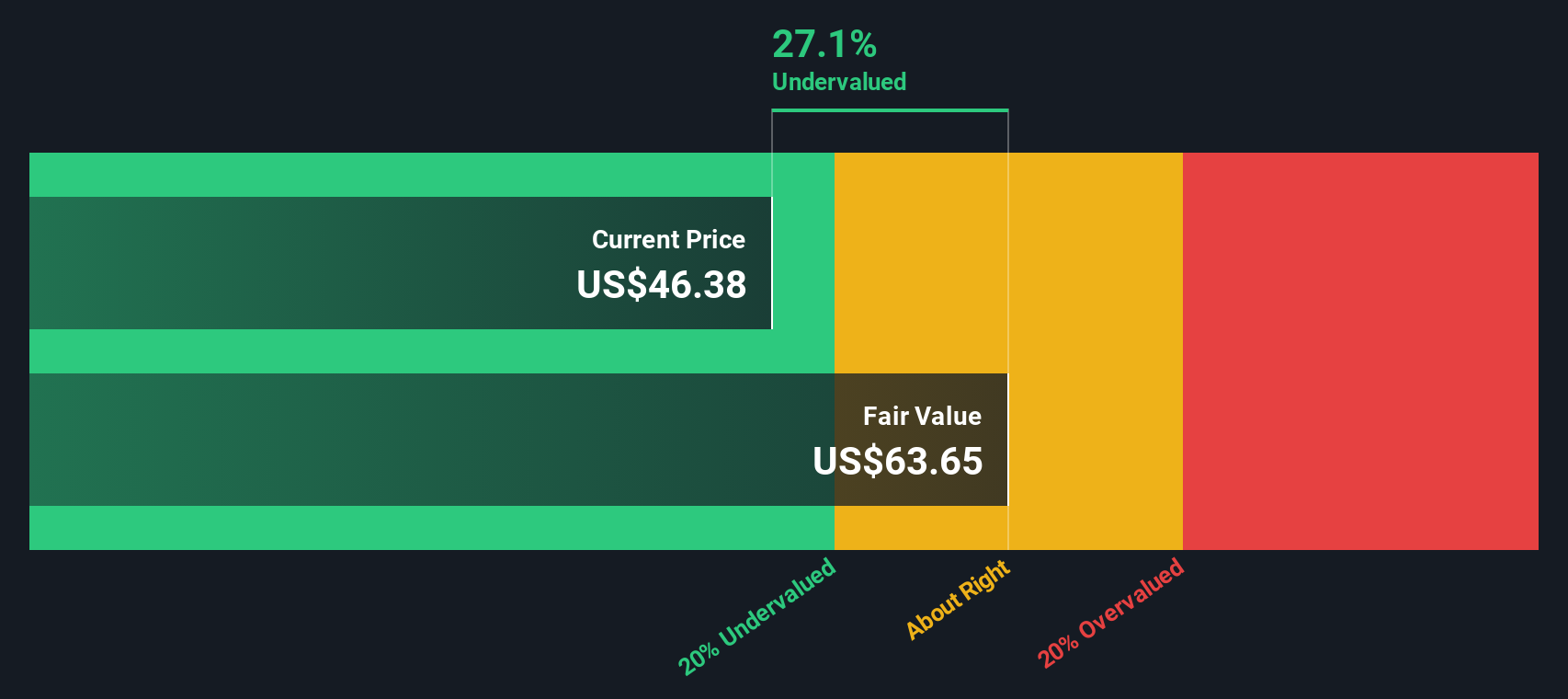

While the price-to-earnings ratio presents one valuation perspective, our SWS DCF model illustrates a different outlook. According to this method, CNA Financial is trading at a 29.5% discount to its estimated fair value, suggesting the shares may be undervalued based on long-term cash flow assumptions rather than earnings multiples.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CNA Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CNA Financial Narrative

If you think the numbers paint a different story or want to do your own digging, you can easily create your own view in just a few minutes. Do it your way.

A great starting point for your CNA Financial research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take your investing to the next level. Smart investors always have options on the table. Don’t miss out on fresh opportunities that could strengthen your portfolio and boost potential returns.

- Tap into game-changing technology by reviewing these 25 AI penny stocks powering innovation across industries and transforming the market with artificial intelligence.

- Secure steady income streams as you search these 18 dividend stocks with yields > 3% that offer competitive yields and reliable performance through market ups and downs.

- Upgrade your strategy by researching these 891 undervalued stocks based on cash flows that may be trading below their true potential based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNA

CNA Financial

An insurance holding company, primarily provides commercial property and casualty insurance products in the United States and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives