- United States

- /

- Insurance

- /

- NYSE:BOW

3 Stocks That Might Offer Value Opportunities In October 2025

Reviewed by Simply Wall St

As the U.S. stock market sees fluctuations with major indices like the S&P 500 and Nasdaq hitting fresh records followed by slight retreats, investors are closely monitoring economic indicators such as Treasury yields and gold prices. In this environment, identifying undervalued stocks becomes crucial for those looking to capitalize on potential value opportunities amidst these shifting market dynamics.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wix.com (WIX) | $135.08 | $260.69 | 48.2% |

| Metropolitan Bank Holding (MCB) | $75.49 | $150.26 | 49.8% |

| McGraw Hill (MH) | $12.50 | $24.53 | 49% |

| Investar Holding (ISTR) | $22.985 | $45.40 | 49.4% |

| Hess Midstream (HESM) | $33.43 | $66.31 | 49.6% |

| HCI Group (HCI) | $194.72 | $376.13 | 48.2% |

| First Commonwealth Financial (FCF) | $16.73 | $32.97 | 49.3% |

| First Busey (BUSE) | $23.37 | $45.30 | 48.4% |

| Alnylam Pharmaceuticals (ALNY) | $450.68 | $886.56 | 49.2% |

| AGNC Investment (AGNC) | $10.16 | $19.46 | 47.8% |

Let's dive into some prime choices out of the screener.

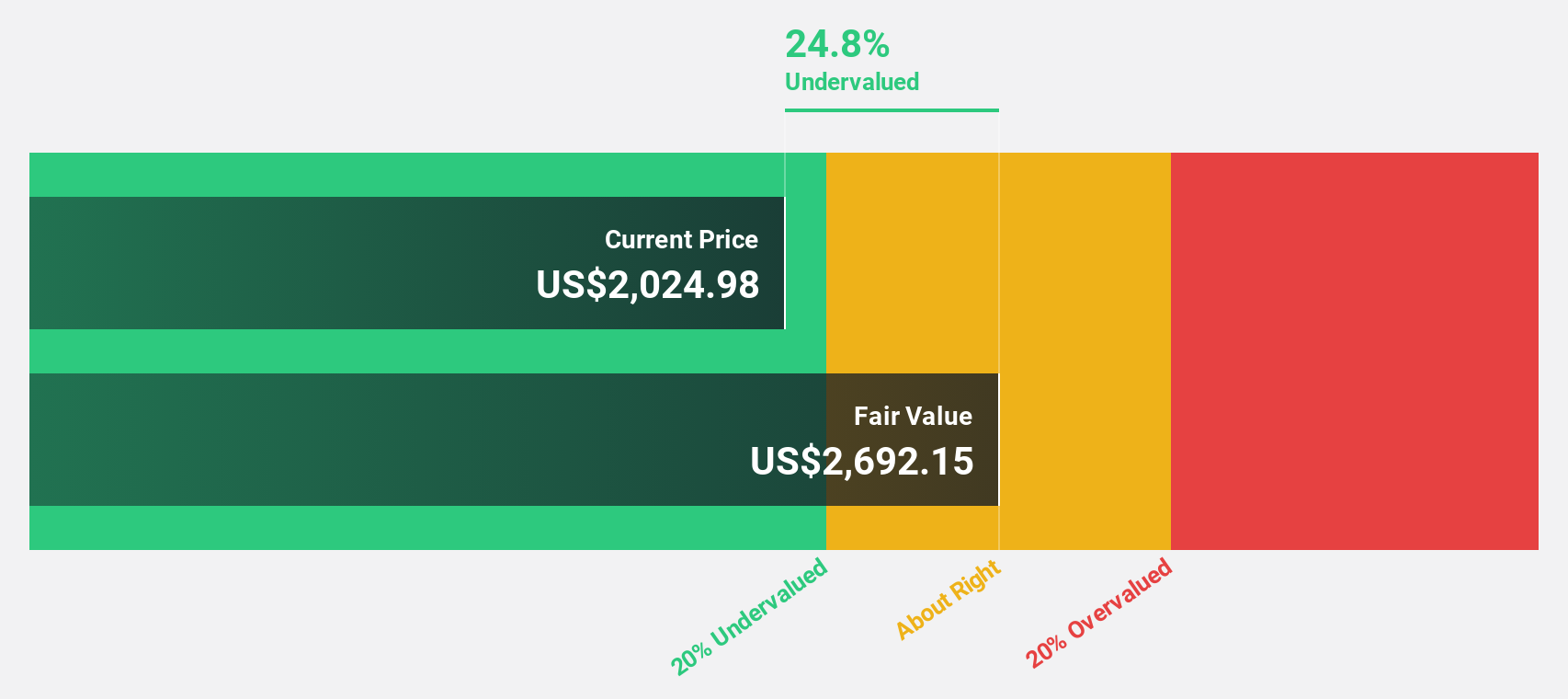

MercadoLibre (MELI)

Overview: MercadoLibre, Inc. operates online commerce platforms across Brazil, Mexico, Argentina, and internationally, with a market cap of $110.90 billion.

Operations: The company's revenue primarily comes from its Internet Software & Services segment, which generated $24.10 billion.

Estimated Discount To Fair Value: 19.1%

MercadoLibre is trading at US$2,179.89, below its estimated fair value of US$2,694.06, suggesting it might be undervalued based on cash flows. Despite a high debt level, its earnings are expected to grow significantly at 25.7% annually over the next three years, outpacing the broader US market's growth rate of 15.4%. Recent earnings reports show substantial revenue growth but slight declines in net income and EPS compared to last year.

- Insights from our recent growth report point to a promising forecast for MercadoLibre's business outlook.

- Delve into the full analysis health report here for a deeper understanding of MercadoLibre.

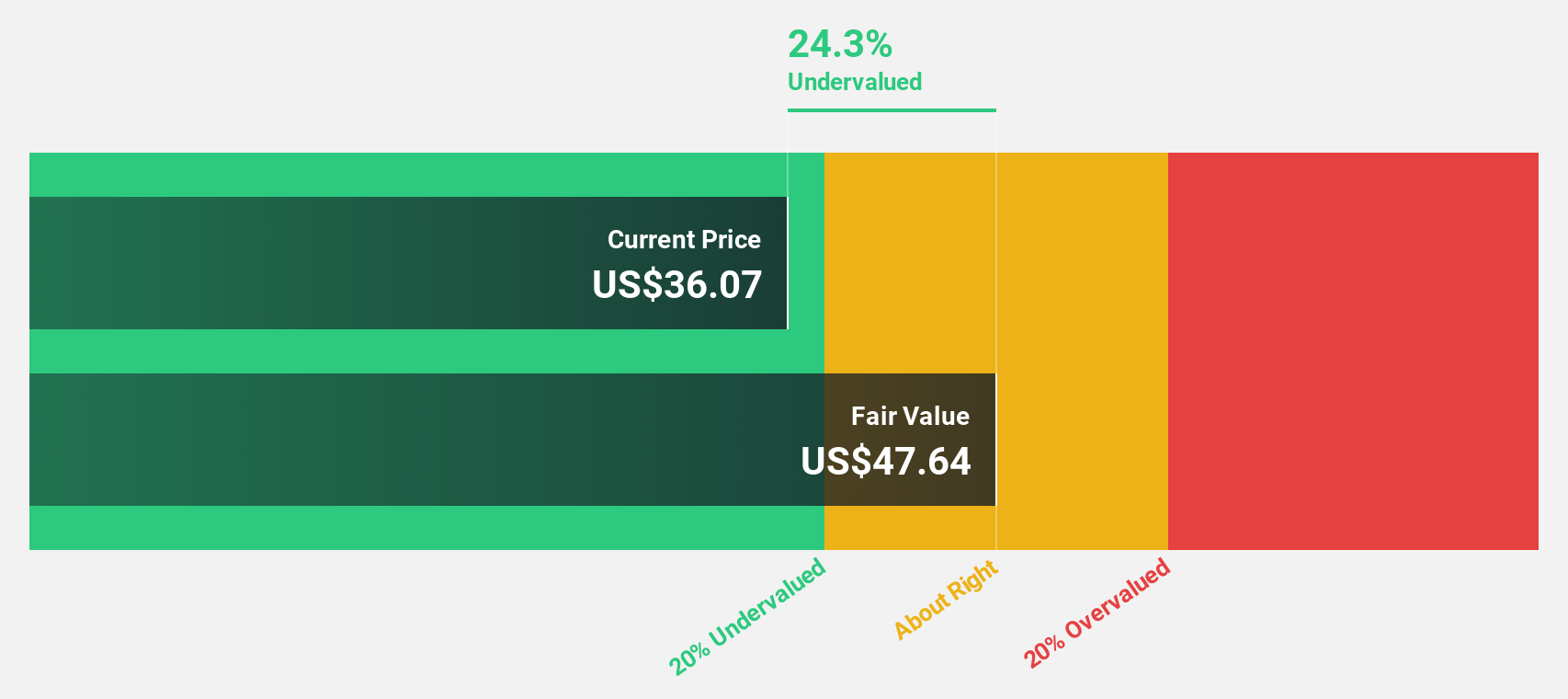

Bowhead Specialty Holdings (BOW)

Overview: Bowhead Specialty Holdings Inc. offers commercial specialty property and casualty insurance products in the United States, with a market cap of $852.65 million.

Operations: The company generates revenue from its commercial specialty property and casualty insurance segment, totaling $492.07 million.

Estimated Discount To Fair Value: 41%

Bowhead Specialty Holdings is trading at US$26.86, significantly below its estimated fair value of US$45.56, highlighting potential undervaluation based on cash flows. Recent earnings reports show notable growth, with net income nearly doubling year-over-year to US$12.34 million for Q2 2025 and strong revenue increases. Despite a recent follow-on equity offering raising US$61.32 million, the company maintains robust profit forecasts with expected annual earnings growth of 23.1%, surpassing the broader market's rate.

- Our growth report here indicates Bowhead Specialty Holdings may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Bowhead Specialty Holdings' balance sheet health report.

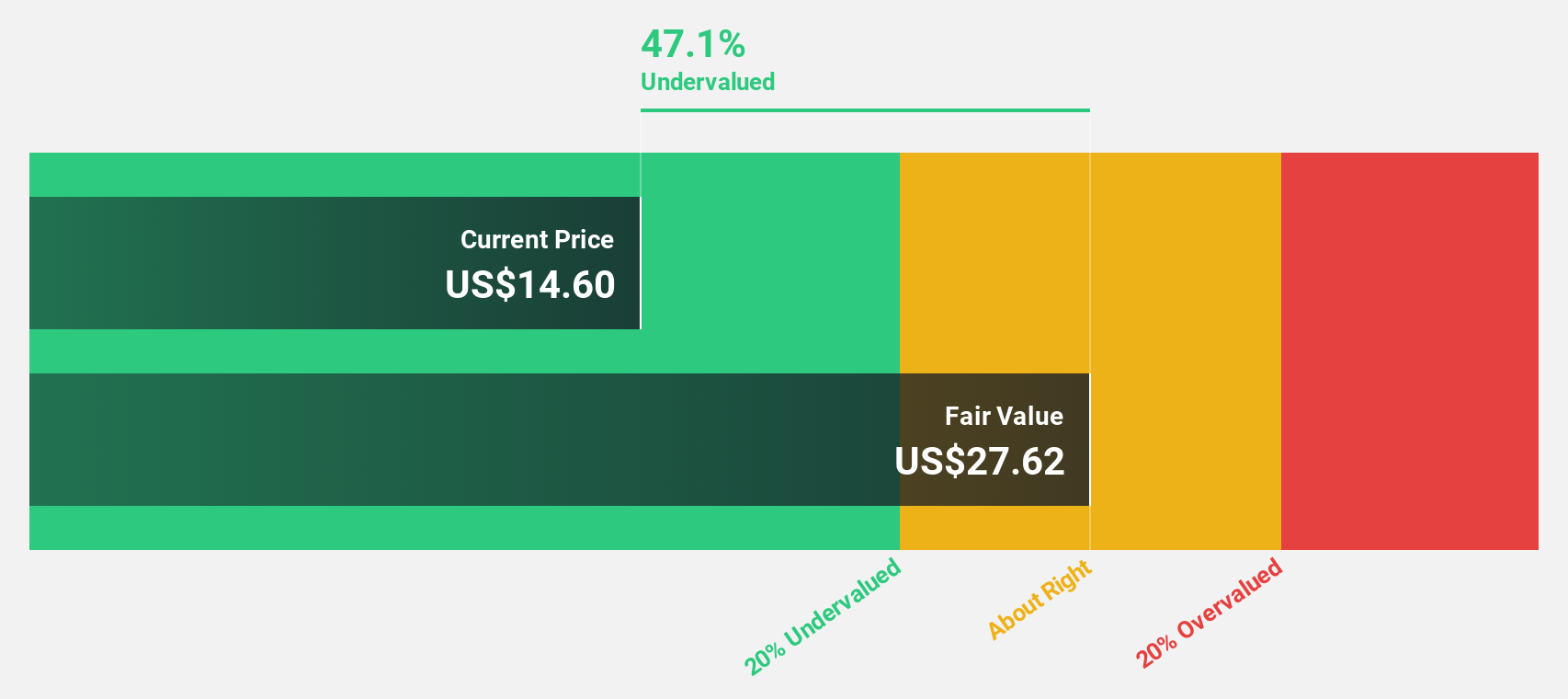

McGraw Hill (MH)

Overview: McGraw Hill, Inc. offers information solutions for K-12, higher education, and professional markets both in the United States and internationally, with a market cap of $2.25 billion.

Operations: The company's revenue is primarily derived from its K-12 segment at $966.59 million, higher education at $805.14 million, international markets contributing $194.56 million, and global professional services adding $149.46 million.

Estimated Discount To Fair Value: 49%

McGraw Hill, trading at US$12.50, is significantly undervalued with an estimated fair value of US$24.53. Despite revenue growth forecasts of 3.3% per year trailing the market's 9.9%, its earnings are projected to grow by a substantial 58.33% annually, becoming profitable within three years—a promising outlook for investors focusing on cash flow potential and profitability enhancement in the educational technology sector following recent AI-driven product launches like Sharpen Advantage and ALEKS for Calculus.

- Our comprehensive growth report raises the possibility that McGraw Hill is poised for substantial financial growth.

- Get an in-depth perspective on McGraw Hill's balance sheet by reading our health report here.

Make It Happen

- Explore the 184 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bowhead Specialty Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOW

Bowhead Specialty Holdings

Provides commercial specialty property and casualty insurance products in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives