- United States

- /

- Insurance

- /

- NasdaqGS:ROOT

Root (ROOT): Is the Insurance Disruptor’s Share Price Reflecting Its True Value?

Reviewed by Kshitija Bhandaru

Root (ROOT) has seen its stock performance shift over the past month, catching the eye of traders who follow insurance disruptors. With year-to-date gains and a long-term growth story, investors are re-examining its position in the market.

See our latest analysis for Root.

Root has shown steady momentum this year, with its share price edging higher and a respectable 3-year total shareholder return of 9.4%. This suggests renewed investor optimism about its growth prospects in the insurance sector.

If Root's latest moves have you curious, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares trading around $86.76 and a notable discount to analyst price targets, the question emerges: is Root flying under the radar, or is the market already anticipating future gains and pricing them in?

Most Popular Narrative: 33.6% Undervalued

Root's most followed narrative places its fair value markedly above the last close of $86.76. This draws focus to whether today's price reflects future potential or leaves upside on the table.

The rapid iteration and deployment of Root's next-generation AI and machine learning pricing models have materially improved risk segmentation and increased customer lifetime value by over 20%, positioning the company to enhance future gross margins and net income as loss ratios improve.

Want to peel back the story behind the big gap between current price and fair value? The twist is that the future valuation hinges on bold assumptions about improving margins and strong revenue growth, all resting on one controversial profit multiple. Dive in to uncover the projections and tensions analysts are betting on.

Result: Fair Value of $130.6 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competitive pressure and rising regulatory costs could erode margins. This may challenge Root's bullish growth outlook and put future earnings at risk.

Find out about the key risks to this Root narrative.

Another View: Caution from Market Comparisons

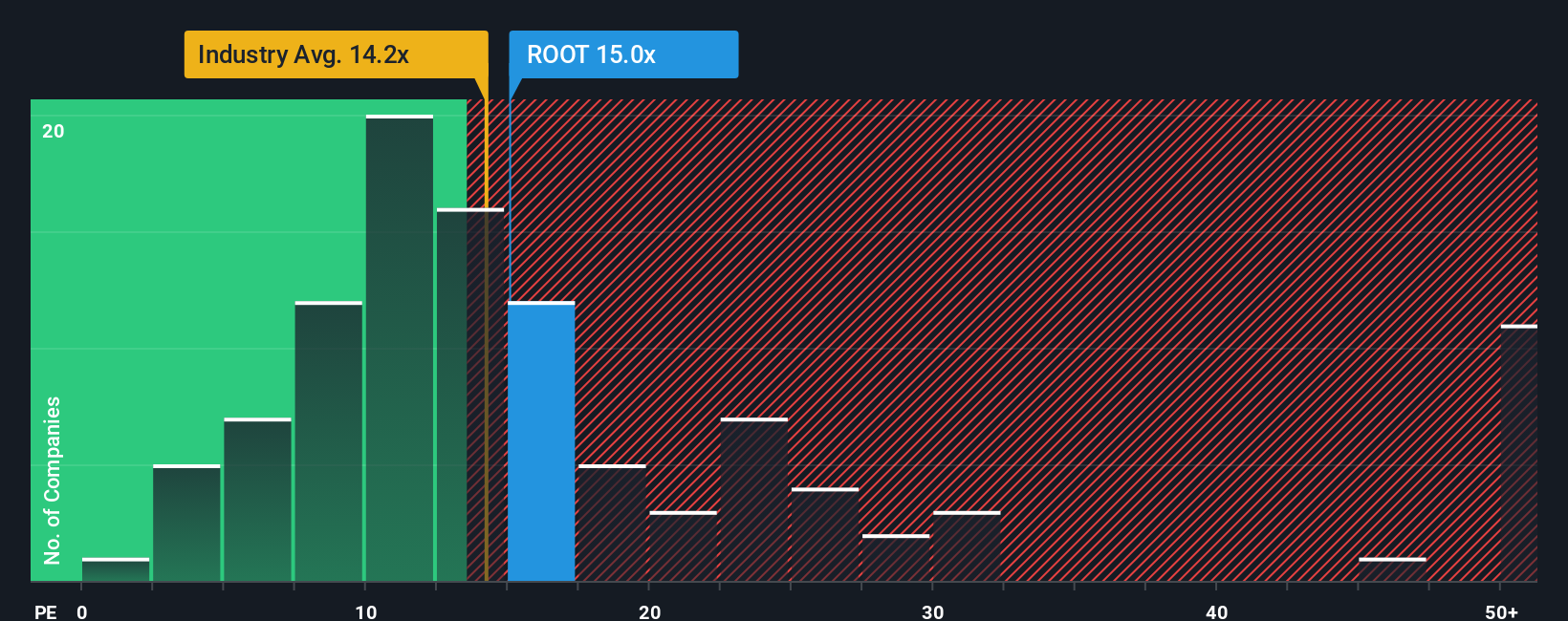

While analyst forecasts point to Root being undervalued, looking at its price-to-earnings ratio tells a different story. Root trades at 16.4 times earnings, above the industry average of 14.2 and much higher than its estimated fair ratio of 9.4. This premium suggests the market is already pricing in optimistic growth. What if those expectations falter?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Root Narrative

If you want to challenge these perspectives or would rather dig into the numbers yourself, you can uncover your own take in just a few minutes with Do it your way.

A great starting point for your Root research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at just one opportunity. Tap into a world of possibilities and gain an edge by evaluating other sectors that could power your portfolio forward.

- Accelerate your search for stocks with untapped upside by checking out these 886 undervalued stocks based on cash flows, which highlights companies trading below their intrinsic value.

- Boost your income potential by browsing these 19 dividend stocks with yields > 3%, where you can spot stocks offering attractive yields over 3%.

- Stay ahead of emerging market shifts by reviewing these 78 cryptocurrency and blockchain stocks, which spotlights companies harnessing the power of blockchain and digital currency innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROOT

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives