- United States

- /

- Insurance

- /

- NasdaqGS:ROOT

Root (NASDAQ:ROOT shareholders incur further losses as stock declines 18% this week, taking one-year losses to 89%

Even the best investor on earth makes unsuccessful investments. But it should be a priority to avoid stomach churning catastrophes, wherever possible. We wouldn't blame Root, Inc. (NASDAQ:ROOT) shareholders if they were still in shock after the stock dropped like a lead balloon, down 89% in just one year. That'd be enough to make even the strongest stomachs churn. Root hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Shareholders have had an even rougher run lately, with the share price down 27% in the last 90 days. However, one could argue that the price has been influenced by the general market, which is down 15% in the same timeframe. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

If the past week is anything to go by, investor sentiment for Root isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Root

Because Root made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Root grew its revenue by 24% over the last year. That's definitely a respectable growth rate. Unfortunately, the market wanted something better, given it sent the share price 89% lower during the year. It could be that the losses are too much for investors to handle without losing their nerve. We'd posit that the future looks challenging, given the disconnect between revenue growth and the share price.

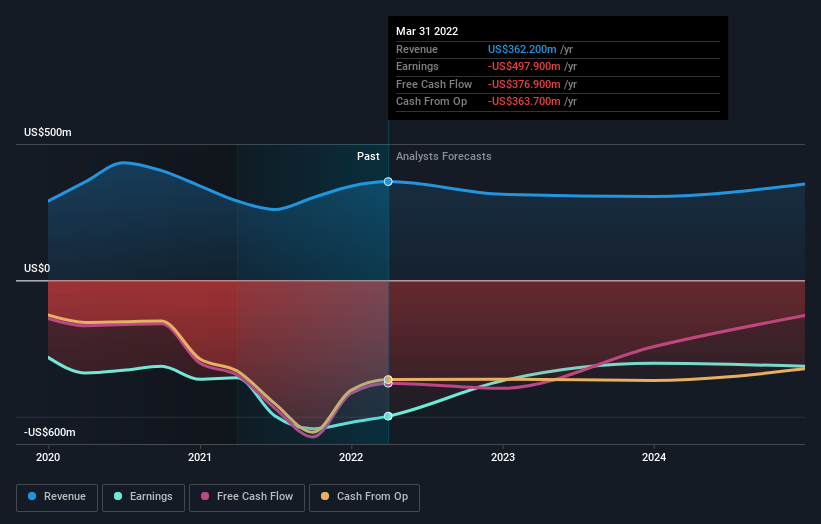

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We doubt Root shareholders are happy with the loss of 89% over twelve months. That falls short of the market, which lost 20%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 27% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Root better, we need to consider many other factors. For example, we've discovered 3 warning signs for Root that you should be aware of before investing here.

Root is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ROOT

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives